Lifting the Hood on the Treasury Yield Backup

Public Sector Forces at Play

Never before has this scale of monetary policy tightening occurred with such large public sector influences at play. This is what the Treasury yield backup last week points to. This ranges from the high fiscal spend and resulting deficits that need to be financed, to the nuanced workings of the Federal Reserve’s balance sheet runoff (Quantitative Tightening), to global factors extending to the Bank of Japan’s Yield Curve Control (YCC) policy. While the focus has been on what will break in the private sector, these public sector dynamics— downsizing the Fed’s balance sheet, running a higher deficit—are unraveling through the recent run up in Treasury yields.

The first factor in the recent Treasury yield backup is the mechanics of the Fed’s balance sheet runoff. Maturing Treasuries on the Fed’s balance sheet result directly in the Treasury having to raise debt to payoff the Fed. On the other hand, monthly paydowns of agency MBS open up a technical supply / demand imbalance requiring private sector (money managers) to step in.

The other factor is higher fiscal spending and the resulting deficit. The mix of higher Social Security, Medicare, and defense outlays, in addition to increased spending from some of the Acts (such as the CHIPS Act and the Inflation Reduction Act) and increased infrastructure spending have contributed to higher borrowing needs. Thus, Treasury auction sizes are expected to grow into 2024. Higher supply of Treasuries coincides with demand largely dependent on money managers, as banks and overseas investors have stepped back.

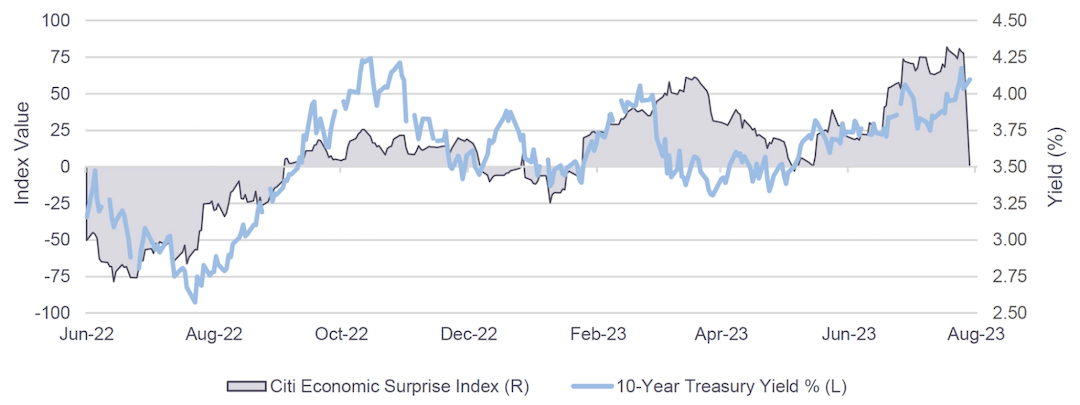

The economy is surprising to the upside, compared to the last time the 10-Year Treasury yield was north of 4% in October 2022. The Citi Economic Surprise Index, a measure of economic data surprises relative to expectations, has surged higher this summer. The turnaround in housing is one notable example where the backdrop has solidified meaningfully. Homebuilder stocks are materially higher after bottoming in October, and homebuilder sentiment has also reversed course after bottoming this winter.

Citi Economic Surprise Index, 10-Year Treasury Yield (%)(1)

- Market pricing and the comments of most observers imply a baseline view that a deal will get done to raise or suspend the debt ceiling prior to a default. Equity volatility ought to be higher and prices lower if the risk of a default was perceived to be high by market participants. The basis of this view is that a default would be so catastrophic for markets, Congress and the White House cannot let it happen.

- In addition to the damage a default would cause to the full faith and credit of the U.S. government (also the reserve currency), the ripple effects through the financial system would likely be devastating. For example, in the event of a default, would Treasuries still be acceptable collateral for derivative agreements or Fed liquidity programs? Negotiations are likely to go to the 11th hour as the parties seek to exert maximum pressure, but the “X Date” is uncertain.

- In 2011, the Treasury was within two days of defaulting before a deal was reached. Should the U.S. government default, the Fed would likely not cut interest rates because this action would in no way offset the disruption to markets. Instead, the Fed would likely focus on the plumbing of the financial system and liquidity measures to support the market functioning.

- Counter-intuitively to many, the run-up in 10-year U.S. Treasury yields into the debt-ceiling agreement on 31 July 2011, followed by the August 5th S&P ratings downgrade of the United States sparked a sharp rally.