The Clarity Trade

The Rithm Take

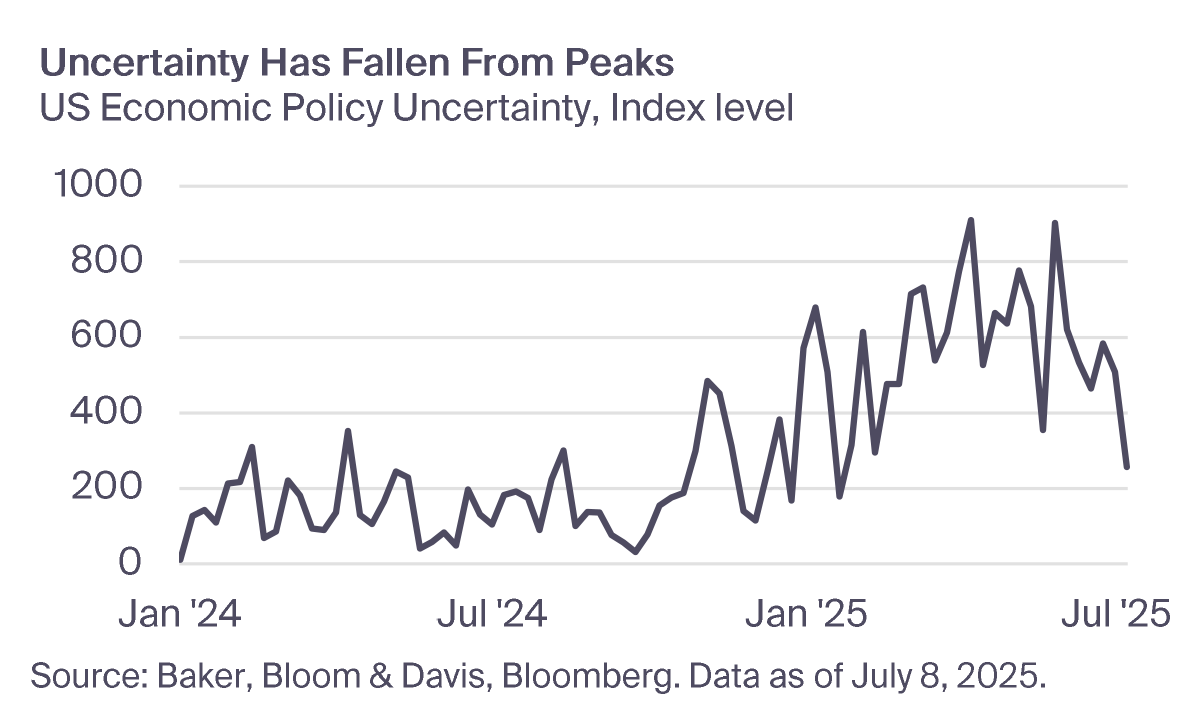

Markets appear to be responding positively to the increased certainty brought by the fiscal bill’s passage and the steady release of tariff details. While higher deficits and tariffs may not seem ideal at first glance, the reduction in uncertainty—following record-high levels earlier this year—has enabled investors to look beyond near-term challenges and focus on longer-term opportunities.

