Eyes on the Market Q2 2025

The Rithm Take

Risk assets have weathered the immediate post-Liberation Day volatility. The data cycle will now begin to reflect the economic impacts of these policy decisions. The market is on high alert as weak survey-based economic data has come through and trends from lagging hard data have yet to emerge. Valuations across both treasuries and risk-on assets (equities, corporate and structured credit) are both vulnerable to a shift in fundamentals as more hard economic data is released. Treasuries and agency MBS are sovereign assets and hence exposed to technicals, the deficit picture and holdings overseas. Corporates and structured credit are more fundamentally exposed. In this quarterly update, we highlight key upcoming data releases, explore the distinction between survey-based and hard metrics, and offer guidance on evaluating their potential impact.

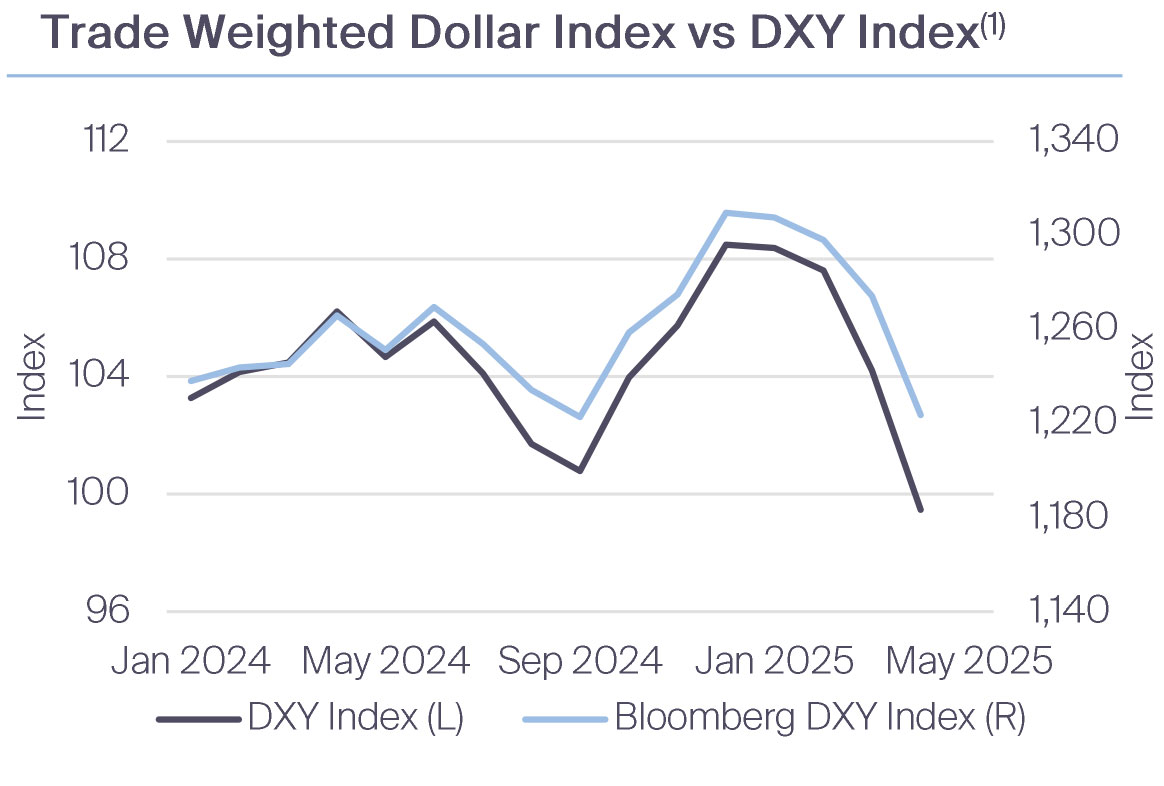

Data: Currency

Timeliness: High

Hard vs. Survey-Based Data: Hard

Why It Is Important: Both these indices track the overall strength of the dollar. However, the Bloomberg version weights the dollar’s strength against other currencies by how much trade is done between the countries included. Should the expectations for high tariffs remain, dollar weakness is likely sustained.

