Fed to Hold Rates Steady but Signal Easing Speculation is Premature

The Federal Open Market Committee meets this week and it is a virtual certainty that the Fed funds rate target range will be held steady at 5¼%-5½%. Core PCE inflation eased to 3.5% year-over-year in October from 3.7% in September—this is down from a peak core inflation rate of 5.6% in February 2022. On the labor market, the ratio of job vacancies (measured at the end of October) to the number of unemployed job seekers (measured in the middle of November) was 1.39 versus 1.44 in the prior month, a peak of 2.02 in April 2022 and an average of 1.20 in the tight labor market of 2019.

The Conversation

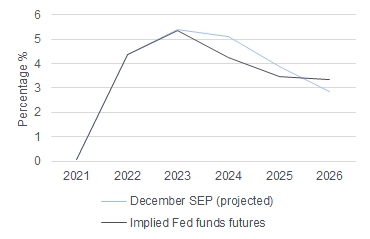

While inflation and the labor market continue to make progress toward the Fed’s goals, it is unlikely that policymakers are ready to declare victory on their objectives. However, the implied year-end 2024 Fed funds rate from the futures market (based on the January 2025 contract) has dropped to 4.24% from 4.52% after the November 1 FOMC meeting. Also, the market puts the odds of a rate cut at the March 2024 FOMC meeting at a 50-50 toss up.

Fed Chair Powell said this week “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.” We expect that Powell will repeat this message in this week’s press conference. We also expect the policy statement to again reference the potential for “additional policy firming” depending on the incoming inflation and labor market data.

The Fed will also update its Summary of Economic Projections this week. We expect 2023 growth and unemployment projections will be revised higher and inflation lower. The year-end 2023 Fed funds rate will be lowered to 5.4% from 5.6%, but we look for the interest rate, growth and inflation projections for 2025 and beyond to be left largely unchanged.

Futures Market versus Fed Rate Projections(1)

Consumer Net Income Expectations vs. Quits Rate(1)

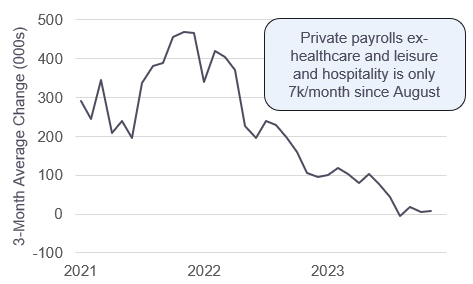

The Rithm Take

The case that the terminal policy rate has been reached is strong, but we expect the Fed will signal it is in no hurry to cut rates given inflation is still too high and the labor market continues to exhibit resilience. The breadth of job gains continues to narrow with private payrolls excluding healthcare and leisure averaging only 7,000 per month since August. The Fed will eventually have to outline its strategy for the fourth phase of this monetary policy cycle in which interest rates are reduced to a neutral level. But we believe it is unlikely that the Fed will cut rates as soon, or by as much, as the market implies in 2024.