Real Rates Rise as Policy Easing Meets a Resilient Economy

The Rithm Take

The upcoming FOMC meeting is unlikely to deliver a policy surprise, but the broader setup is more consequential than the decision itself. The Fed has already moved policy meaningfully closer to neutral, yet the economy continues to run with underlying momentum. Growth remains firm, labor markets are still tight by historical standards, and inflation progress has slowed but not reversed. In that context, holding rates steady next week is less a pause driven by caution and more a recognition that policy easing is now colliding with a resilient real economy. Our base case remains that this interaction supports continued growth and earnings durability, but it also implies higher real rates than the market expected earlier in the easing cycle and a more constrained path for additional cuts.

Market Signals

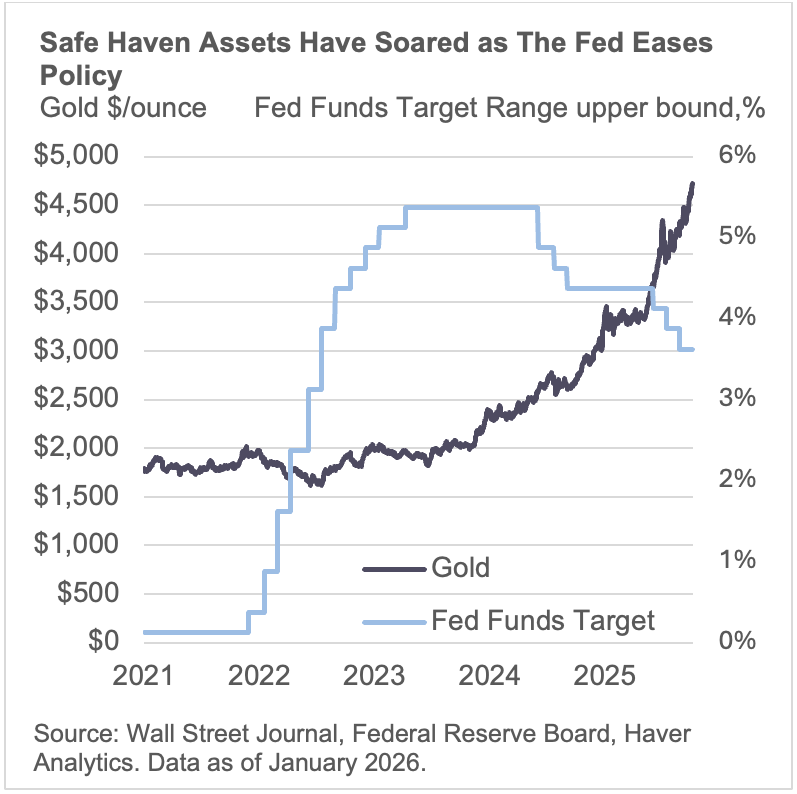

Long-term Treasuries continue to perform poorly in the wake of rate cuts. The 10-year Treasury yield is 4.27% at the present time compared to 4.03% on the day before the Fed restarted cutting interest rates in September. Precious metals prices have surged with the price of gold soaring from around $3700/oz on September 16 to over $4800/oz—although in part this is no doubt due to heightened geopolitical tensions. While 10-year inflation breakevens have changed little since mid-September, the real yield on 10-year Treasury debt has risen and accounts for the increase in 10-year yields referred to above. These market price moves suggest that the decisions to cut interest rates during the last four months of 2025 may have been ill-advised with the effects of tariffs still to be fully passed through. Chair Powell said at his last press conference in reference to tariffs, “Our obligation is to make sure that a one-time increase in the price level does not become an ongoing inflation problem.” Kansas City Fed President Schmid, who dissented at the last two FOMC meetings in favor of keeping policy on hold, argues that monetary policy should be “modestly restrictive” to prevent the pass-through of tariffs into a sustained increase in inflation and that monetary policy at present is “not very restrictive.” One could argue that market prices—including equity prices, which hit a new record high on January 12, and credit spreads, which are generally tight—suggest that monetary policy is actually accommodative.

The Conversation

The Fed meeting takes place in the wake of perceived assaults on the Fed’s independence on monetary policy issues. President Trump has already tried to remove Governor Cook for cause over allegedly claiming more than one residence as her primary residence on mortgage applications and the Supreme Court held a hearing on the matter this week. It will likely be several months before a ruling is issued in the matter but the overwhelming opinion of Supreme Court watchers was that the court appeared reluctant to permit the firing of Governor Cook. Two weeks ago, the Justice Department took the unprecedented step of issuing a subpoena to Chair Powell and the Fed over cost overruns on the renovations of the Fed’s Headquarters in Washington D.C. Chair Powell responded with a video statement that said “ The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President” adding “This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions—or whether instead monetary policy will be directed by political pressure or intimidation.” President Trump denied any knowledge about the investigation, but the perceived climate of harassment makes it difficult for the Fed to cut rates in the event the data suggested it was a close call because of the perception that the Fed might be being unduly influenced by the Administration.

