The Rithm Investment Portfolio

Our highly-disciplined, opportunistic investment strategy is designed to drive robust returns for our investors—across changing market conditions.

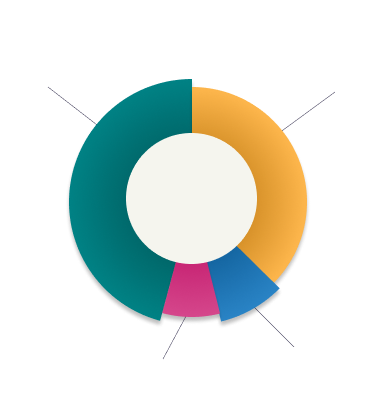

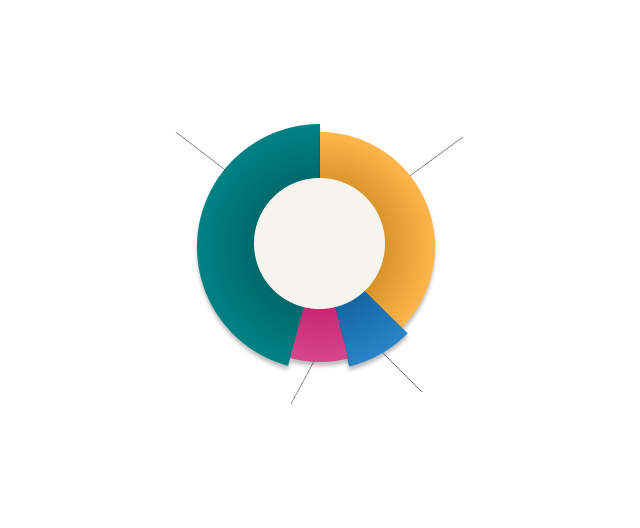

Asset Classes We Invest In

We invest across a wide range of real estate and financial services assets, seeking to generate maximum long-term value while maintaining a rigorous risk management approach.

Residential real estate loans, including Agency, Non-Agency, Non-QM, and Scratch & Dent.

MSRs originated organically by Rithm operating companies and opportunistic acquisitions from third-parties.

Sourcing and acquisition of construction, bridge, and fix-and-flip loans.

Focus on opportunistic credit and distressed situations across real estate asset classes, and strategic equity investments in development or assets requiring repositioning.

Sourcing, acquisition, renovation, and lease-up of properties across various markets in the U.S.

Unsecured consumer loans and loans backed by household debt (e.g., auto loans, credit cards, personal installment loans).

Loans and securities backed by residential and commercial real estate, single-family rental, transitional loans, and asset backed securities.

Portfolio Summary

Total Assets

Stockholders' Equity in Rithm Capital Corp

Book Value (Q4'25)(1)

Dividend Yield (Q4'25)(2)

Investable Assets(3)

AUM (4)

- Data based on 555,880,947 basic shares outstanding as of Q4’25 financial reporting period ending December 31, 2025.

- Dividend Yield based on Rithm common stock closing price of $10.90 on December 31, 2025 and annualized dividend based on a $0.25 per common share quarterly dividend.

- Represents the sum of the investable assets, including investments in operating companies, across the Rithm platform, including (i) $53 billion of Total Assets on Rithm's Balance Sheet, less $10.4 billion in consolidated fund assets, and (ii) $63 billion of AUM.

- Represents Assets Under Management (AUM) at Rithm Asset Management and its affiliated investment managers as of December 31, 2025. AUM is an estimated and unaudited amount. Please see the latest Form 10-Q/10-K for more information.

Our Family Of Operating Companies

Lending & Servicing

Real Estate Investing

Asset Management

Expanding Our Investment Platform

Rithm is strengthening its core investment platform through strategic principal investments, opportunistic financial investments and third-party capital to drive a new era of growth.