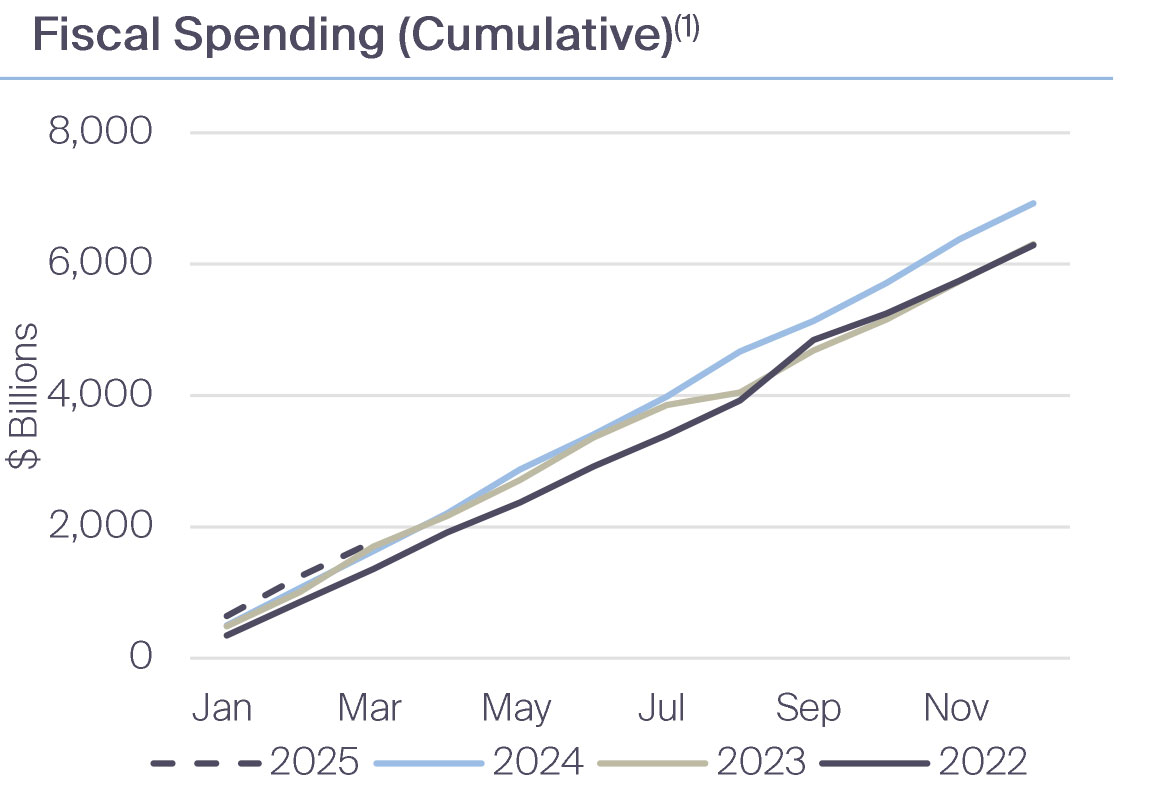

Data: Government Spending

Timeliness: Moderate

Hard vs. Survey-Based Data: Hard

Why It Is Important: This is the cumulative government spending each year. The magnitude of fiscal spending was a key factor in preventing a recession in 2022. Fiscal spending has continued at the pace of recent years. Will this trend continue in 2025?

