Unchanged Rates as Fed Considers Cooling Inflation and Strong Growth

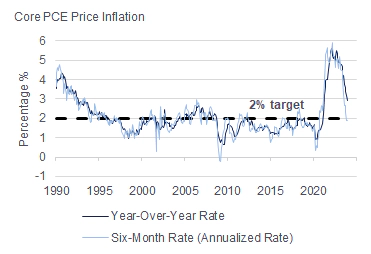

The Federal Open Market Committee (“FOMC”) concludes its two-day policy meeting on Wednesday. It is a virtual certainty that the funds rate target range will be left unchanged at 5¼-5½% this week. Core PCE year-over-year change in inflation eased to 2.9% in December versus 3.2% in November (down from a peak core inflation rate of 5.6% in February 2022). Meanwhile, the economy remained resilient with the final quarter of 2023 showing stronger-than-expected 3.3% annualized real GDP growth. The strength of the economy may leave Fed officials concerned that economic growth is not cooling enough return inflation to 2%.

The Conversation

Recent inflation reports have been encouraging, with, for example, year-over-year core PCE inflation slowing to 2.9% in December and three- and six-month annualized inflation rates easing to 1.5% and 1.9%, respectively. Inflation continues to grow more rapidly than projected progress toward the Fed’s goal.

The economy, however, continues to grow at a pace that is faster than estimates, with real GDP growth averaging 4.1% at an annual rate in the second half of 2023 (the Fed sees potential growth at 1.8%). This pace of growth will likely leave Fed officials concerned about pressures on resource utilization that may, in their view, prevent inflation from maintaining its downward path toward 2%.

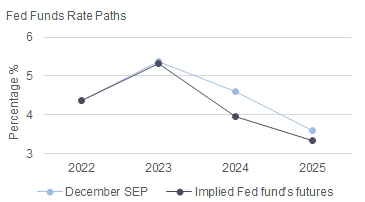

Fed Chair Powell’s dovish tone at the December FOMC meeting led markets to fully price in a quarter-point rate cut by the March 20th FOMC meeting. It has taken several speeches by other Fed officials (with an assist from solid economic data) to walk back market pricing of a rate cut in the first quarter of 2024. Policymakers are likely encouraged by the recent inflation data. However, in addition to continued solid reports on economic activity, financial conditions have eased materially, and this may be viewed as a development that is counter-productive to returning inflation to the 2% target.

Inflation Moderation, Futures Market versus Fed Rate Projections(1)

The Rithm Take

Though the implied odds of a quarter-point rate cut by the March FOMC meeting have fallen to 50/50 from 100% in the middle of January, the resilience of the economy combined with easing financial conditions should encourage policymakers to be patient in removing monetary policy restraint. Thus, a rate cut at the March meeting seems unlikely at this point. In addition, the market-implied year-end 2024 Fed funds rate, at 3.97% based on the January 2025 Fed funds futures contract, is lower than the projections of all but one FOMC participant and compares to a median FOMC projection of a 4.6% year-end Fed funds rate.