In Search of “Neutral”

The FOMC’s September Summary of Economic Projections (SEP) continued to signal one more quarter-point rate hike in 2023, raised the 2024 to 2025 policy path 50bps compared to the June SEP, and introduced forecasts for 2026. The Federal Funds Rate (FFR) path is forecasted at 5.6% for 2023, 5.1% for 2024, 3.9% for 2025, and 2.9% for 2026, when unemployment and inflation align with the Fed’s view of their longer-run rates of 4% and 2%, respectively. The 2.9% FFR in 2026 is still above the longer-term projected FFR of 2.5%.

“The Conversation”

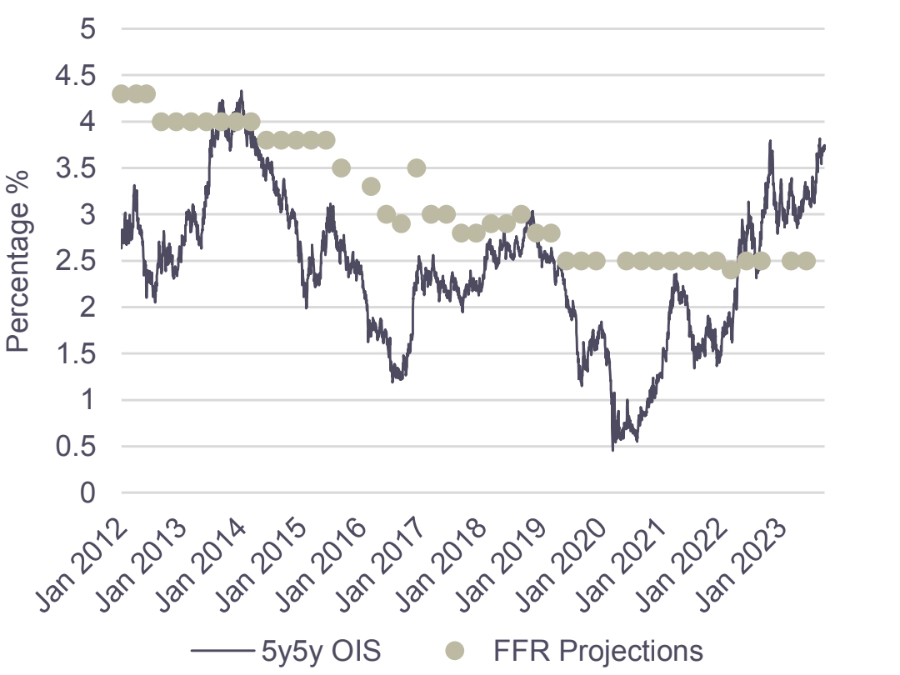

Through the post-GFC era the Fed’s long-term FFR projection has anchored the 5y5y Overnight Index Swap (OIS) rate, the rate for five years in five years one is willing to swap to receive a floating market benchmark rate. Through the summer though, the 5y5Y OIS rate has notched higher. The driver this time is the economic resilience, compared to high inflation which last year elevated this rate. At a current 3.86% on the 5y5y OIS rate, it sits well above the 2.5% long term FFR.

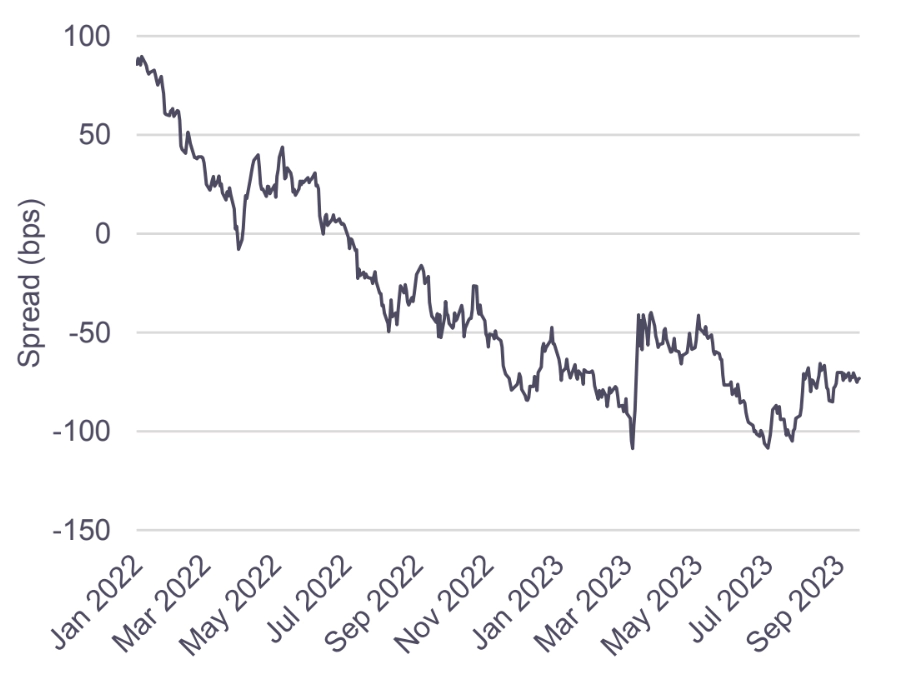

This marks a new phase of monetary policy tightening. Since the onset of the Fed’s rate hikes the 2s10s Treasury curve has steadily inverted. However, the curve has been steepening while the 5y5y OIS rate has reset to new levels. The 525bps cumulative rise in the FFR in this tightening cycle since early 2022 has been paralleled by a 435bps rise in the 2-year Treasury yield, and a 280bps rise in the 10-year Treasury yield, with almost 100bps of the move in the 10-year yield occurring through this summer.

Central to this move, and notable departure from being anchored for so long by the Fed’s FFR projection, is the market’s, and the Fed’s discovery, of the appropriate “neutral” rate. Defined as the rate where monetary policy is seen as neither accommodative nor restrictive, the ‘neutral” rate is not observable, at best estimated, and best understood after a long passage of time. Also known as R*, Chair Powell himself acknowledged that we can only know it “by its works” and it may “of course be that the neutral rate has risen.” The resilience of the economy thus far points to a higher R*. NY Fed President Williams’ estimates, using the Laubach-Williams model shows R* as low as 0.5% to revised estimates well above 1%. Should a higher estimate be proven right, the LT FFR projection of 2.5% is too low.

5y5y OIS rate has surged above FFR projections(1)

2s10s curve has re-steepened through summer(1)

The Rithm Take

Future FOMC meetings stand to draw growing focus on the Fed’s 2026 and LT FFR projections. While the 2.9% FFR projected for 2026 is a nod in the right direction, the LT FFR at 2.5% will be closely followed. The LT FFR projection is subject to being revised in small steps, however, has remained at 2.5% since the second quarter of 2019 (apart from the first quarter of 2022, when the projection was 2.375%). Long end Treasury yields will take their cue from these moves.