Funding the Expansion

The Rithm Take

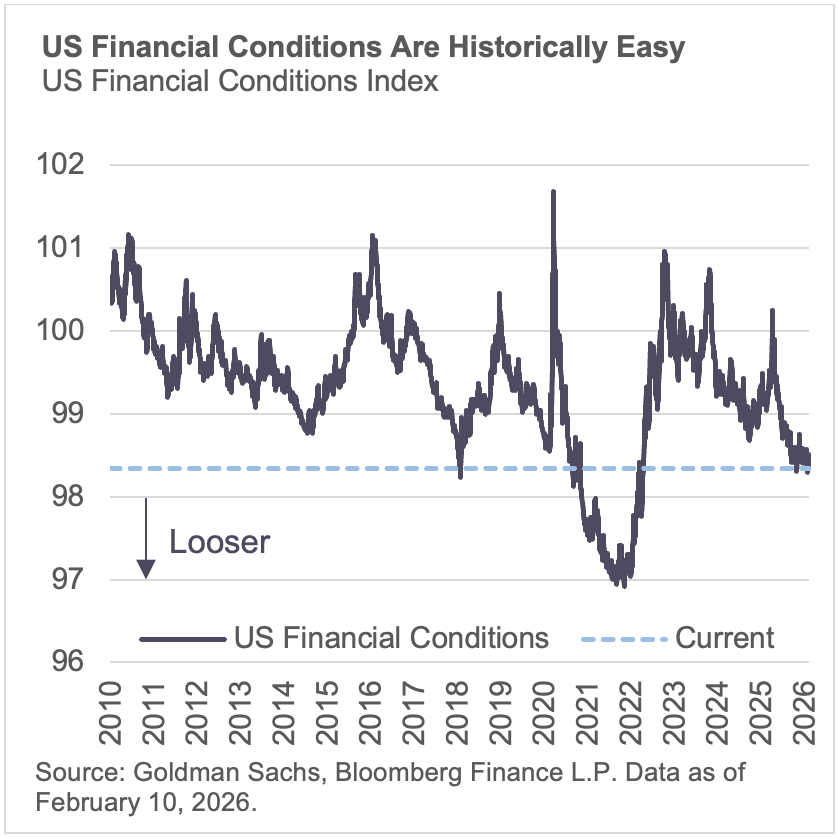

The surface narrative remains constructive. Earnings are beating expectations. Margins are near cycle highs. Credit markets are absorbing heavy issuance. Treasury demand remains stable. Mortgage spreads are tightening.

But the underlying story is about financing.

Corporate profitability is holding up, yet growth is increasingly being supported by balance sheet deployment rather than demand reacceleration. Hyperscalers are issuing debt to fund AI infrastructure at historic scale. Investment grade markets are bridging a multi-year capex cycle. Treasury demand is broad, but increasingly sensitive. In mortgages, GSE purchases are offsetting Fed runoff, stabilizing spreads without expanding liquidity.

Even the software sell-off reflects this dynamic. Forward earnings estimates are rising, but markets are reassessing long-term cash flow durability in a world where AI compresses barriers to entry. Equity is repricing structural uncertainty while credit markets are differentiating refinancing risk further out the curve.

The expansion is intact, but it is being carried forward by financing conditions.

That distinction matters. When growth is mediated through capital markets, funding costs and market access become central swing factors. Profits today are solid. The question is how dependent forward earnings are on continued capital market accommodation.

Market Signals/The Conversation

Equity earnings

S&P 500 earnings are strong. Earnings have exceeded analyst expectations so far in the Q4 earnings season. If earnings hold at these levels, it will be the fifth quarter in a row of double-digit earnings growth and the tenth quarter in a row year-over-year of earnings growth.

Under the surface, earnings growth remains somewhat concentrated, though breadth has improved relative to earlier in the year. Margin resilience has been supported by operating leverage, productivity gains, and cost discipline, offsetting pockets of top-line moderation. At the index level, margins remain near cycle highs, reinforcing that the current expansion is being driven more by profitability durability than by accelerating nominal growth.

The key question for markets is less about realized earnings and more about sustainability. With valuations above long-term averages, continued multiple support will depend on earnings durability broadening across sectors and maintaining momentum into the first half of the year.

Software Sell Off.

The software sector within the S&P 500 has lost nearly a fifth of its value year-to-date amid rapid advances in AI-enabled development, specifically the rollout of task-specific professional tools. Markets are repricing structural uncertainty, not current earnings – in fact S&P 500 software one-year forward earnings forecasts have increased year-to-date.

