Fed to Pare Back Projected 2024 Rate Cuts

The Federal Open Market Committee (FOMC) will conclude a two-day monetary policy meeting on Wednesday and is widely expected to maintain its target range for the fed funds rate of 5¼%-5½%. The inflation data since the last FOMC meeting should have reduced concern among policymakers that disinflation progress might reverse and there are also signs that the tightness of the labor market has eased. However, job creation remained strong in May and inflation is still too high. In its March Summary of Economic Projections, the Fed forecasted three quarter-point rate cuts in 2024 but this is likely to be viewed as too aggressive a rate cutting path given the recent data.

The Conversation

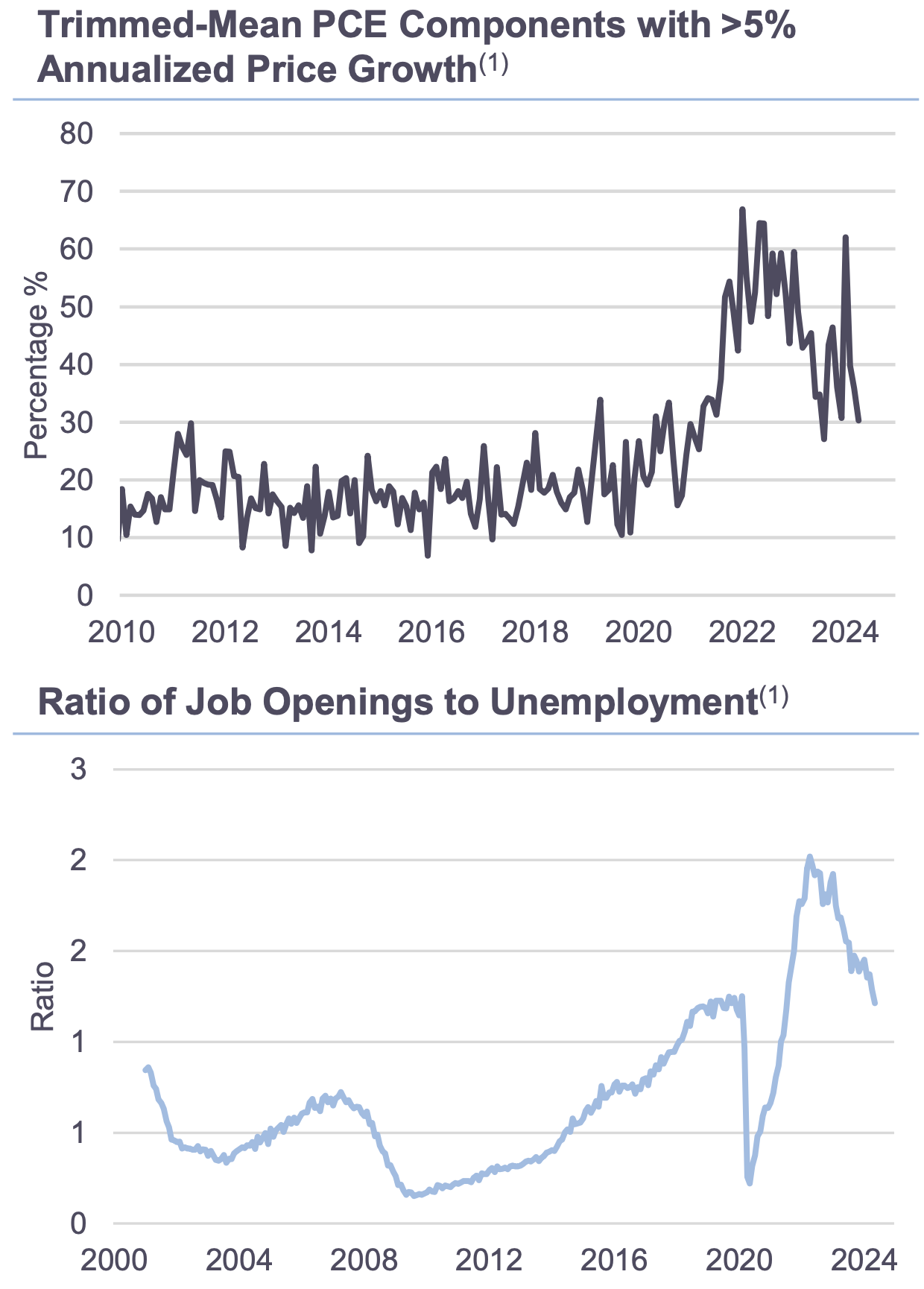

The Fed’s May 1st statement that “In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective” seems to be an overly pessimistic assessment of inflation developments. Core PCE inflation moderated to 2.8% year-over-year from 2.9% at the end of 2023 and trimmed-mean PCE inflation slowed to 2.9% in April from 3.2% in December. Also, the share of trimmed- mean components rising at a 5% or faster rate declined to 30% in April from an average of 36% in the second half of 2023 and 56% in 2022.

Nonfarm payrolls surged by 272,000 in May but the ratio of job openings to unemployed job seekers declined to 1.21 from 1.29. Fed officials are likely gratified that business demand for labor is coming into better balance with available labor supply via a decline in vacancies rather than a rise in unemployment. Though the unemployment rate ticked higher again in May to 4.0%, since the peak in the vacancy-unemployment ratio in April 2022 job vacancies have fallen by 4.1 million, while unemployment has risen by only 615,000. The reduction in labor market tightness without a material rise in unemployment will leave Fed officials encouraged that there can be a soft landing for the economy even as policy restraint is maintained in order to lower inflation to the 2% target.

The Rithm Take

Though inflation is moving toward the Fed’s target, albeit slowly, and labor market is coming into better balance, the economy remains far from the Fed’s dual objectives. Thus, policymakers will want to see more signs of progress toward their inflation goal, or weakness in the labor market, before cutting rates. However, given recent developments, it is unlikely that the Fed will want to take a rate cut this year off the table and both verbal guidance from Powell and the Summary of Economic Projections will probably signal that the Fed still expects to lower rates in 2024, but by less than the three quarter-point cuts signaled in the March SEPs.