The Rithm Investment Portfolio

Our highly-disciplined, opportunistic investment strategy is designed to drive robust returns for our investors—across changing market conditions.

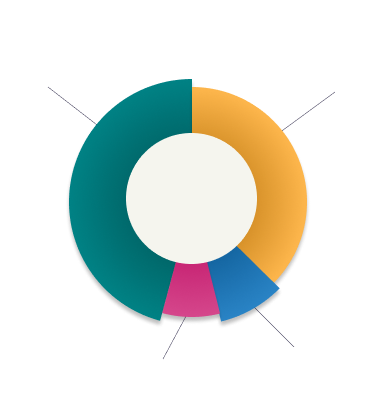

Asset Classes We Invest In

We invest across a wide range of real estate and financial services assets, seeking to generate maximum long-term value while maintaining a rigorous risk management approach.

Residential real estate loans, including Agency, Non-Agency, Non-QM, and Scratch & Dent.

MSRs originated organically by Rithm operating companies and opportunistic acquisitions from third-parties.

Sourcing and acquisition of construction, bridge, and fix-and-flip loans.

Focus on opportunistic credit and distressed situations across real estate asset classes, and strategic equity investments in development or assets requiring repositioning.

Sourcing, acquisition, renovation, and lease-up of properties across various markets in the U.S.

Unsecured consumer loans and loans backed by household debt (e.g., auto loans, credit cards, personal installment loans).

Loans and securities backed by residential and commercial real estate, single-family rental, transitional loans, and asset backed securities.

Portfolio Summary

Assets

Total Equity

Book Value (Q1'25)(1)

Dividend Yield (Q1'25)(2)

Total Dividends(3) Since Inception

AUM (4)

- Data based on 530,122,477 basic shares outstanding as of Q1’25 financial reporting period ending March 31, 2025

- Dividend Yield based on Rithm common stock closing price of $11.45 on March 31, 2025 and annualized dividend based on a $0.25 per common share quarterly dividend.

- Total Dividends does not include (i) the common dividend for the first quarter ended March 31, 2025, which was declared March 21, 2025 and will be paid April 30, 2025 or (ii) the Series A, Series B, Series C and Series D preferred dividends, which were declared March 21, 2025 and will be paid on May 15, 2025.

- Represents Assets Under Management (AUM) at Sculptor and other affiliated investment managers as of March 31, 2025. AUM is an estimated and unaudited amount. Please see the latest Form 10-Q/10-K for more information.

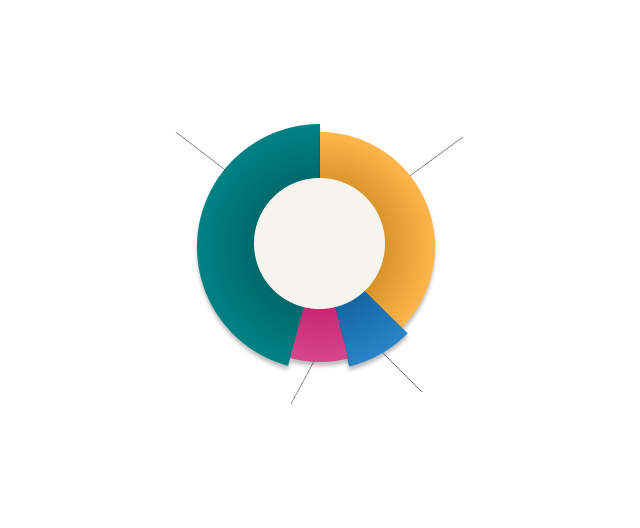

Our Family Of Operating Companies

Lending & Servicing

Real Estate Services

Real Estate Investing

Asset Management

Expanding Our Investment Platform

Rithm is strengthening its core investment platform through strategic principal investments, opportunistic financial investments and third-party capital to drive a new era of growth.