Housing, Where the Price is Right

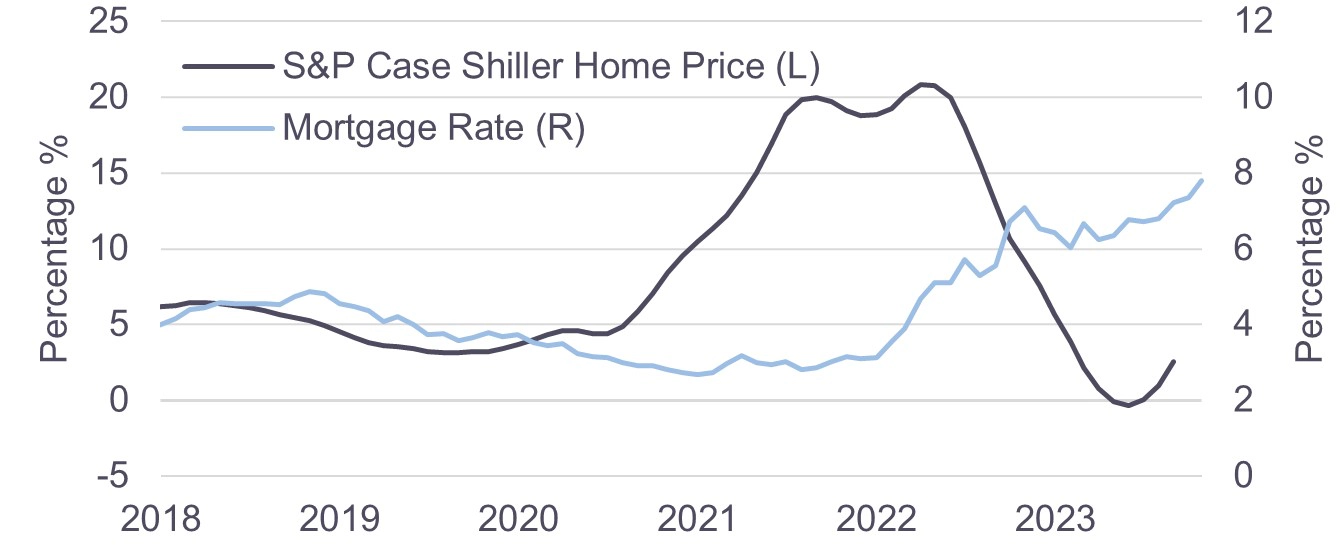

Multi decade highs in mortgage rates and lows in housing affordability have choked the supply of homes and mortgage lending volumes. Home prices are actually appreciating against this backdrop, while the headlines suggest risk of prices declining.

