The American Consumer: Resilient, But Not Uniform

The Rithm Take

While the current economic landscape is characterized by a "K-shaped" divergence, we think the overall consumer narrative is one of strength and resilience, with forward-looking tailwinds providing a counterweight to present risks. The durable foundation of high-net-worth and middle-aged consumers continues to be a powerful stabilizing force, driven by robust income growth and wealth effects. This strength, coupled with nascent signs of stabilization in some credit metrics and the immense "bequest effect" from older cohorts, suggests that the consumer is on a constructive path. While pockets of stress exist among younger and lower-income segments, these are viewed as manageable risks within a broader context of financial health. A clearer, more accurate picture of the consumer is also beginning to emerge as the temporary financial boosts from the student loan pause and post-COVID stimulus fade. This provides a more reliable and less inflated view of consumer financial health, particularly through credit data.

Market Signals

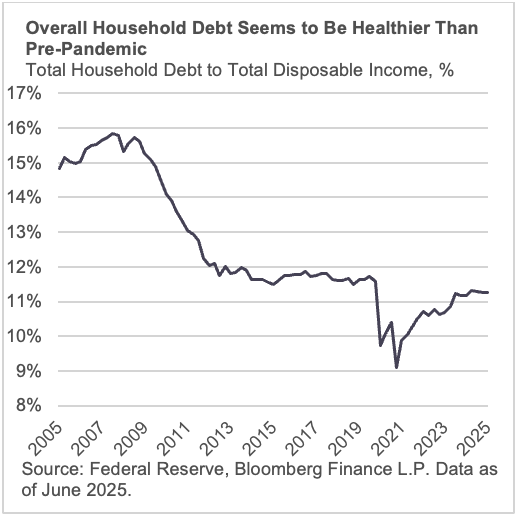

At a macro level, households are better positioned than they were pre-pandemic in terms of debt to disposable income.

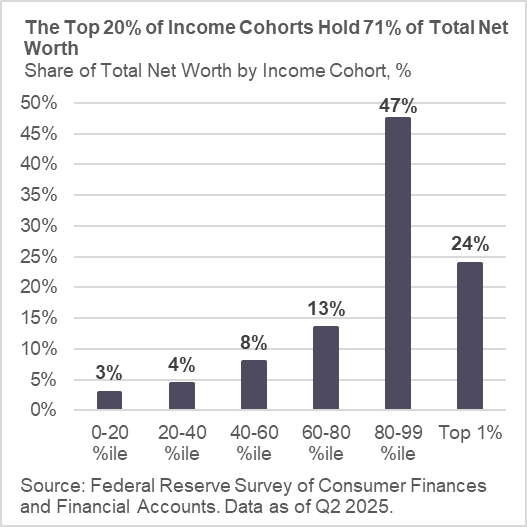

Much of that positive story is being skewed by older, higher income, and higher net worth individuals who command nearly three quarters of the total net worth.

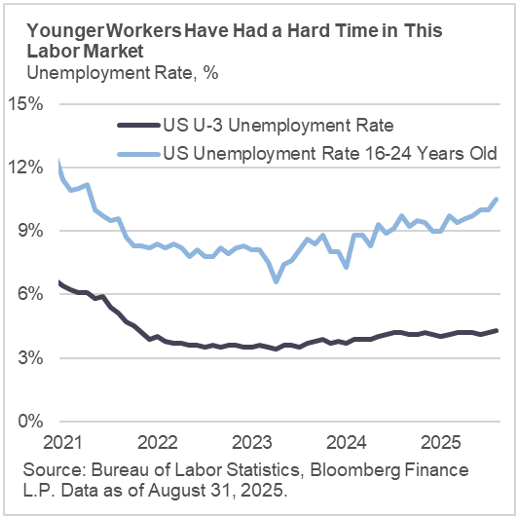

There are certain stresses across consumers and households as we dig deeper. Many of those stresses lie within the younger and lower income cohort who have been experiencing a relatively difficult time in the current labor market.

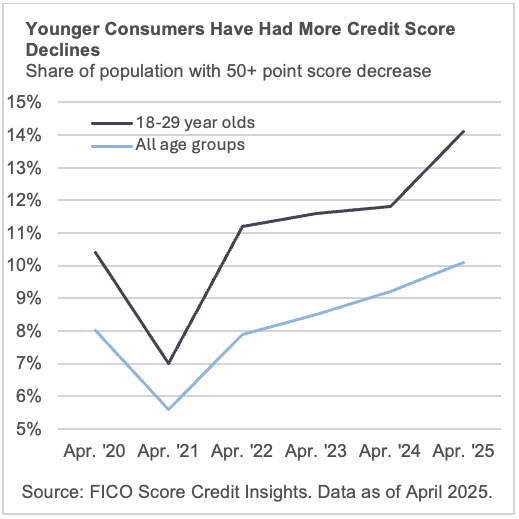

As jobs have been more difficult to come by for these consumers, they have had to take on increased financing to support their livelihoods. The increasing debt loads have consequently contributed to more declines in FICO scores.