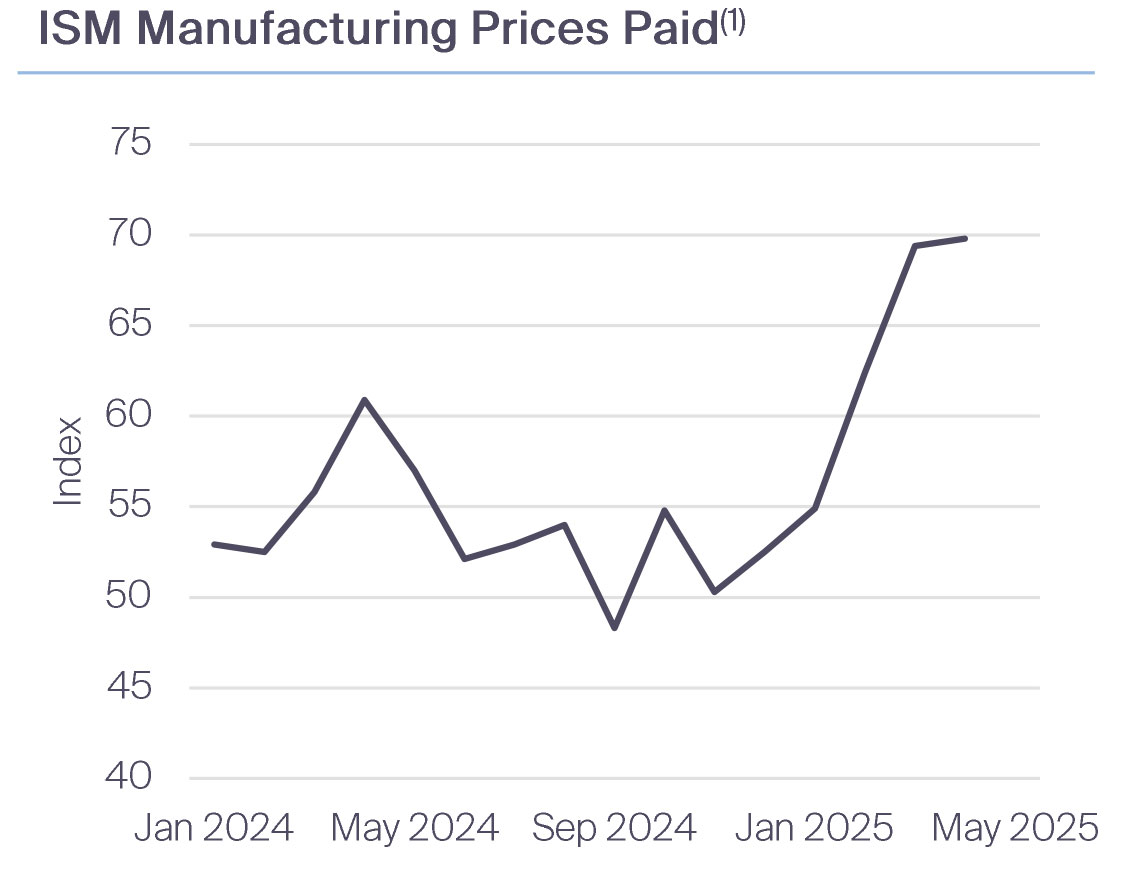

Data: Prices

Timeliness: Moderate

Hard vs. Survey-Based Data: Survey-Based

Why It Is Important: The manufacturing sector is on the front line when it comes to tariffs. Manufacturers rely on imported input materials, which are subject to varying tariffs, and those who export face retaliatory tariffs from their foreign customers. The prices paid data will indicate the breadth of companies facing price increases. Notably, as demand shifted from goods to services post-pandemic, a goods recession had suppressed prices.

Upcoming Data: June 2, July 1

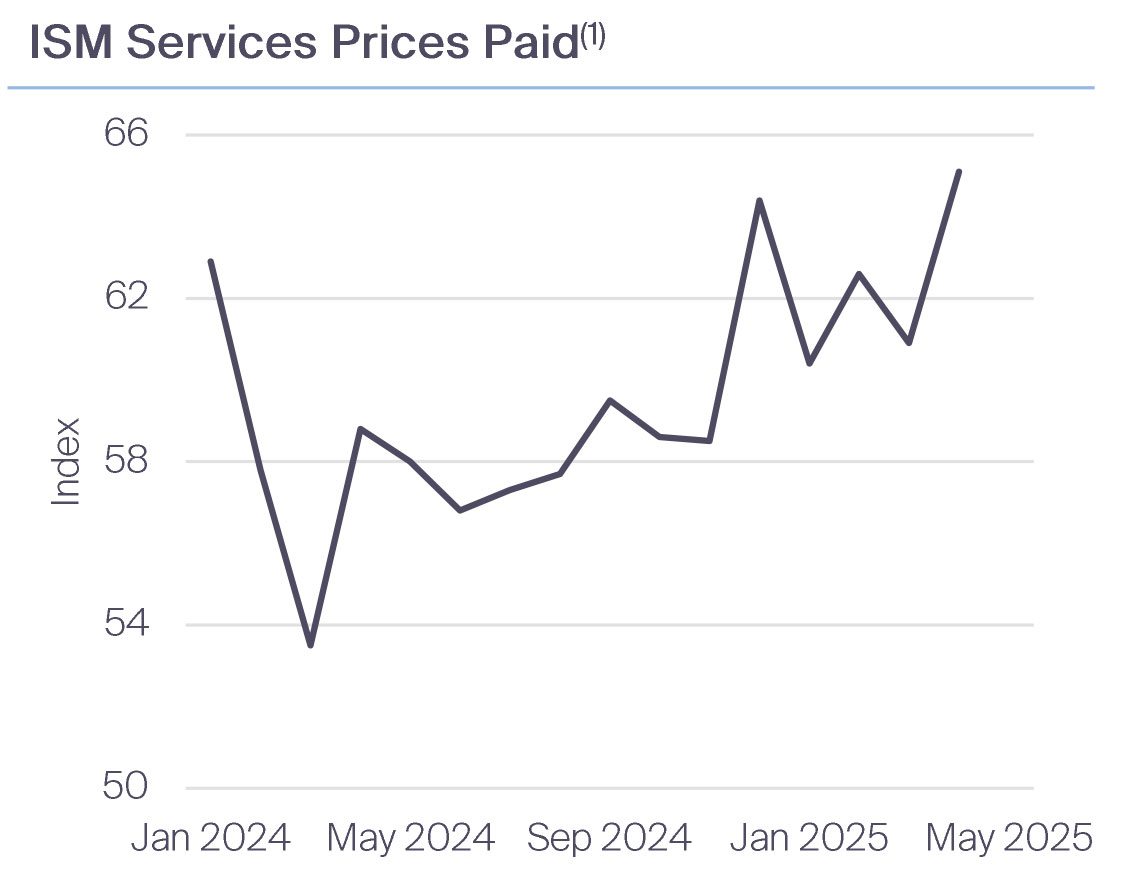

Timeliness: Moderate

Hard vs. Survey-Based Data: Survey-Based

Why It Is Important: Are goods sector pressures feeding into the services sector? Prices paid is particularly important. A pick up in prices signals that service firms are facing higher input costs—often a precursor to broader inflationary pressures—while a decline suggests easing cost pressures and a potential slowdown in underlying inflation.