The implications are increasingly visible in credit. Software represents 4.7% of HY and 13.8% of leveraged loans, but roughly 21% of the private credit universe. Spreads have widened meaningfully, particularly in loans, where a higher share of issuers are rated B3/B- or below. Three-year software loan spreads near 710bp are at their widest levels since early 2023. While near-term maturities are modest, the refinancing burden increases materially in 2028–2029, concentrated in lower-rated issuers. Until there is greater clarity around earnings durability and margin sustainability, software valuations, particularly in lower-rated credit, are likely to remain under pressure. We think a lender’s ability to underwrite is paramount in this cycle, which will entail differentiating the software companies engrained throughout businesses versus software that may be more easily replaced.

Capex Spending.

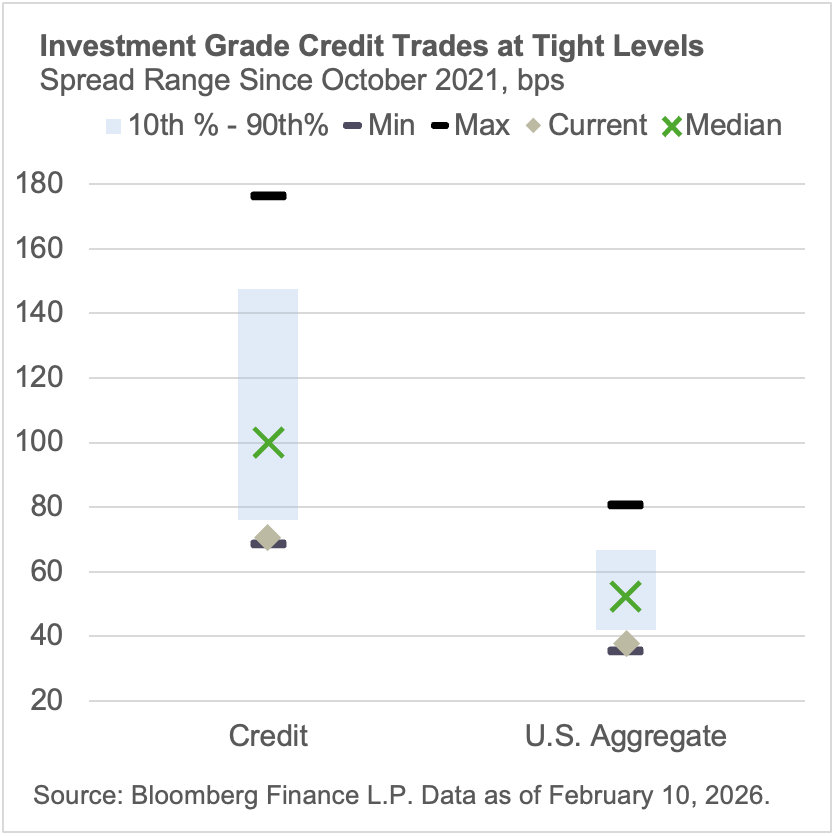

Dollar denominated investment grade corporate bond issuance has surpassed $320bn YTD, with meaningful AI-driven supply from Communications and Tech, led by Alphabet ($20bn) and Oracle ($25bn). Hyperscalers are gearing up for ~$650bn of 2026 capex as part of a multi-trillion dollar data center buildout, signaling a structural shift from buybacks toward investment, with debt markets acting as a key funding bridge. Demand for duration remains deep—evidenced by Alphabet’s 100-year bond—while spreads show clear quality bifurcation (AA ~50–65bps vs. BBB tech 120–140+). Credit markets are readily financing the AI infrastructure cycle, with durable demand for high-quality duration. Our view is that greater than expected capital needs are a technical headwind to investment grade spreads which are in the first percentile of tightness over the last five years.

Treasury Demand.

Despite recurring narratives around a so-called “Sell America” trade and geopolitical pressures on sovereign allocators, fundamental demand for U.S. Treasuries remains robust and multifaceted. Foreign investors — including major holders such as Japan, the United Kingdom, and China — continue to maintain trillions of dollars of Treasury exposure, with total foreign holdings reaching all-time peaks above $9 trillion in 2025 and rising year-over-year, underscoring continued confidence in U.S. sovereign liquidity and credit even as official-sector purchases ebb. At the same time, domestic investors and price-sensitive private buyers have materially stepped into the market, as the Federal Reserve’s quantitative tightening recedes, broadening the holder base to include money market funds, mutual funds, and hedge funds that anchor both short- and long-term demand.

That said, markets are rightly attentive to shifts in ownership composition and risk premia. Official foreign purchases have been more muted in recent years, and the increasing share of price-sensitive buyers implies greater yield sensitivity to macro data and supply dynamics. Nevertheless, the sheer scale of Treasury demand, measured by sustained foreign holdings at record levels and expanding domestic participation, demonstrates that core safe-haven demand persists, even as investors actively price fiscal and geopolitical uncertainties into yields.

