Residential Transition Loans: Asset-Based Finance meets Private Credit

2024 is witness to rated deals securitized by Residential Transition Loans (RTL), a source of renovation and construction housing finance. As commercial real estate stresses bank lending, RTL lenders have gained market share. The sector is an example of the expansion of private credit into structured and securitization finance, also referenced broadly as asset-based finance.

The Conversation

The US faces a severe housing shortage, estimated between 2-5 million units. The inventory of existing stock is aging. Moreover, high mortgage rates today has suppressed for-sale inventory with existing homeowners locked in at pandemic era lows in rates.

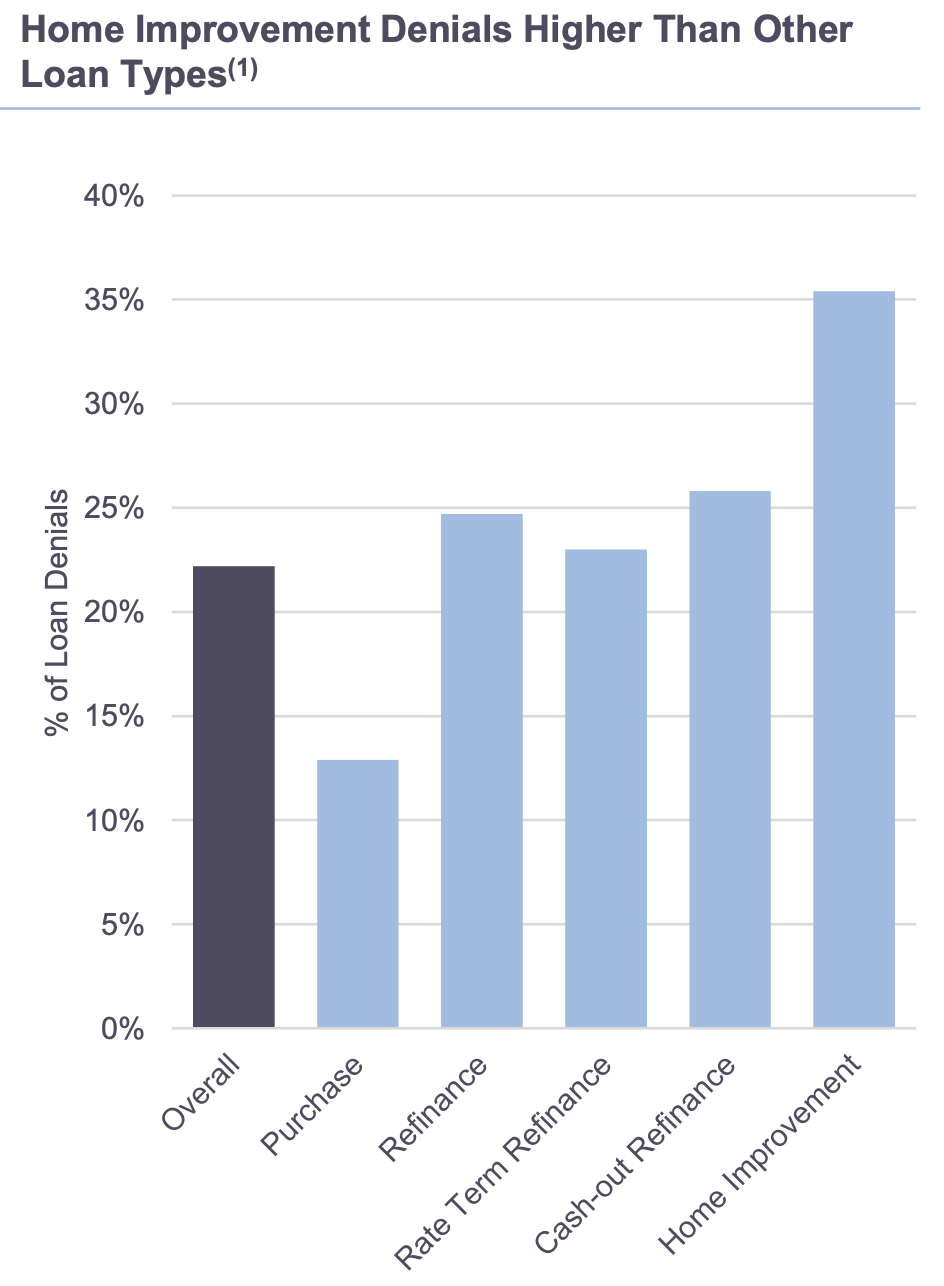

Limited access to construction and renovation financing has further curbed the flow of credit to close this severe shortage. Aggravating this is the retrenchment by banks from real estate lending as office and multi-family sectors get repriced lower to a new regime. Even with existing programs at FHA and the GSEs for renovation financing, denial rates are high and focus is on institutional over individual borrowers.

This has all led to the emergence of RTLs, loans made for purposes including construction, renovation, bridge financing and investor loans. Loans are short-term, generally 12-18 months, typically bearing low double-digit coupons. Lender programs span a wide range, targeting across commercial to retail borrowers, single to multi-family projects, and with narrow to broad geographic concentrations. Lender platforms can be direct origination or aggregator focused.

Accordingly, post-closing controls also vary, from controls exercised at the bottom-up sponsor level to risk reviews at a top-down portfolio level. Moreover, shifts are ongoing amongst those relying on renovation financing (limited by existing inventory shortages) to ground up construction.

The Rithm Take

Investor demand for exposure to direct housing credit risk is high, with record tight spread evidenced in related securitized sectors like credit risk transfer (CRT) notes. RTLs are an asset class that stands to further fulfill this demand. Rated, public deals expand the universe of investors. Tiering based on varying platforms and product profiles is the next phase in the adoption of this asset class.