The US Consumer: Powering Through

Market Signals

Near term data on the consumer is going to be clouded by the flow through price impacts of tariffs, front loading of consumption, as well as the onset of delinquency reporting on student loan debt. The Yale Budget Lab estimates that the overall trade-weighted tariff is currently settled at 14%, reducing the purchasing power for the average household by $2,800. Barclays Research estimates, on an average $35k student loan, a $400 monthly payment accounts for 6.5% of take-home pay of someone making $100k in annual income.

The Conversation

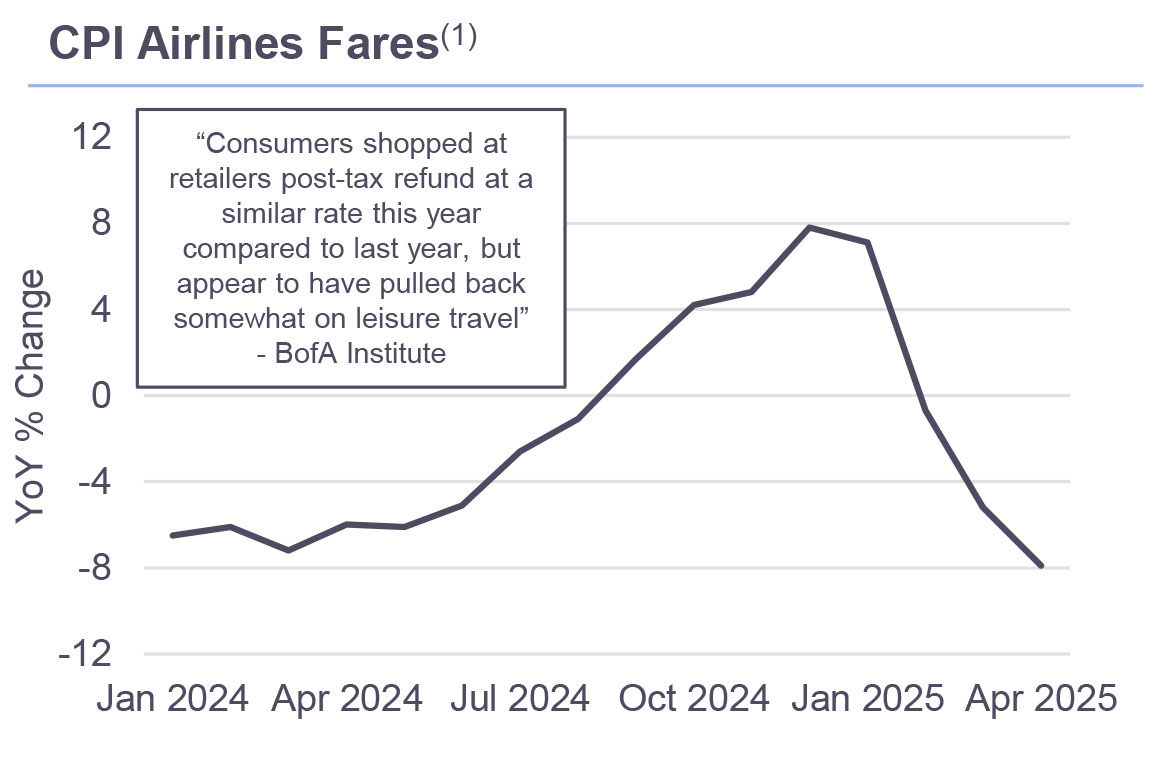

Household balance sheets have shown resilience. Although spending patterns are shifting. Discretionary categories such as travel are pulling back—not necessarily from weaker volumes, but in part due to lower pricing. The CPI airline fares index fell 11.6% over the three months ending April, while lodging-away-from-home prices dropped 4.6% over two months. still-strong travel activity is highlighted by TSA checkpoint volumes, averaging 2.7 million screenings per day. Meanwhile, hardship distributions from 401(k) plans declined in Q1 2025 after nearly two years of increases, suggesting fewer families are tapping retirement savings—an encouraging signal of household stability.

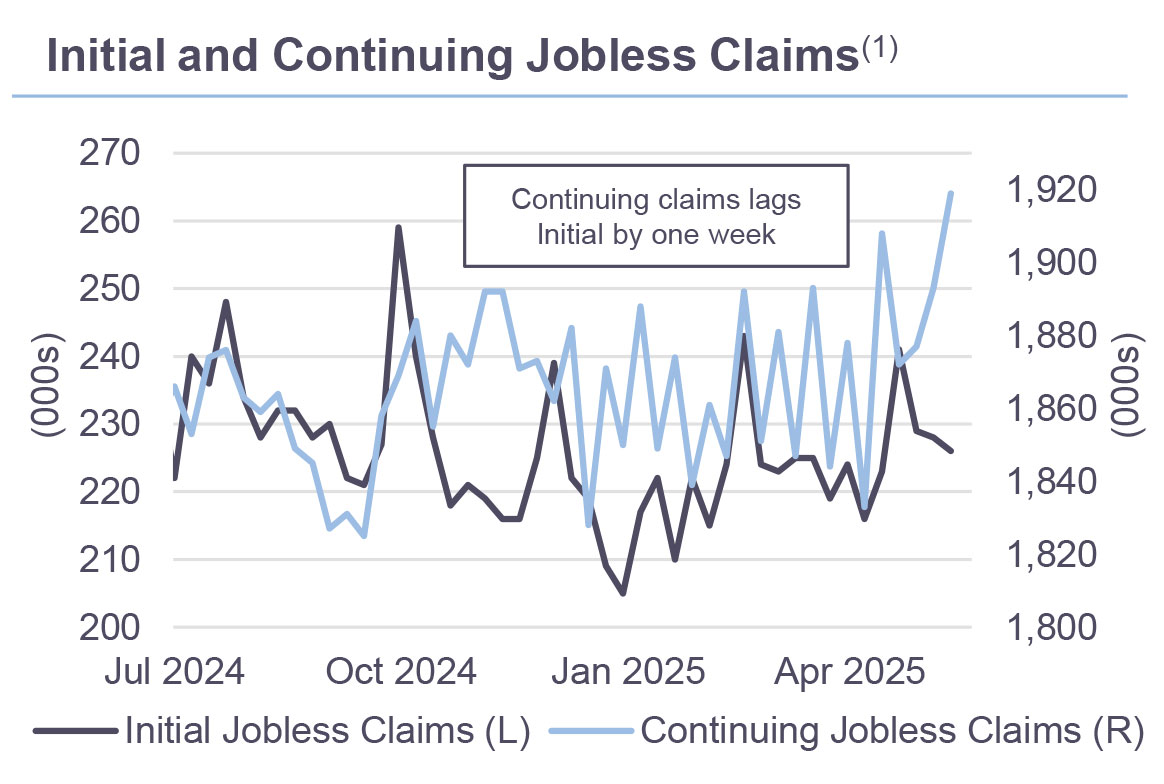

Labor market dynamics should track the strength seen in corporate profitability. As long as corporate margins remain high, the consumer benefits from higher wages, which provides resilience in the face of tariffs and other macro pressures. Initial Claims data remain suppressed, but we stay watchful for signs of weakness from Continuing Claims.

The Rithm Take

The consumer outlook remains a delicate balance between resilience and risk. Consumer discretionary has rebounded higher with the S&P 500 since Liberation Day, and consumer staples have held steady. Historically, consumers rarely cut back spending relative to income to cushion savings, until a recession is already underway. It is income—driven by profits and employment—that ultimately sustains consumption. Strong corporate profit margins are an added source of resilience on top of stock market and housing wealth effects as consumer spending patterns continue to shift.