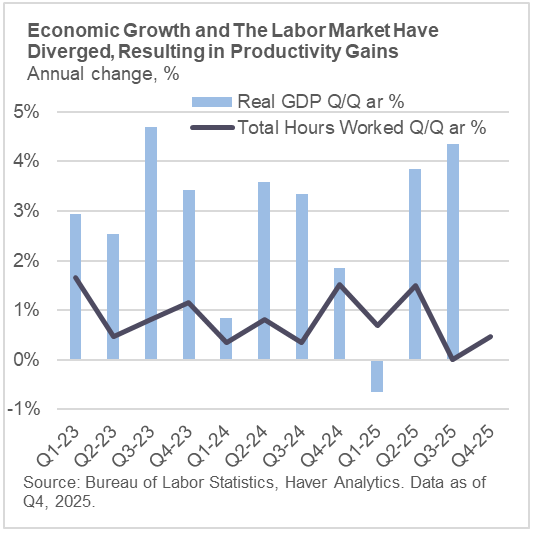

In any event, the data do not support the case for an additional rate cut. Real GDP growth was 4.3% in the third quarter and the Atlanta Fed’s GDPNow estimate puts fourth-quarter real economic growth at 5.4%. The strength of growth stands in marked contrast, however, to the growth in the labor input into production measured by total hours worked in the private sector, which were unchanged in the third quarter and grew at an annualized rate of only 0.4% in the fourth quarter of 2025. In addition, government employment fell at an annualized rate of 0.2% in the third quarter and by a whopping 2.9% in the fourth quarter as resignations made earlier in the year took effect. The strength of the economy in the face of labor market softness points to strong productivity growth (nonfarm business productivity grew at an annualized rate of 4.9% in the third quarter while nonfinancial corporate productivity growth was 3.0% in the quarter). Strong productivity growth that is not matched by equally strong real wage growth would raise the rate of return on capital, other things being equal, which economic theory suggests would raise the neutral real rate of interest. Of course other things have not been equal but strong productivity gains may have allowed companies to absorb temporarily the increase in tariffs without putting downward pressure on profit margins or fully passing through the tariff increases to consumers. With the 10-year real Treasury yield already standing at 1.9% on a CPI basis (roughly 2.2% on a PCE price adjusted basis) and against the backdrop of strong productivity gains, the FOMC’s central estimate of the real neutral rate of 1% looks to be low and monetary policy may well be accommodative rather than neutral.

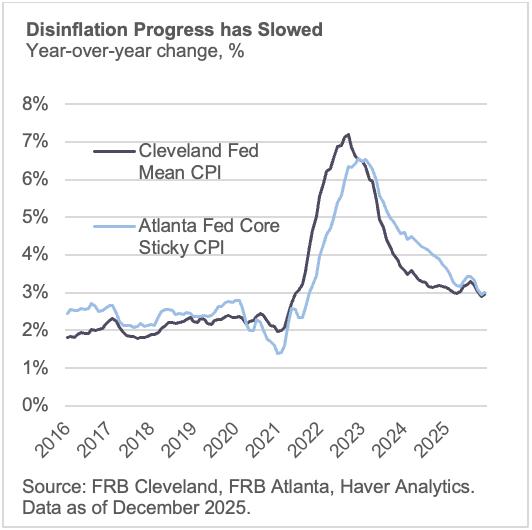

We raised the question of the perception of the independence of the Fed last October following the cut in interest rates at the September FOMC meeting. We said “President Trump has made no secret of his desire to see the Fed cut interest rates and his criticisms of Powell have been vocal…If market participants eventually conclude that monetary policy decisions were being made in response to pressure from the administration rather than based on economic fundamentals, this could produce an adverse reaction in the bond market and produce a marked steepening of the yield curve.” We now appear to be diving deeper into such a political environment and the bond market is behaving as we suggested that it might. Moreover, the economy seemed to be delivering strong demand growth as 2025 drew to a close—although the lingering effects of the government shutdown mean that some key data points are not yet known. It may be worth repeating the warning that we gave in October, “Easing monetary policy in a fully-employed economy that has been experiencing stubborn inflation pressures and solid demand growth is a recipe for higher inflation.” Since we wrote those words, the Fed has cut rates by another 50 basis points. Fortunately, the Fed does not seem set to dig that monetary hole deeper next week as the economy enters a potentially critical phase in the determination of inflation with underlying disinflation appearing to have stalled out (as suggested by the Atlanta Fed’s sticky CPI or the Cleveland Fed’s trimmed-mean CPI—see chart) and as companies enter a new year and have to decide whether to pass more of the tariff increases along.