Inflation's Challenge, Growth's Resilience

The Rithm Take

The US economy is defying expectations, surprising to the upside on the eve of a likely Fed easing cycle. While initial forecasts pointed to a slowdown driven by tariffs, corporate earnings and consumer resilience have proven stronger than anticipated. This unique setup—where a Fed rate-cutting cycle begins in an environment of solid growth and improving corporate profitability—creates a powerful tailwind for risk assets. This dynamic directly benefits equities and corporate credit, while potentially reviving the housing market and certain sectors like financials.

Market Signals

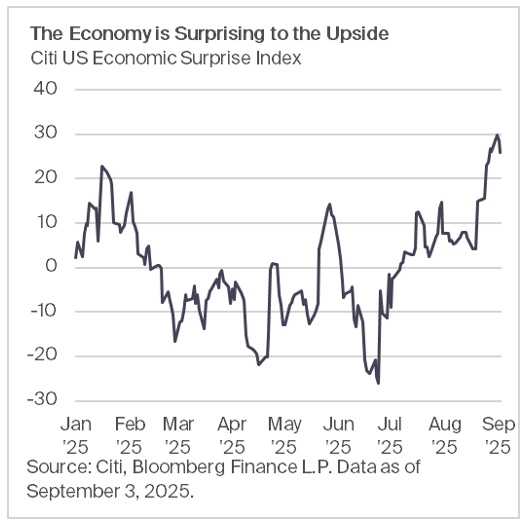

The US economy has been surprising to the upside. Most market participants had anticipated a growth slowdown in the second half of this year driven by trade policy, and for now that slowdown hasn't come to fruition, or appears to have been delayed. Either way, the economy is advancing on the eve of what seems to be the start of a monetary easing cycle.

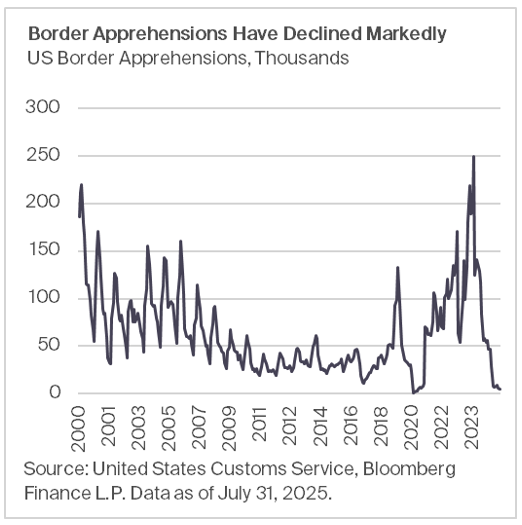

Potential growth may be limited as labor force growth is set to be challenged amid changing immigration policy.

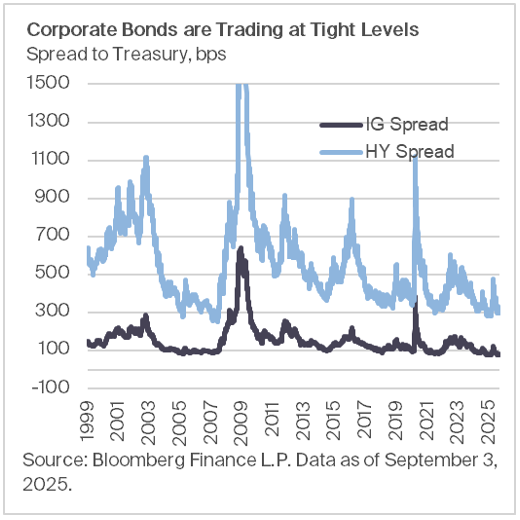

Corporate bond issuance has accelerated, but spreads remain tight, as investor demand is bolstered by all-in yields above those during the 2010-2020 decade.

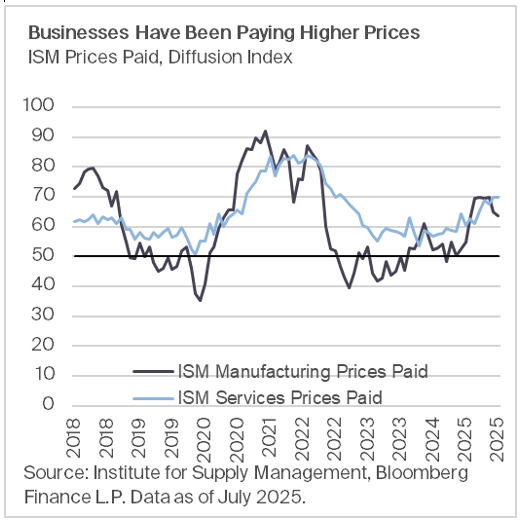

Underlying inflation pressures remain a risk to the Fed’s easing cycle. Businesses have been forced to pay up in the production process, and it is still unclear who (consumers or businesses) will bear the burden of those increases.

The Conversation

The story of the economic slowdown picked up steam after Liberation Day tariffs brought the effective tariff rate to the highest level in the post-war era. The consensus called for stagflationary pressures to derail the US growth picture and company profitability. As the course of the year continued tariffs, have been applied in a more incremental measure but are economically significant nonetheless. What has changed though is the market participants view towards the resilience of the consumer and US corporations strength in the face of said tariffs. Most recently those same participants have even suggested a resurgence in strength.

This has been evident in the economic surprise index, which stands close to year-to-date highs and the results of the most recent corporate earnings season. The second quarter earnings season proved to be a strong one, with the largest US corporations growing earnings at double digit levels year-over-year for the third consecutive quarter. Analyst two-year earnings revisions were more positive than negative for the first time in three years. Now US equities sit near all-time highs and sell side economists have been adjusting their growth forecasts higher.

This set up exists as the market is all but sure the Fed is set to embark on an easing cycle with four interest rate cuts priced in the next seven FOMC meetings. A Fed easing conditions in a market where growth is holding in better than feared and corporations are expanding their earnings can act as a powerful tailwind for risk assets. In fact, according to Reuters in the 12 months following the initial rate cut the S&P 500 had an average gain of 13% when the economy avoids a recession. Perhaps most notably, a rate cut could also free up some turnover in what has essentially been a frozen housing market and benefitting securitized products and financials amid a steeper curve. The first signals of this may already be appearing, as ARM issuance has increased as a percentage of loan application volume to ~8% from ~5% a year ago.

But risks remain. The latest JOLTS report showed job openings declined while layoffs have been rising. The labor force is growing more slowly amid current immigration policy; border apprehensions have fallen to essentially zero from December's 250k peak, reducing potential GDP. All of this while inflation risks remain, ISM prices paid and input/output prices both point to continued price pressure, and some of the tariff impact is starting to be seen in PCE goods inflation.

Nonetheless, we believe the market tailwinds outweigh the headwinds. Consumer balance sheets are stronger than they were pre-COVID and income growth is outpacing broad inflation, which should allow for a continuation of spending growth. This leads us to believe the economy will avoid a recession and grow at a modest pace over the next year helped by easing conditions, the resilient consumer, and a bump from favorable tax policy which should make its way through in early 2026.