Life In Office – It’s Not All Bad

Office Sector Beginning to Attract Capital

When in rains, it pours! Breaking out this week (from a long stretch of ominous headlines plaguing commercial real estate’s office sector) are notable headlines signaling some life in the sector with a few investments in office properties:

- Vornado Realty Trust announced $1.2bn in spending plans to overhaul two of its office buildings, totaling 9mm square feet surrounding Manhattan’s Penn Station.(1)

- SL Green Realty Corp. announced the sale of a 49.9% stake in its 1.8mm square feet skyscraper located at 245 Park Avenue in Midtown Manhattan.(2)

- In Fort Worth, TX, America’s fastest growing major city, 168k square feet of office space is to be developed as Crescent Fort Worth, a mixed-use development including 175 upscale apartments and a 200-room luxury hotel.(1)

Separately, interest in CMBS B-pieces is growing with activity surfacing across primary and secondary offerings.(3) Buyers are being drawn to double digit yields, and a mix of factors lowering risk of the collateral.

A common theme resonating collectively through this activity, despite relatively low issuance, is demand for trophy and amenitized properties in select locations, emphasis on quality tenants, tighter lending standards, and more conservative underwriting.

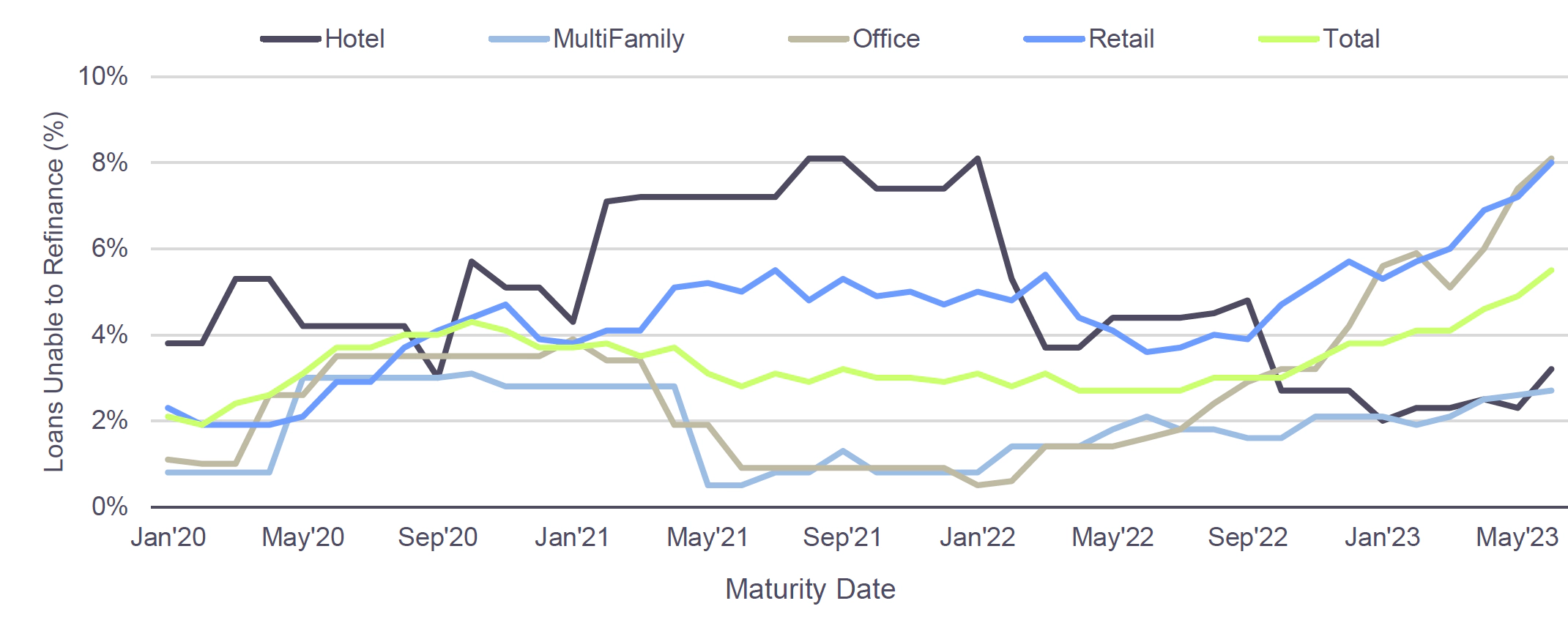

Rather than sound the “all-clear”, loan workout trends point to a rising share of office properties securitized in private CMBS transactions that are failing to refinance. These are similar to trends seen during the pandemic era, notably with hotel and retail assets. 2H’23 trends in office refinance failures should serve as a first measure of forthcoming pain, providing further insight into the level of credit distress in this critical sector of commercial real estate.

Yet in office too, workout solutions are coming to life, especially for trophy properties. In May, RFR secured a ~$1bn refinancing on the Seagram Building, an 860k square foot, 38-story skyscraper in Midtown Manhattan. It took restriking the terms on this much watched CMBS loan and included a plan to repurpose the 35k square foot garage into an amenity space. Next up in August is a Tishman Speyer $485mn CMBS loan on 300 Park Avenue, which has been transferred into special servicing.(4)

Conduit Loans Unable to Refinance on Time (12-Month Rolling Avg)(5)