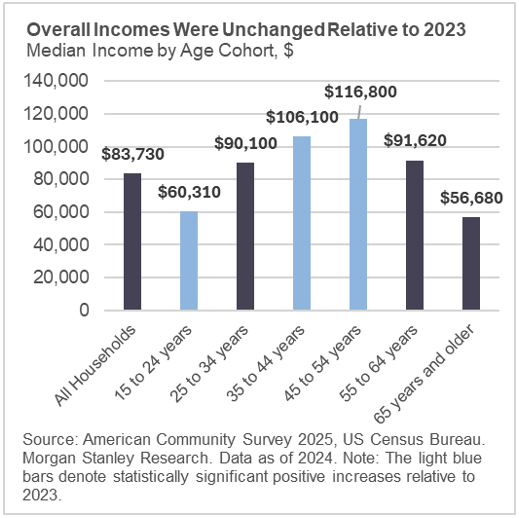

The younger cohort has also not experienced rising wages relative to their 35 to 54-year-old counterparts.

The Conversation

While the consumer has demonstrated remarkable resilience, the current landscape is far from uniform. A granular analysis reveals a bifurcated narrative of strength and risk, a distinction that is crucial for understanding the economic path forward. This divergence points to a "K-shaped economy," where some borrowers have benefited from asset gains while others are struggling with affordability.

A key pillar of consumer resilience comes from a segment of the population that remains on solid footing. According to Morgan Stanley Research, consumers aged 35 to 54 are driving resilient consumption. This is significant as this group makes up a quarter of the U.S. population and was the only age cohort to see statistically significant income growth in 2024 relative to the previous year. Their spending is supported by rising earnings and wealth effects, with their share of discretionary spending picking up since 2019. This is a critical point of strength that has provided a stabilizing force in the face of broader economic uncertainty.

However, this strength is not universal, and risks are clearly concentrated among lower-end consumers. Younger cohorts, defined by FICO's Credit Insights as 18- to 29-year-olds, are facing significant headwinds. This group has an average FICO Score of 676, which is 39 points lower than the national average. Having had less time to build savings and accumulate assets, this cohort is more likely to have affordability issues and be impacted by higher interest rates and inflation. The data shows that these consumers are experiencing more financial volatility, with 14.1% of Gen Z having a 50-point score decrease in the last year, a figure more than double that of 2021.

The end of temporary credit inflation: A clearer picture of the consumer is now emerging as we move past what was effectively a period of "FICO inflation." This was a temporary phenomenon driven by the student loan payment pause and post-COVID stimulus programs, which artificially improved credit metrics for many borrowers. The recent declines in average FICO scores are not necessarily a sign of a new, sudden deterioration in credit health. Instead, they represent a return to more accurate, pre-pandemic baselines as these temporary tailwinds fade and the true financial picture of the consumer is revealed. This is particularly evident in the resumption of student loan payments, which has had a severe impact on the credit health of a vulnerable population segment.

According to FICO's Credit Insights, the student loan delinquency rate has hit record highs. The importance of this is evident in the data, as 3.1% of the total scorable population (6.1 million consumers) had a student loan delinquency added to their credit file between February and April 2025. This has had a substantial impact on credit scores, with the affected population experiencing an average decrease of 69 points. The payment hierarchy has also shifted, with autos rising to the top, while student loans have fallen to the bottom. This is a key behavioral insight, indicating that consumers are prioritizing secured assets essential for their daily lives, such as transportation or housing, over unsecured educational debt.

The performance of consumer loans further underscores this bifurcation, with subprime auto loan delinquencies continuing to worsen, while prime auto loan performance has stabilized. This points to what FICO calls a "K-shaped economy," where some borrowers have benefited from asset gains while others are struggling with inflation and higher interest rates.

Despite these challenges, it would be incomplete to view the consumer purely through a negative lens. The bifurcated nature of the economy also means that a significant portion of the consumer base is on solid footing, and there are potential tailwinds that could support the broader consumer over the medium term. A key factor is the "bequest effect," as the total net worth of older cohorts has grown substantially, holding about five times the net worth relative to 1999. According to Morgan Stanley Research, this is expected to be an important driver of future consumption for younger and middle-aged cohorts. Additionally, there are other signs of stabilization, such as personal loan delinquencies declining from recent peaks and more consumers scoring in the highest credit score ranges, suggesting that a large portion of the population is responsibly managing their credit. Our view on the consumer is therefore one of a balanced and dynamic landscape, where pockets of strength and forward-looking tailwinds provide a counterweight to the present risks.