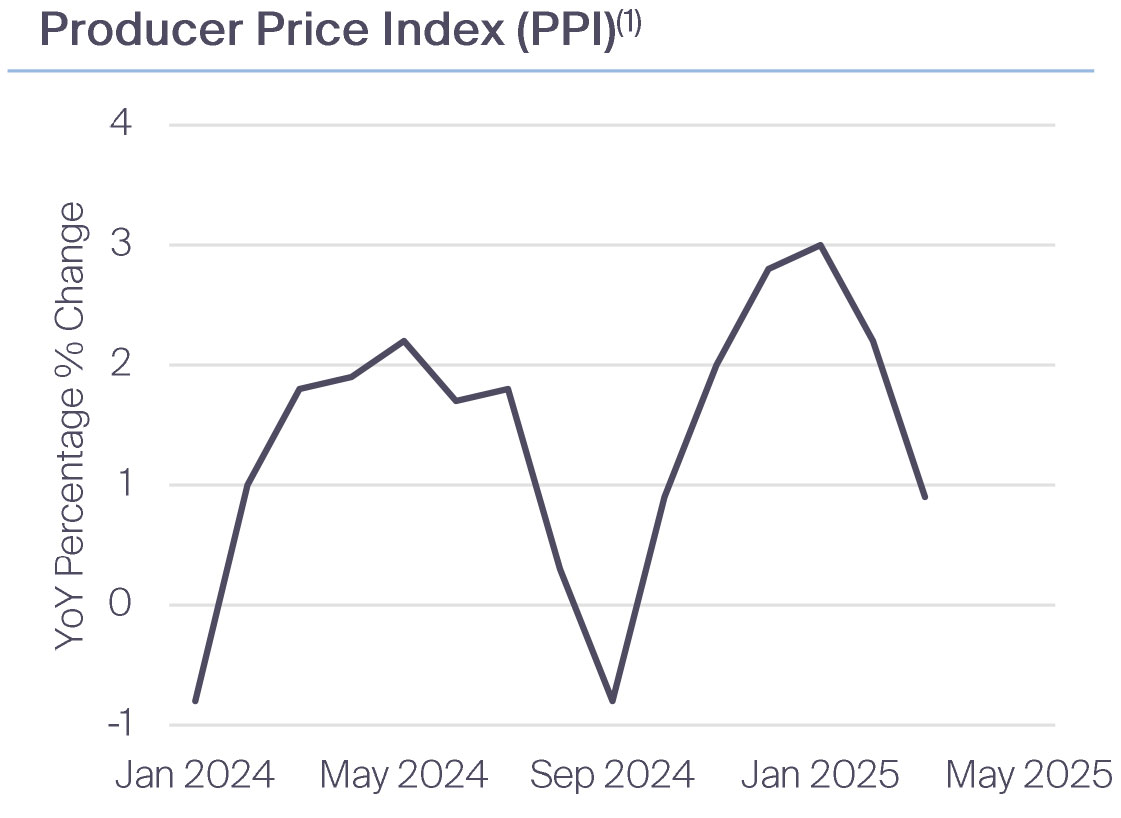

Upcoming Data: May 13, June 10, July 8

Timeliness: Moderate

Hard vs. Survey-Based Data: Hard

Why It Is Important: The PPI shows the cost pressures faced by producers before they reach consumers. A rising PPI reading signals that wholesale input costs are accelerating—often foreshadowing higher consumer-price inflation—whereas a decline suggests easing upstream price pressures and a potential slowdown in overall inflation. We have not seen a PPI print since Liberation Day and we should brace for a potential rise as a result.