The Conversation

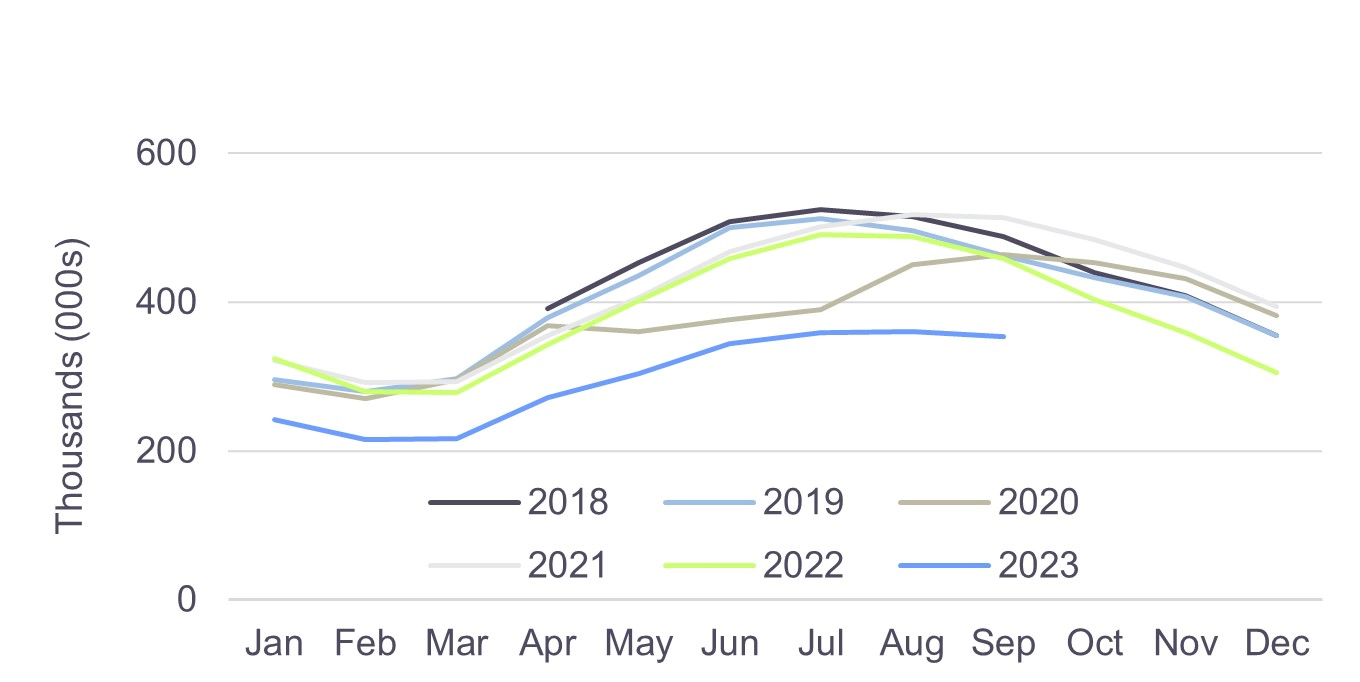

In 2023, the housing market looks quite different from 2022. Home prices are on the rise, despite higher mortgage rates, reversing the slowdown seen just a year ago. This increase in home prices is happening even as the number of homes listed for sale remains steady into the winter months, despite challenges like high rates and affordability concerns.

While volumes are lower, buyers and sellers have found a balance that supports these home prices. Homebuilders are offering lower mortgage rates, often 2-2.5% below the prevailing rates, which helps address broader affordability issues. D.R. Horton reports 60% of homebuyers getting rate buydowns. It remains to be seen if this prevails as land and building costs have kept rising, with an eye on still high homebuilder margins.

Another development stemming from higher home prices is the relative appeal of institutional single-family rentals. Renter income is double the national average, creating higher renter-vs-owner affordability. This trend is encouraging operators to transition from older, higher maintenance homes to newer homes with higher income potential.

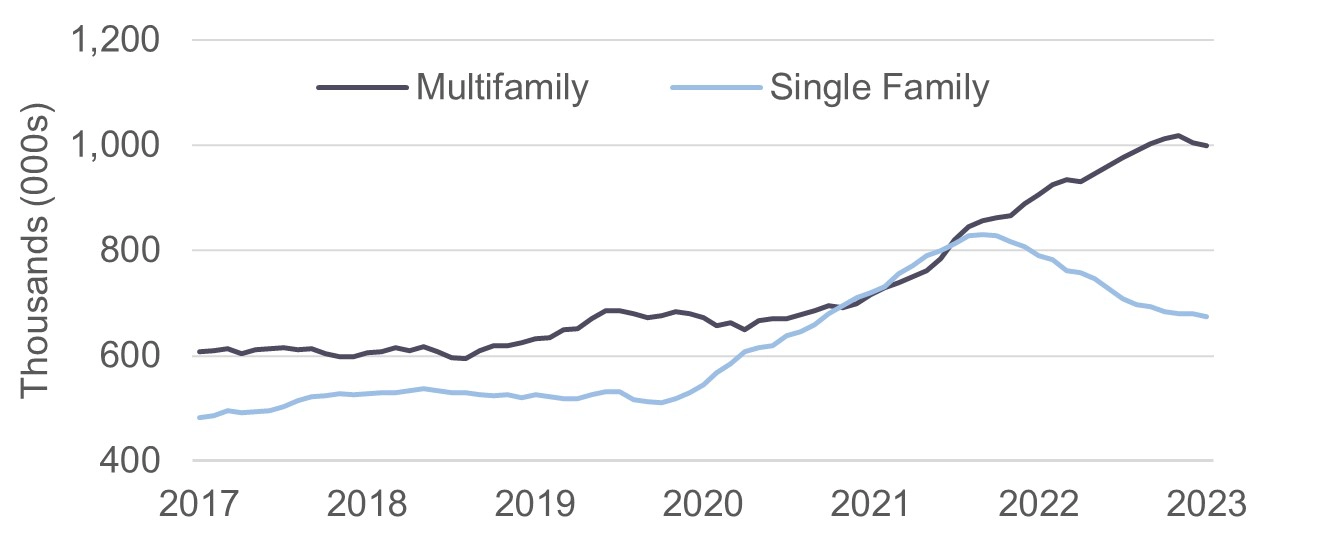

Changes in the housing market are expected to strengthen single-family rental rates compared to multifamily rentals. With more supply coming online for multifamily rentals, they are likely to weaken, while the single-family rental sector is set to play a vital role in providing housing solutions in the United States.

Case Shiller Home Prices vs. Mortgage Rate(1)

Zillow New Residential Listings Seasonality(2)

Single-Family vs. Multifamily Construction(1)

The Rithm Take

Should the FOMC indeed be close to the end of its tightening cycle, stable funding rates ahead indicate a stable footing for single-family rental operators. Cap rates haven’t adjusted as much, but higher exit prices and pricing power in rental yields add to expected returns. Apart from addressing the current affordability challenges, a bigger challenge is a post-GFC period of declining housing mobility. This is even more pronounced today given the low rates existing homeowners locked into during the pandemic, disincentivizing owners to move into higher price homes with higher mortgage rates. A larger rental footprint in the United States could fulfill the needs for economic, job, and upward mobility ahead.