Housing Headwinds & Hidden Strengths

The Rithm Take

The current dislocation between housing supply and demand is rippling through the rental sector. The homeowner lock-in effect is well known, a similar trend is unfolding in the rental market. This lock-in effect in combination with the housing deficit is creating an environment for landlords to increase rent growth on renewals and tenants are extending rental tenures.

Market Signals

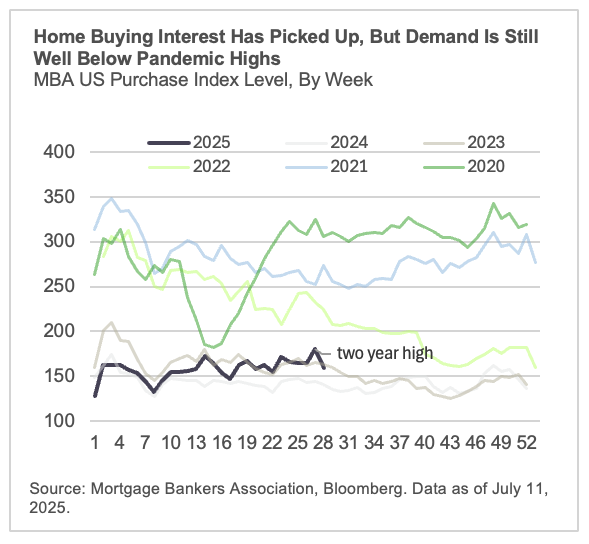

Purchase applications have increased year-to-date to a two-year high, hinting at an early recovery in housing demand and pointing to pent up interest. However, purchase intent is not translating into actual home sales, and activity remains well below levels seen when interest rates were less restrictive.

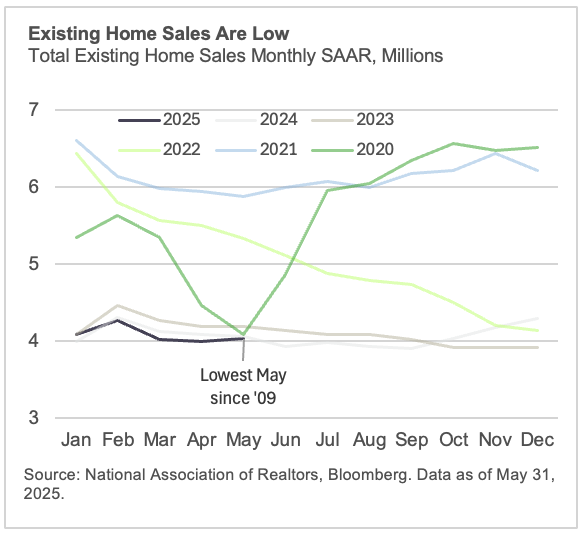

On the supply side, we're seeing suppression of homes for sale due to the borrower "lock-in effect." Homeowners with existing mortgages at rates below current market levels are disincentivized to sell and give up their favorable rates. This has limited mobility and reduced resale activity. As a result, existing home sales in May recorded their lowest level for that month since 2009.