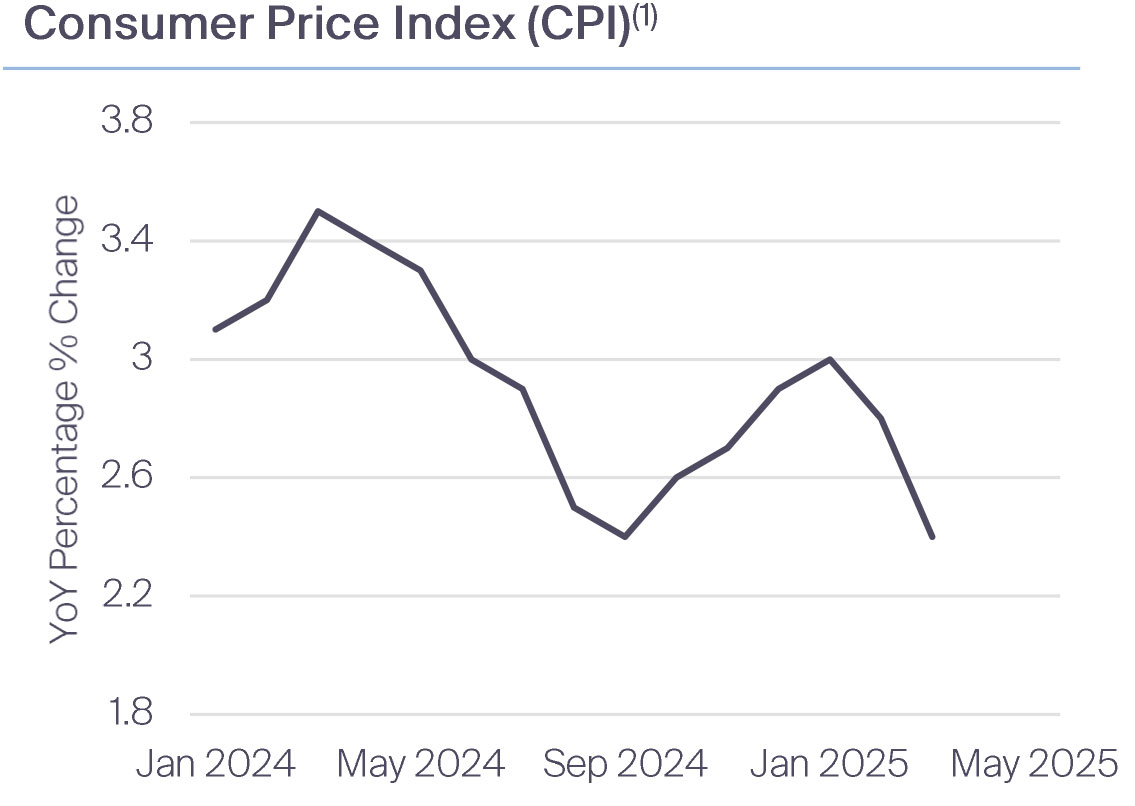

Upcoming Data: May 15, June 12, July 15

Timeliness: Moderate

Hard vs. Survey-Based Data: Hard

Why It Is Important: The CPI measures the pass-through of costs into consumer prices. A rising CPI reading signals that households are facing higher living costs—eroding real purchasing power, squeezing budgets, and potentially curbing spending—whereas a decline suggests easing price pressures, offering relief to consumers and supporting real incomes.

