Policy on Hold as Trade Story Unfolds

Market Signals

The Federal Open Market Committee (FOMC) will conclude a two-day monetary policy meeting on Wednesday. It is widely expected that the fed funds target range will be maintained at 4.25%-4.5%. Recent data point to stability in the labor market and monthly price gains have been benign, although year-over-year core inflation is still higher than the Fed’s objective and has not moderated since the last FOMC meeting. The outlook for the labor market and inflation remains highly uncertain given an evolving trade policy environment. Fed Chair Powell will likely avoid giving new guidance on the policy outlook.

The Conversation

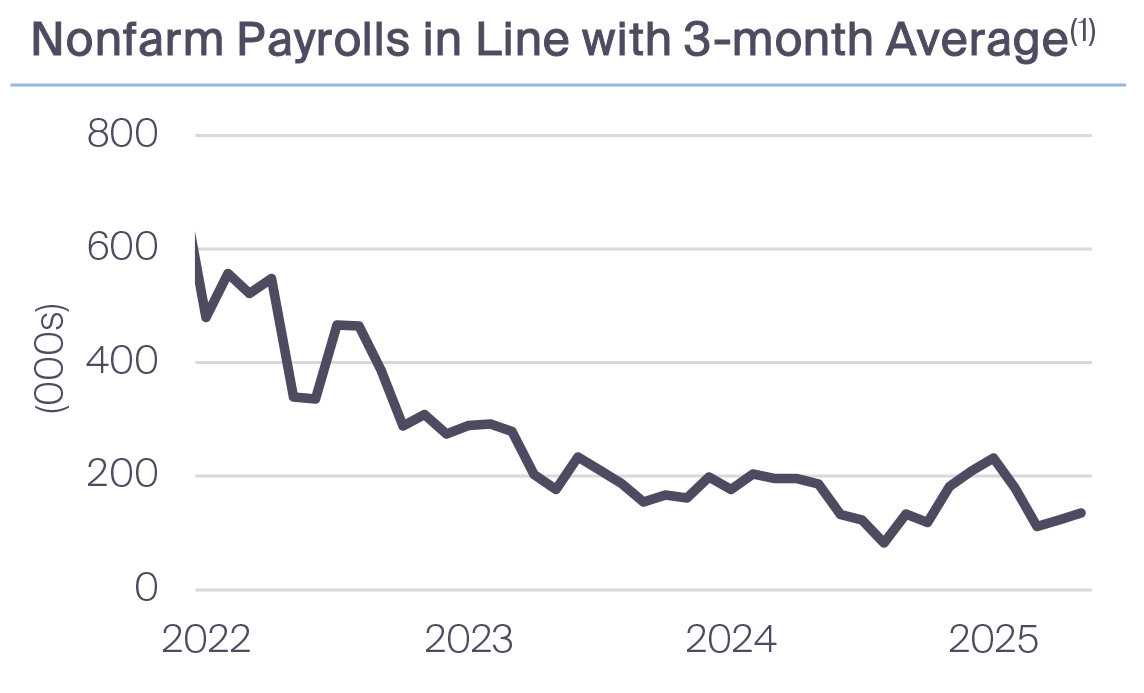

The May employment report pointed to stable job creation trends. Nonfarm payrolls rose 139,000 in May, about in line with the three-month average gain of 135,000 and the 12-month average gain of 144,000. The unemployment rate was unchanged at 4.2% for the third straight month in May. Jobless claims have picked up but remain at a historically low level.

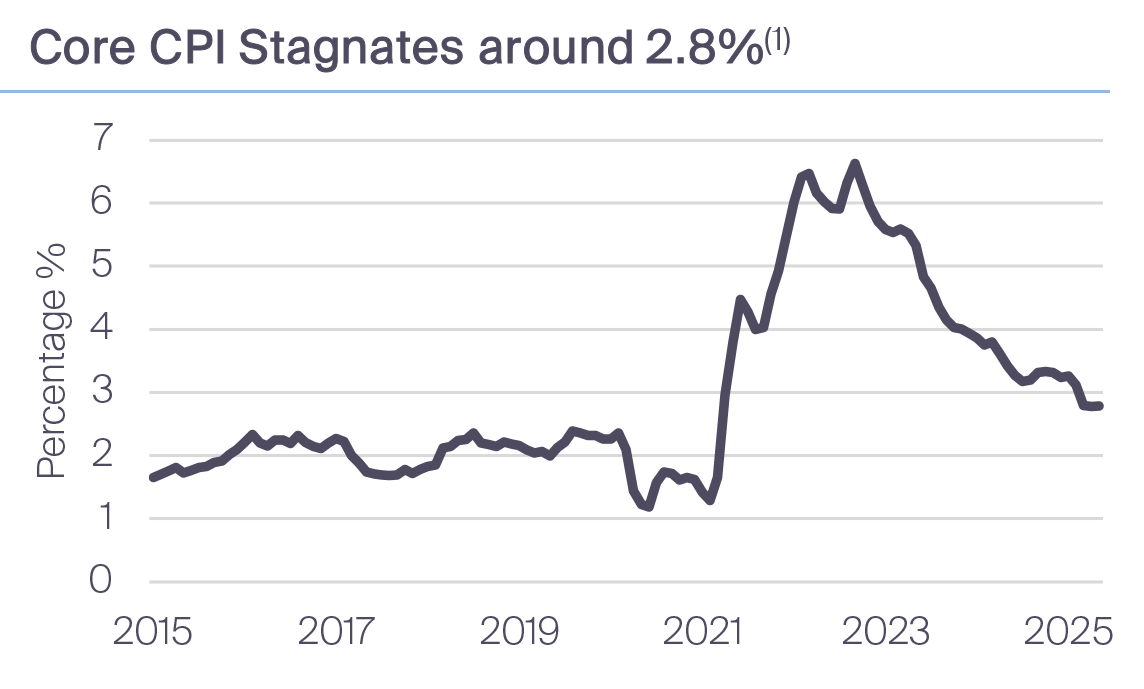

Monthly price gains have been modest, but core CPI inflation has been stuck at 2.8% on a year-over-year basis for three straight months through May. Core PCE inflation moderated to 2.5% in April, the lowest since March 2021.

Absent tariff uncertainty, Fed officials would be encouraged by the recent labor market and inflation data. However, business anecdotes on pricing are likely concerning to policymakers. For example, the Fed’s recent Beige Book noted “widespread reports of contacts expecting costs and prices to rise at a faster rate going forward … A few Districts described these expected cost increases as strong, significant, or substantial … All District reports indicated that higher tariff rates were putting upward pressure on costs and prices … Contacts that plan to pass along tariff-related costs expect to do so within three months.”

The Rithm Take

A consistent message from Fed policymakers has been that the outlook for the labor market and inflation is more uncertain given evolving trade policies and it will take some time to gain clarity on the economic outlook. It is unlikely that there is enough clarity at this point to signal anything other than a continued “wait and see” approach to setting monetary policy. The Fed likely continues to view monetary policy as well positioned to deal with risks and uncertainties on the outlook. The updated Summary of Economic Projections should continue to show 50bps of rate cuts later this year, roughly in line with market pricing.