The Conversation

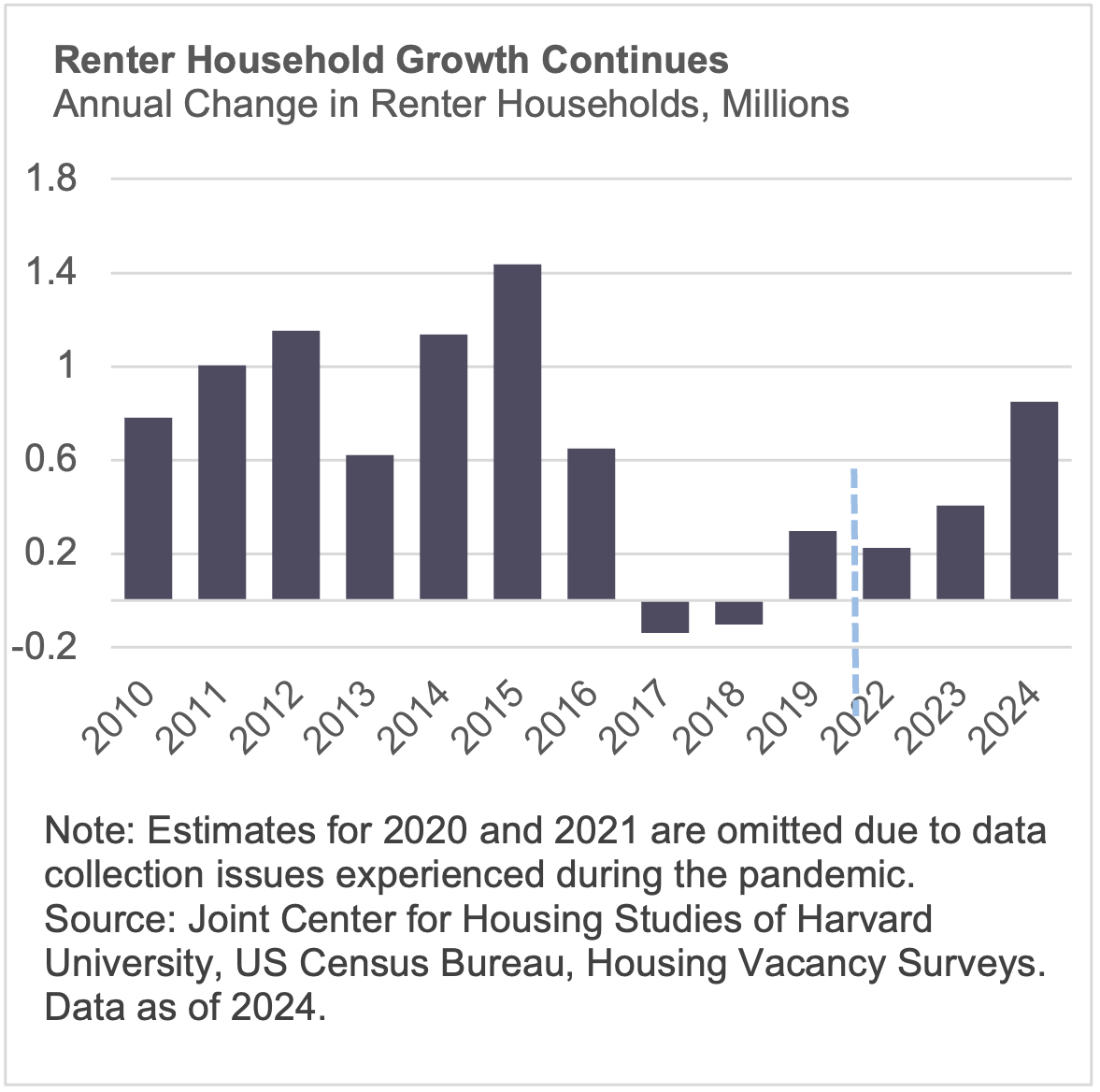

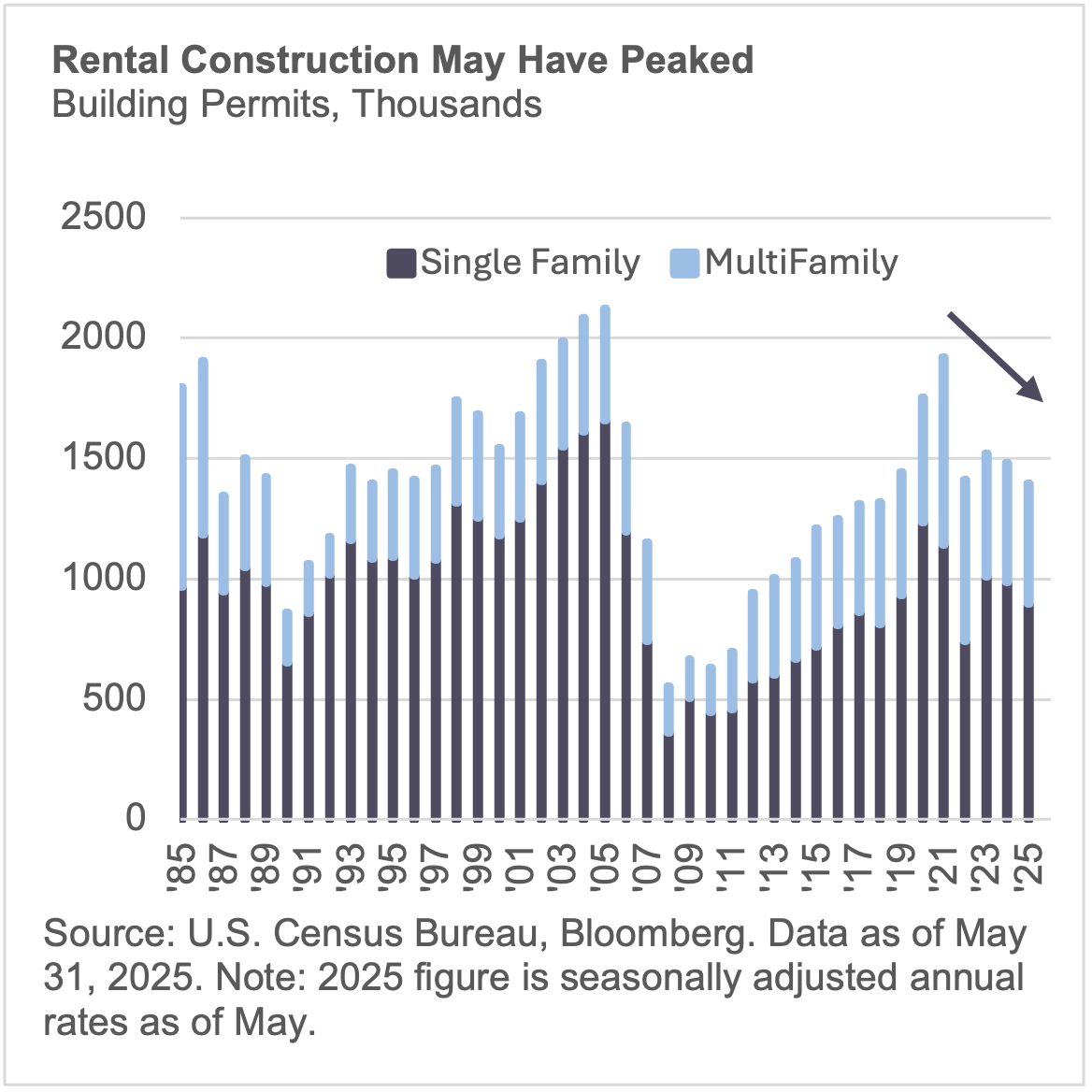

While housing affordability remains a major hurdle for potential buyers, it’s creating an effect for renters and landlords. Many renters are staying put longer. J.P. Morgan Global Research reports the average renter tenure has extended to 30 months, from 20 months. For single-family rentals, tenures are even longer, closer to four years. As renters stay, landlords are gaining more pricing power, with lease renewals estimated to increase by 4% year-over-year. The sector also stands to be reshaped with an imbalance of supply and demand, growth forecasted in renter households and construction which perhaps has peaked.