Upcoming Data: May 13, June 11, July 15

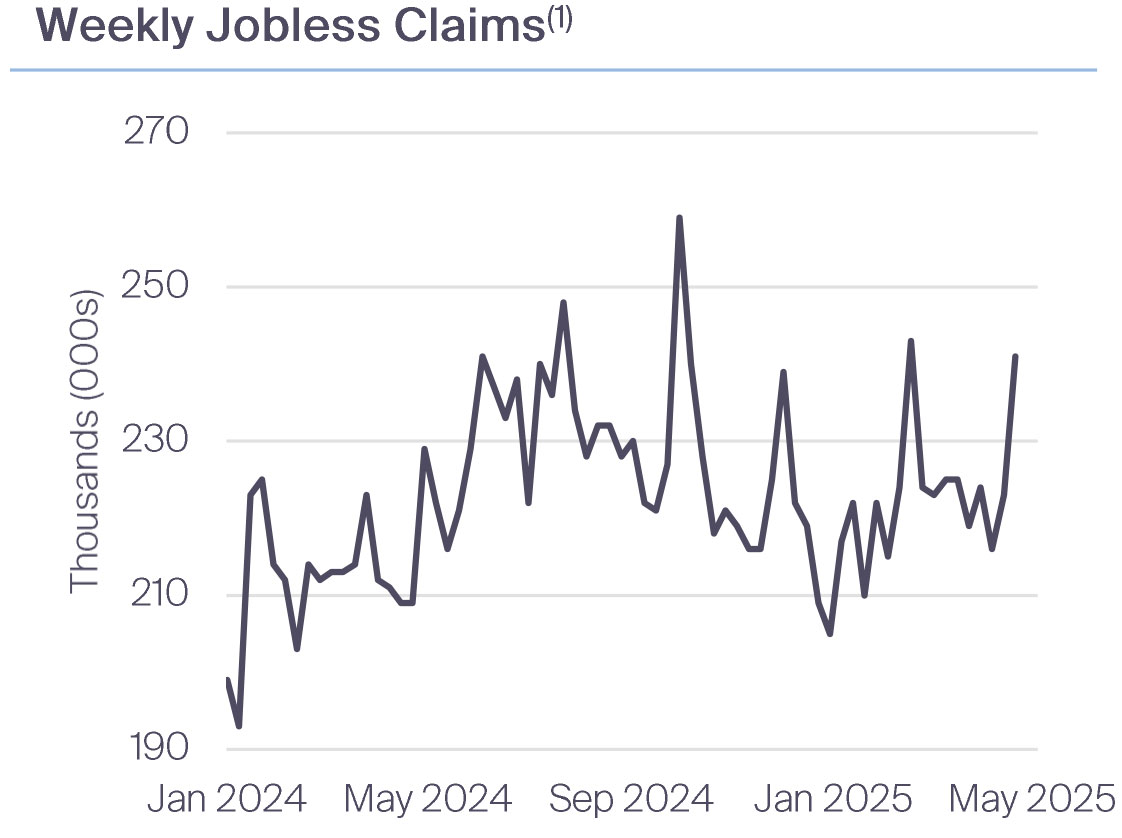

Data: Employment

Timeliness: High

Hard vs. Survey-Based Data: Hard

Why It Is Important: Initial claims will reflect if layoffs are spreading to the private sector. Federal government layoffs have surged. However, many of these laid off federal workers are receiving severance, which reduces eligibility for unemployment benefits. Thus, jobless claims for federal workers (measured separately from regular jobless claims) have also remained low.

Upcoming Data: Every Thursday

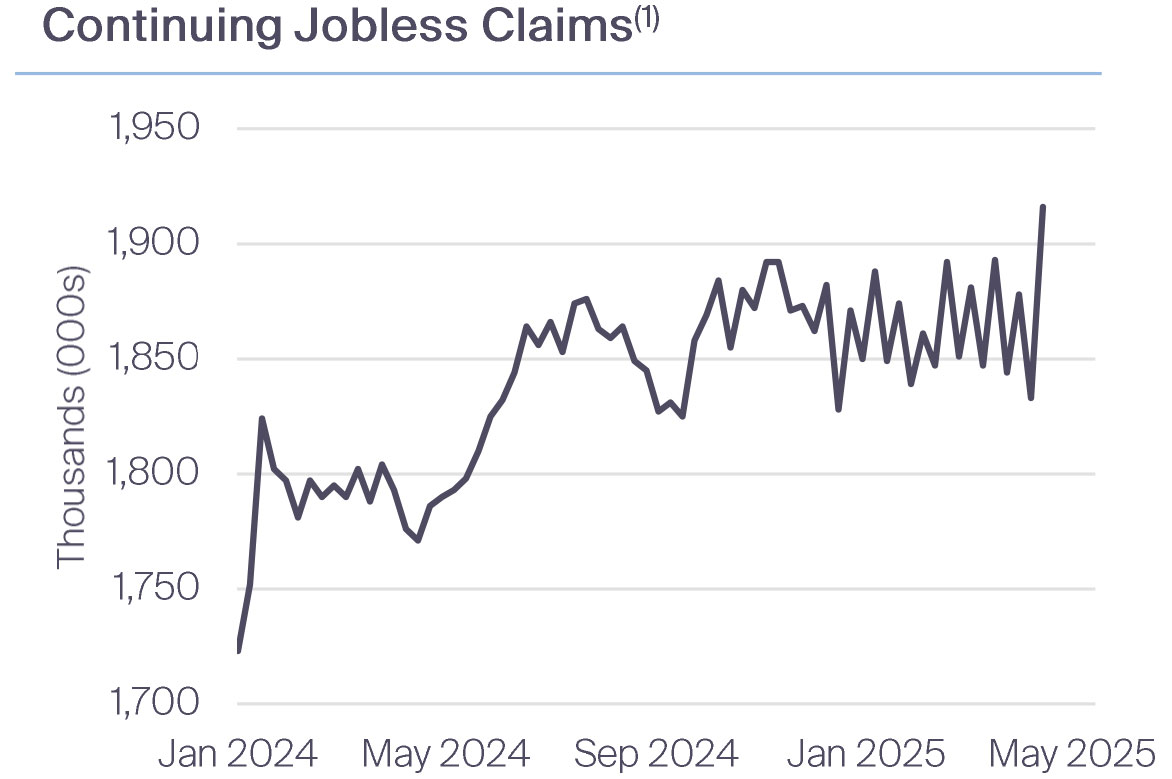

Timeliness: High

Hard vs. Survey-Based Data: Hard

Why It Is Important: Shows repeat filings for unemployment benefits, which provides a signal about the difficulty or ease of unemployed workers to find a new job.

