Unexplained Dovish Surprise Hinges March FOMC Easing to Data

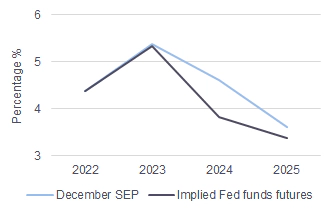

The Federal Open Market Committee left rates unchanged at the conclusion of this week’s policy meeting and more strongly indicated that the peak policy rate has been reached. However, the Fed also signaled three quarter-point rate cuts in 2024 by lowering the year-end Fed funds rate projection to 4.6% from September’s 5.1% forecast, an unexpectedly dovish shift that prompted a sharp decline in Treasury yields, a less inverted yield curve, and a strong rally in risk asset prices.

The Conversation

The Fed’s policy guidance this week was puzzling. The FOMC statement referred to potential “additional policy firming,” and Chair Powell said the FOMC is “prepared to tighten policy further.” However, Powell also said “dialing back the amount of policy restraint in place…[was] also a discussion for us at our meeting today.” Thus, the Fed simultaneously left the door open to a further rate hike in 2024, but also discussed the possibility of rate cuts next year. The discussion this week of dialing back policy restraint occurred despite Powell saying less than two weeks ago, “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.”

We argued that the Fed should outline its strategy to eventually reduce interest rates to a more neutral level, but there was no such strategy in the guidance this week. The reason for the dovish shift went unexplained, but it might reflect more divergent views about the scope for rate cuts in 2024, a development that may be outlined in the minutes for this week’s meeting, which will be published in the first week of January. The November FOMC minutes referenced some participants’ comments that their contacts are reporting weaker conditions than indicated by the data and the subsequent Beige Book contained a further weakening in the anecdotal information.

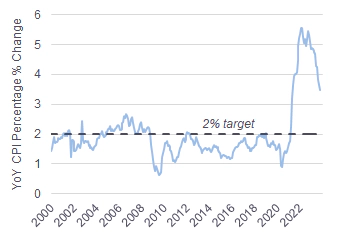

Inflation Still Far from the Fed’s Target(1)

Futures Market vs. Fed Rate Projections(1)

The Rithm Take

Policymakers kept the door open to additional firming given inflation that is too high, yet Fed officials also discussed rate cuts even though they are not yet confident “that inflation is moving down sustainably toward” their target. Interest rate futures raised the odds of a quarter-point rate cut at the March 20 FOMC meeting to 92%, and Fed officials might be uncomfortable with this high of a rate cut probability just two meetings from today. In addition to any Fed speeches, the PCE prices data next Friday, JOLTS on January 3, the jobs report on January 5, and CPI on January 11 will be important for market pricing of the March rate decision.