Mid-Year Strategy Playbook

Market Signals

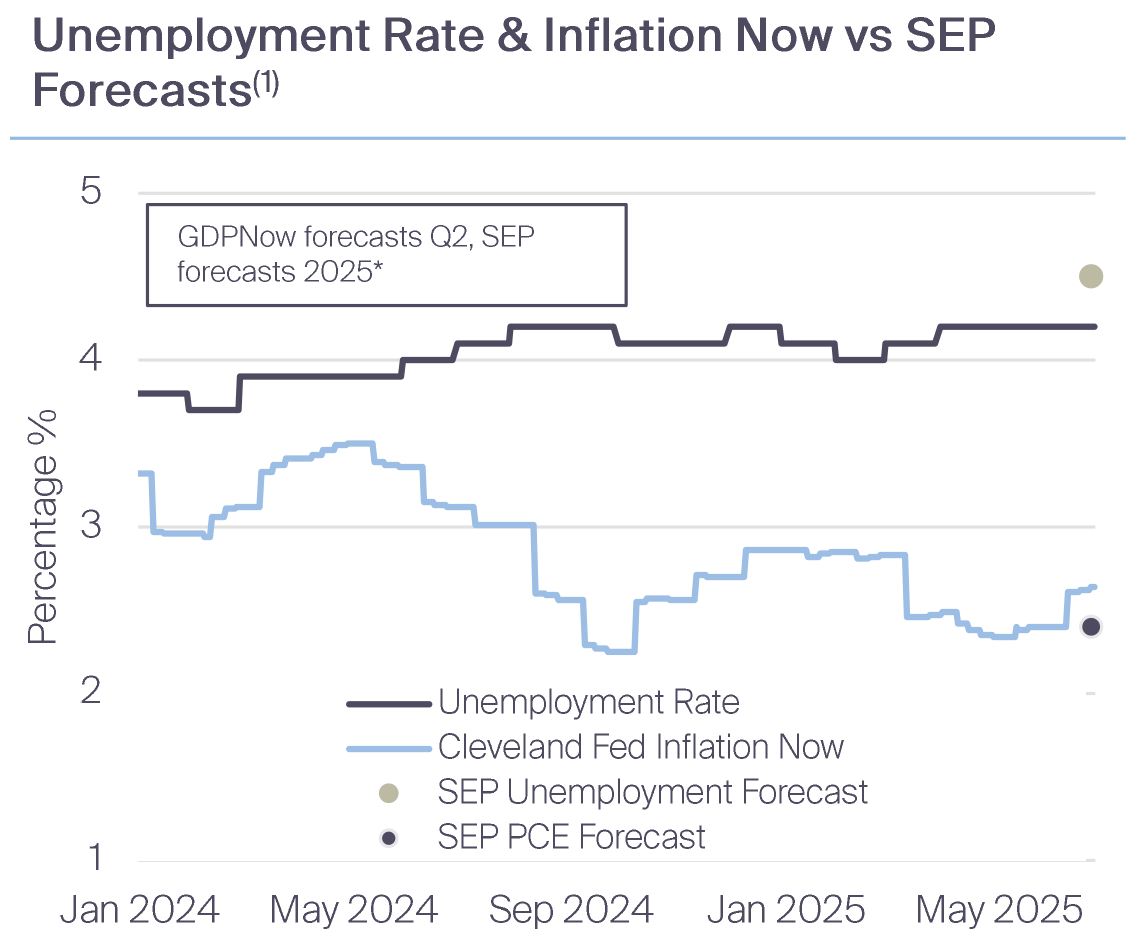

The outlook for economic resilience remains intact. The Atlanta Fed’s GDPNow model projects roughly 3.4% growth versus the Fed’s Summary of Economic Projections (SEP) at 1.4% (down from 1.7% in March). May’s headline and core CPI were 2.4% and 2.8%, while the Cleveland Fed’s Nowcast sits at 2.64%. June’s SEP shows PCE and core PCE forecasts of 3.0% and 3.1%. Weekly initial jobless claims average about 245,000, with continuing claims at 1.974 million. The unemployment rate is 4.2%, versus a 4.5% Fed projection by year end 2025.

Federal Reserve Policy & Economic Outlook

Resilient growth and tame inflation have raised the threshold for rate cuts. The divergence between Atlanta Fed GDPNow estimates and SEP from the Fed has widened this year. Tariff pass-through into prices remains the key inflation risk, keeping the Fed on hold. Unemployment forecasts stay well below the mid-5% range the Banks, such as JP Morgan, forecasted after Liberation Day.

Corporate Earnings & Credit Spreads

Economic resilience underpins credit fundamentals and valuations. Q2 earnings have exceeded expectations, and robust corporate margins reinforce this strength. Investors have shifted from spread-based to absolute-yield buying, supporting technical momentum. Headline-driven pullbacks in risk assets have repeatedly created attractive entry points.

Policy Uncertainty & Agency MBS

Policy uncertainty remains elevated—around 450 on the economic policy uncertainty index, versus an average of 426 in 2025 and 131 in 2024. This uncertainty contributes to a historically wide agency MBS basis. The basis is currently at 147bps while averaging 117bps since 2019.

Housing Market & Mortgage Demand

Housing faces a paradox: poor affordability suppresses demand, yet with a large number of sellers relative to buyers, it suggests a mid-single-digit percent decrease in home prices. To date, prices have held up. As of April, Florida, Texas, and Arizona lead in inventory, while the steepest price declines among the top 50 MSAs are in Texas and Florida, led by Austin, Tampa, and Dallas. However, home prices nationwide have thus far remained sticky to the downside.

Consumer Income & Spending Trends

Consumers rarely drive recessions. With high corporate margins, rising wages and low unemployment bolster resilience against tariffs and other pressures. Typically, income leads spending, which leads delinquencies and then leads credit performance. Recent data indicate student-loan delinquency rates may have peaked, though debt-to-income ratios remain elevated since 2022. We expect a continuation of the resilient consumer due wealth effects stemming from rising equities and embedded home valuations.

Commercial Real Estate

Headline risks have cooled down. Two sectors of note are office and multifamily, each a case subject to fundamental and technical events, respectively. Office investors are increasingly distinguishing by quality, favoring Type A buildings over B and C. While, in select regions, a technical reversal is bolstering multifamily demand.