Upcoming Data: Every Thursday

Timeliness: Moderate (1-month lag)

Hard vs. Survey-Based Data: Hard

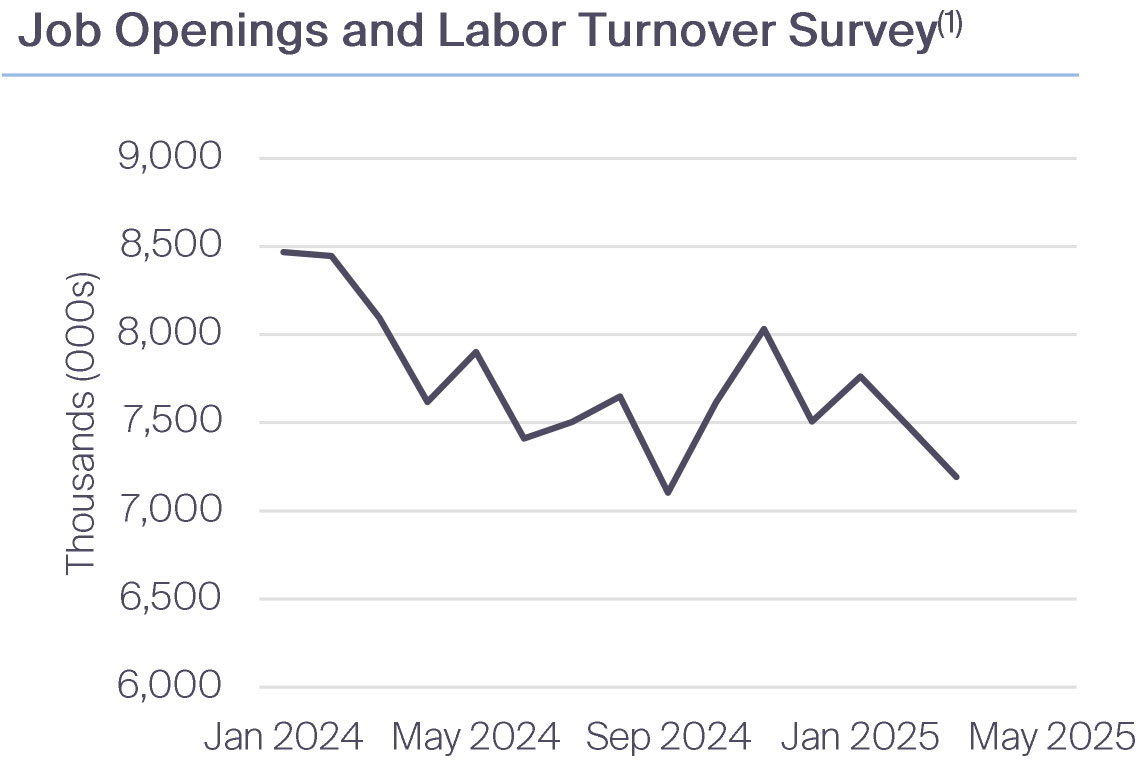

Why It Is Important: JOLTS provides an indication of business demand for labor. Hirings and separations allow for a breakdown of the payrolls data, with a lag. If payroll growth slows, is it because hiring rates have declined, or because layoffs have picked up?

