Tariffs 2025: Basis Points, Not Breaking Points

The Rithm Take

Tariffs are biting gradually, not the big one-time bite initially expected. Effective incurrence continues to be managed through rerouting, inventory buffers, and margin cushions, producing marginal creep rather than a regime shift for the broad economy. The dominant risk is process and timing across authorities used: Supreme Court challenge paths, and refund mechanics, more than the ultimate destination of policy.

Looking ahead, the transmission of tariffs should be gradual and path-dependent as procurement calendars reset, contracts roll, and freight conditions normalize from unusually easy levels. We expect uneven category impacts rather than a wholesale macro break.

Against that backdrop, the Trump–Xi meeting is context, not centerpiece. A tactical truce—marginally lower effective tariff rates and short deferrals—slightly flattens the near-term pass-through path. It narrows tail risk at the edges but leaves broader technology, security, and enforcement concerns intact, and the medium-to-longer-term trajectory is largely unchanged and uncertain.

Even with the Supreme Court decision overhang and fading cushions, we believe the most probable path remains an incremental, goods-led pass-through—not a step-function shock. Freight is rising from low levels, services inflation has cooled enough to offset part of the goods firmness, and contractual staggers diffuse adjustments over time. Post-summit tweaks slightly ease the near-term glide path, but the larger catalyst is legal clarity around authorities and refunds. Net-net, this is accrual measured in basis points, tolerable for the aggregate outlook, with continued attention to category dispersion.

Market Signals

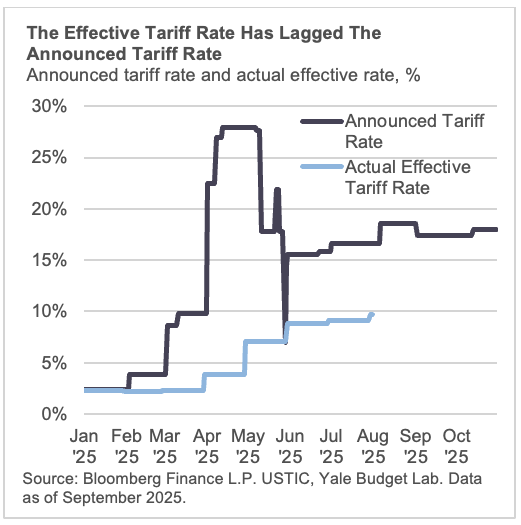

Announced tariff rates neared 30% in April, but realized effective rates have been much more muted.

Corporate Profitability remains strong. Per Bloomberg estimates, profit margins have been above the 5-year trailing average for nine straight quarters.

Trade has rerouted away from China, towards alternative trading partners.

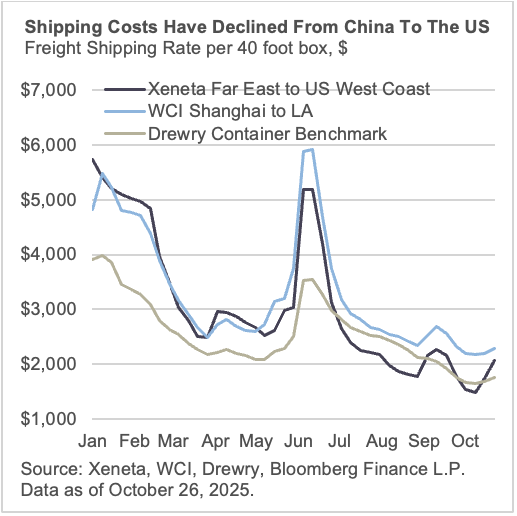

Freight pressure‑relief: Drewry freight rate per 40 foot box benchmark fell for 17 weeks, providing relief relative levels at the start of the year. China import prices have also fallen −3.1% YoY in August, helping to further offset duties at import.

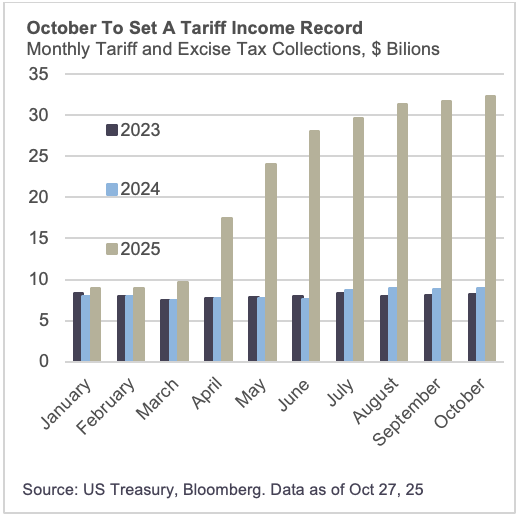

Tariff collections have been increasing month-over-month with October set to break an all-time monthly record.