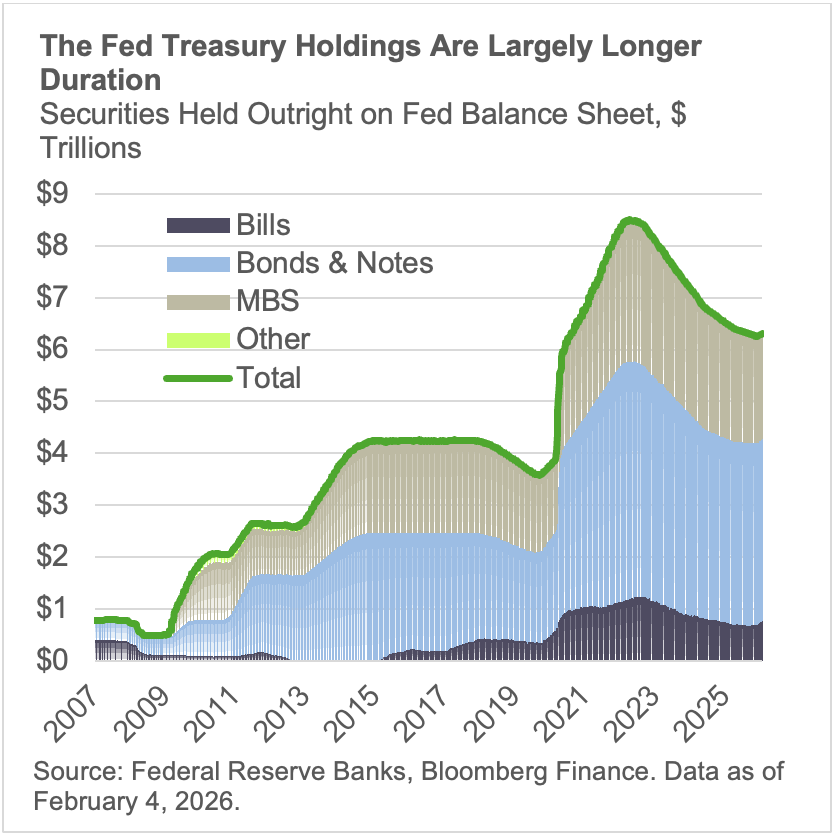

Fed Balance Sheet.

President Trump has nominated Kevin Warsh as the next Chair of the Federal Reserve. Warsh will need to be confirmed in Congress before taking a seat. Until then, there has been growing speculation on how he will modify the Fed-Treasury Accord, which is the 1951 agreement that ended the Federal Reserve’s obligation to cap Treasury yields and reestablished monetary policy independence. Much of the speculation, driven by Warsh’s hawkish balance sheet comments in the past, has focused on the use and composition of the Fed’s balance sheet. The Fed’s balance sheet has grown more levered to MBS and longer duration Treasury Securities relative to the pre-GFC period. Two possible implications for the balance sheet entail (1) reducing MBS securities in coordination with Treasury and the Agencies to avoid an increase in mortgage rates (a major goal of the Trump administration), and (2) a shift in the composition of the Fed’s Treasury holdings towards shorter duration Bills in an effort to reduce the Fed’s footprint in term premia.

Two potential outcomes from the shift: (1) higher Treasury volatility as the balance sheet is refinanced at an increasing cadence and (2) a shift in mortgages from the public sector to the private sector given a change in bank regulations needed to entice economic buyers to the market.

Mortgage Assets.

The Agency MBS basis tightened roughly 10 basis points year-to-date following increased GSE purchase activity, pushing current coupon spreads towards 100 basis points. The program is intended to largely offset the Fed’s ongoing MBS runoff of roughly $17 billion per month, acting as a technical stabilizer rather than a net liquidity expansion.

While lower rates are directionally supportive, refinancing sensitivity remains limited. Roughly two-thirds to 70% of outstanding mortgages carry rates at or below 5%, leaving much of the housing stock locked in. A modest rate decline is unlikely to generate a broad-based refi wave.

Incrementally, improved carry and lower rate volatility could support renewed bank demand for MBS, particularly as corporate IG faces heavier supply and curve steepening pressure. For now, mortgage performance remains driven more by technicals and relative value than by a material shift in borrower behavior.

Commercial Real Estate

While the office recovery is progressing unevenly by geography, the sector has exhibited the most pronounced improvement in transaction volumes during 2025. Momentum is increasingly evident in two of our highest-conviction markets, Manhattan and San Francisco. According to Avison Young, Manhattan leasing activity reached nearly 40.0 million square feet in 2025, the highest annual total since 2019. San Francisco, meanwhile, led major U.S. markets with a 41.3% year-over-year increase in leasing volume. Taken together, these trends reinforce our view that tenant demand is re-anchoring first in globally competitive, supply-constrained markets, supporting a selective opportunity set in well-located, institutional-quality office assets despite structural challenges elsewhere in the sector.