Market Signals

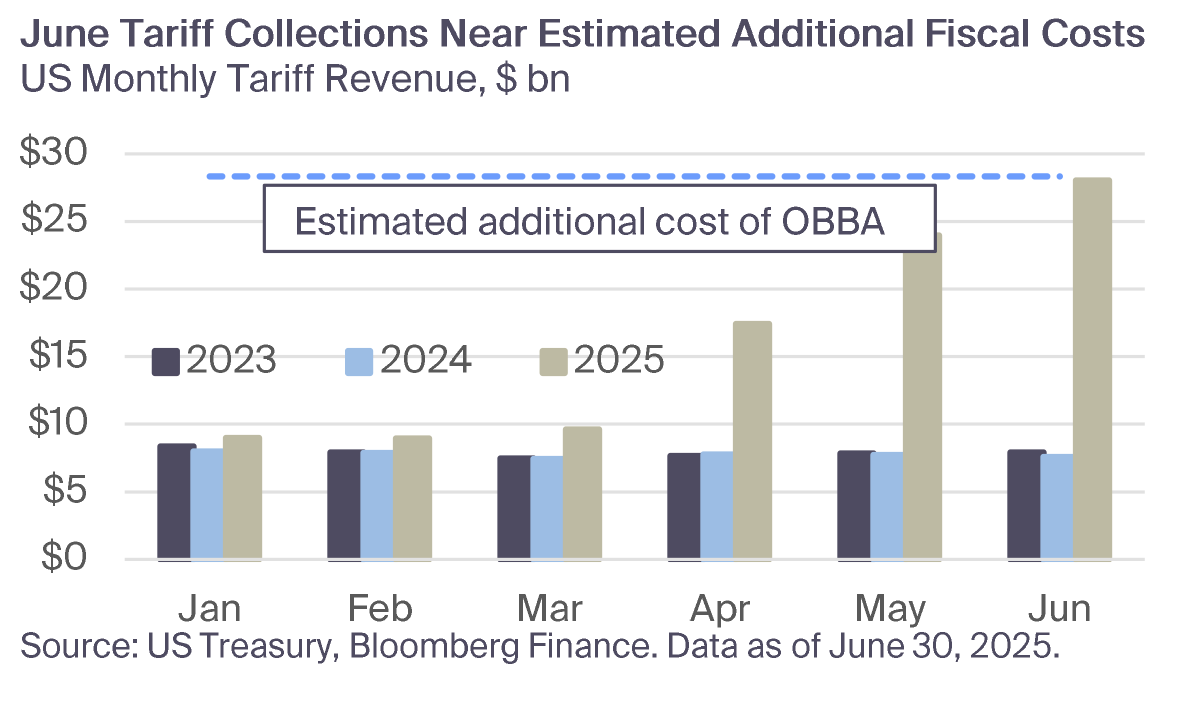

The One Big Beautiful Bill Act (OBBA) was passed last week, extending the 2017 Tax Cuts and Jobs Act (TCJA), which was set to expire at the end of this year. The bill also introduces additional tax benefits for both consumers and businesses. According to the Congressional Budget Office (CBO), it is projected to increase the federal deficit by $3.4 trillion over the 2025–2034 period—equivalent to approximately $28.3 billion in additional monthly spending over the next decade.

One proposed funding source for this spending is increased tariff collections. Although the implementation of the Liberation Day tariffs has been delayed until August 1st, June’s tariff revenues already nearly matched the estimated monthly cost increase associated with the bill.

From a growth perspective, some market participants are concerned that higher prices on goods could dampen investor demand and, in turn, slow economic expansion. However, taking a broader macroeconomic view, the estimated $300 billion in annual tariffs outlined by Treasury Secretary Scott Bessent represents just 1.5% of the $20 trillion in annual consumer spending.

The Conversation

Markets have been grappling with how tariffs and increased fiscal spending might play out. The US government can be viewed as a business, where revenues (taxes) and expenses (such as Social Security, Medicare, and military spending) net out to produce either a fiscal surplus (profit) or a deficit (loss).

Recent market price action suggests that tariffs could help offset the cost of extending the TCJA and reduce the fiscal deficit. Additionally, some believe the tax base could expand enough to counterbalance

the lower tax rates, given the economic growth typically generated by fiscal stimulus.

One key risk is that tariff revenue—one of the bill’s primary funding sources—is enacted through executive order and can be reversed at any time. While historical precedent (2018–2019) suggests tariffs may persist, they cannot be reliably counted on over the next decade.

Moreover, the primary deficit—used to calculate the additional monthly revenue needed to offset fiscal spending—does not include interest costs. When interest is factored in, the deficit is likely to continue expanding, putting upward pressure on US government funding costs, particularly at the long end of the yield curve. This pressure may be mitigated by technical adjustments, such as shifting issuance from long-term bonds to short-term bills.

Finally, markets appear fatigued by tariff-related headlines, with each new announcement generating a smaller reaction. For example, South Korean equities rallied 2% following a 25% US-imposed tariff—likely interpreted by investors as a signal that tariff levels had peaked and could be negotiated lower.