The Conversation

Following “Liberation Day” in April, where President Trump unveiled sweeping tariff rates across countries which was well above Street expectations, economists pivoted their views from US exceptionalism towards a 40% chance of US recession. The thesis for the bearish outlook made logical sense using the existing academic literature1. The literature suggested, as a rule of thumb, that for every percentage point increase of the tariff rate corresponds with a 10bp increase in CPI and 10bp hit to real GDP. Given the announced tariff rates in April were 26pp above the tariff rate at the start of 2025, that would imply ~2.6% upward pressure on CPI and ~2.6% downward pressure on real GDP (not accounting for substitution effects, trade re-routing, etc.) In reality, CPI has increased 70bps since April and the Atlanta Fed GDPNow is estimating the economy grew at 3.9% in the third quarter.

Why has the data held up better relative to economist expectations? We walk through three reasons below.

Corporations built inventories. Analysis from Peterson Institute for International Economics (PIIE) shows that real U.S. goods imports (inflation-adjusted) in January-March 2025 were roughly ~25% above the same period in 2024, with part of the gain driven by importers pulling forward orders ahead of tariff enforcement. The S&P Global U.S. Manufacturing PMI sub-index for “Inventory of Purchases” surged in May, reaching the highest reading in the survey’s history (18 + years) — signaling “unprecedented accumulation of inventory… front-running tariff-related supply problems”. Stockpiling inventories allowed corporations to avoid (at least until inventories are depleted) the increased cost of imports.

Healthy margins. Corporate profitability stayed historically high—11.2% net margin in Q3. Per Bloomberg data the quarterly profit margin for the S&P 500 has now been above the 5-year trailing average for nine straight quarters. Elevated margins have allowed corporations to bear the brunt of the tariff costs, rather than pass them on to consumers. Goldman Sachs estimates US firms absorbed ~64% of tariff costs through June, with consumers just ~22% and foreign exporters ~14%. But, the risk remains that as inventories are depleted and margins come under pressure, corporations may start to pass more of that cost on to consumers. Goldman projects the consumer share to rise toward ~65% as price resets cycle through and category coverage broadens.

Declining shipping rates. Global freight has become one of 2025’s biggest inflation offsets. Ocean shipping rates have fallen nearly 50% year-on-year, with the Drewry World Container Index in October averaging its lowest level since 2019. A record 9% increase in global vessel capacity, improved port efficiency, and softer fuel prices have unleashed excess supply, a powerful cushion against tariffs. For many US importers, per-unit freight costs are down 30–40%, offsetting much of the baseline duty. Lower logistics costs trimmed landed prices and kept the BLS import-price index flat year-on-year, even as tariffs expanded. For corporates, cheaper freight is a direct benefit to operating margins that might have been hurt by duties. But the tailwind is volatile: if global trade rebounds or Red Sea disruptions return, freight could normalize fast, increasing pass-through risk.

With services inflation providing some relief at the margin, our base case is that tariffs remain operationally manageable—but two risks can still complicate the path.

- Supreme Court IEEPA ruling and refund overhang. If courts ultimately curtail the use of IEEPA, the administration is unlikely to abandon the objective; it would pivot to other authorities (e.g. section 232) with different timelines and challenge paths. That handoff would be create new notices, scope resets, and litigation, adding volatility even if the destination is broadly the same. It also leaves a duty-refund overhang, to what has been a significant revenue source for the Treasury.

- Logistics and the slow bite. Earlier mitigants—unusually low shipping costs, inventory coverage, and contract lags—helped mute pass-through. As those buffers normalize, the tariff impulse is more likely to accrue than shock: basis-point increments that build through 2026, particularly if year-end GRIs (General Rate Increases announced by ocean carriers) and route frictions stick even partially. The practical risk is not a macro break but more frequent, goods-led noise and greater cross-issuer dispersion as categories reset on different timetables.

Even accounting for Supreme Court decision overhangs and fading cushions, our view of the most probable tariff path is an incremental, goods-led pass-through, not a step-function shock. Freight is rising from low levels, services have cooled enough to offset part of the goods firmness, and contractual staggers spread adjustments over time. The result is an accrual, not a rupture, and should be tolerable for the aggregate outlook, while keeping us alert to category and issuer dispersion.