Upcoming Data: June 3, July 1

Data: Sentiment

Timeliness: Moderate

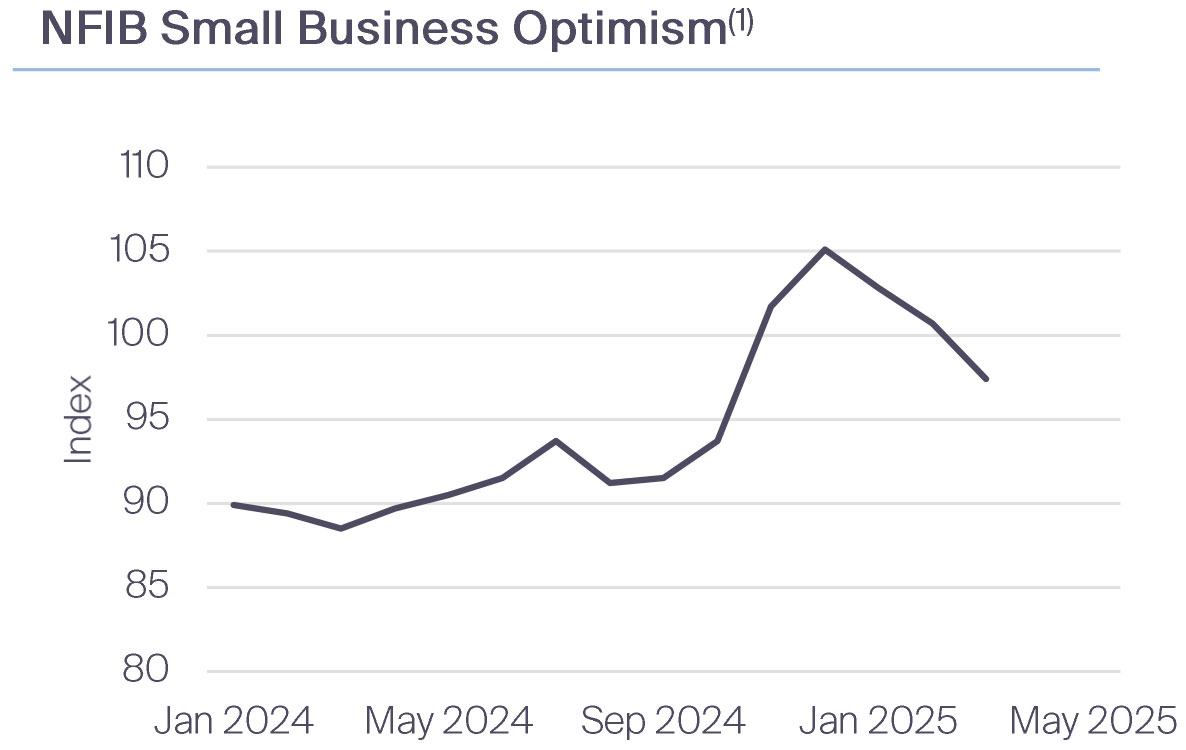

Hard vs. Survey-Based Data: Survey-Based

Why It Is Important: Small Business Optimism surged following President Trump’s election victory. Will tariffs dampen that optimism? Important readings on hiring intentions and future pricing are included in this survey.

Upcoming Data: May 13, June 10, July 8

Data: Consumer

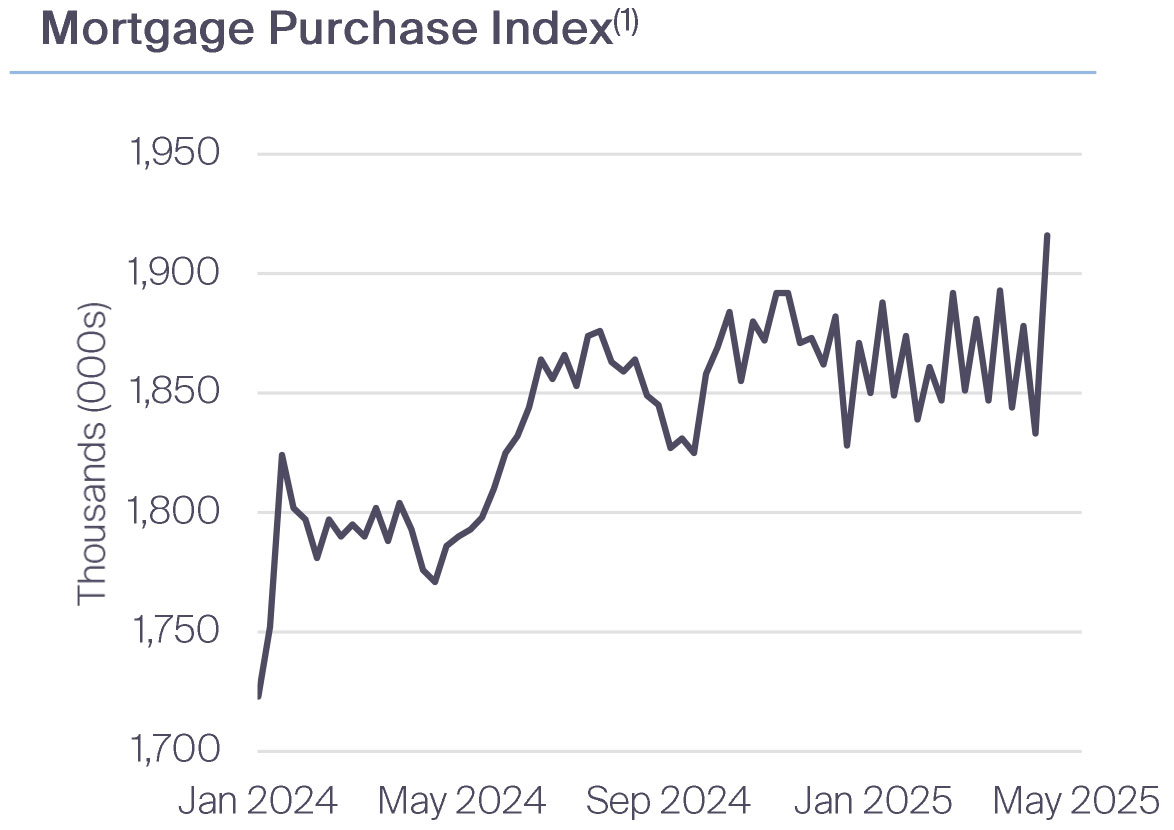

Timeliness: High

Hard vs. Survey-Based Data: Hard

Why It Is Important: The Mortgage Purchase Index tracks demand for home‐purchase mortgages. A rising reading signals strengthening homebuying activity—reflecting consumer confidence, upward pressure on housing prices, and spill-overs into construction and goods—whereas a decline points to cooling demand, easing price pressures, and a potential slowdown in housing‐related spending. The spring housing season will be key to watch.

Upcoming Data: May 13, June 10, July 8