Finding Value in Office: Capital Flows to Premier Markets

The Rithm Take

After years of negative headlines and pricing resets, U.S. office real estate is beginning to show early signs of stabilization. Leasing activity is picking up, capital is selectively returning, and distressed sales are helping to clear markets. While remote work and obsolescence risks remain, we see a more constructive path emerging, led by high-quality, amenity-rich properties.

Manhattan remains a global gateway market with strong Class A absorption, irreplaceable assets, and deep tenant demand. San Francisco, after historic challenges, is regaining momentum as a blue-chip innovation hub, supported by positive leasing and the nation’s largest ML/AI talent base.

Together, these markets highlight how recovery will be concentrated in premier locations aligned with secular growth. We see selective opportunities for well-located, high-quality assets to deliver outsized performance as capital flows and tenant demand reinforce a bottoming process.

Market Signals

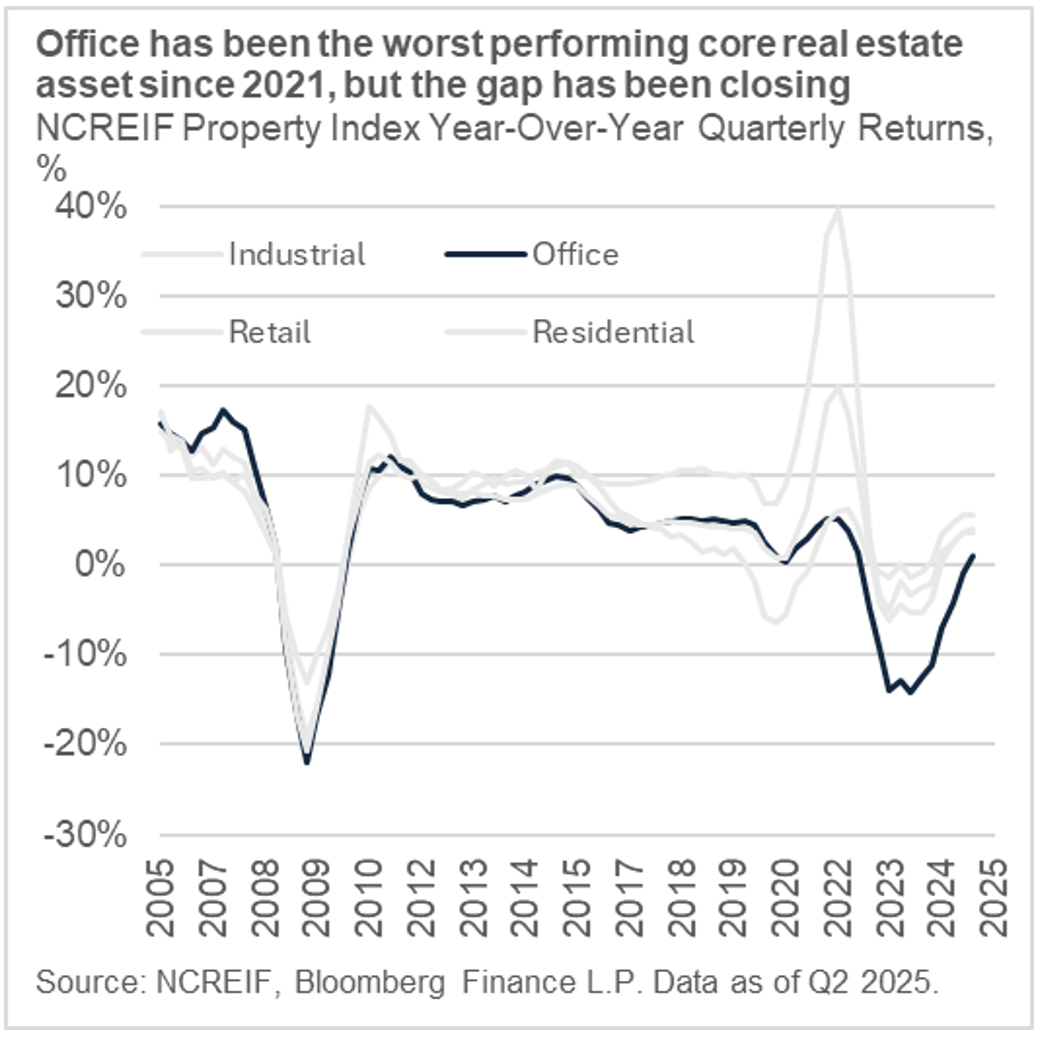

Office returns have underperformed other commercial asset types, but the gap is shrinking.

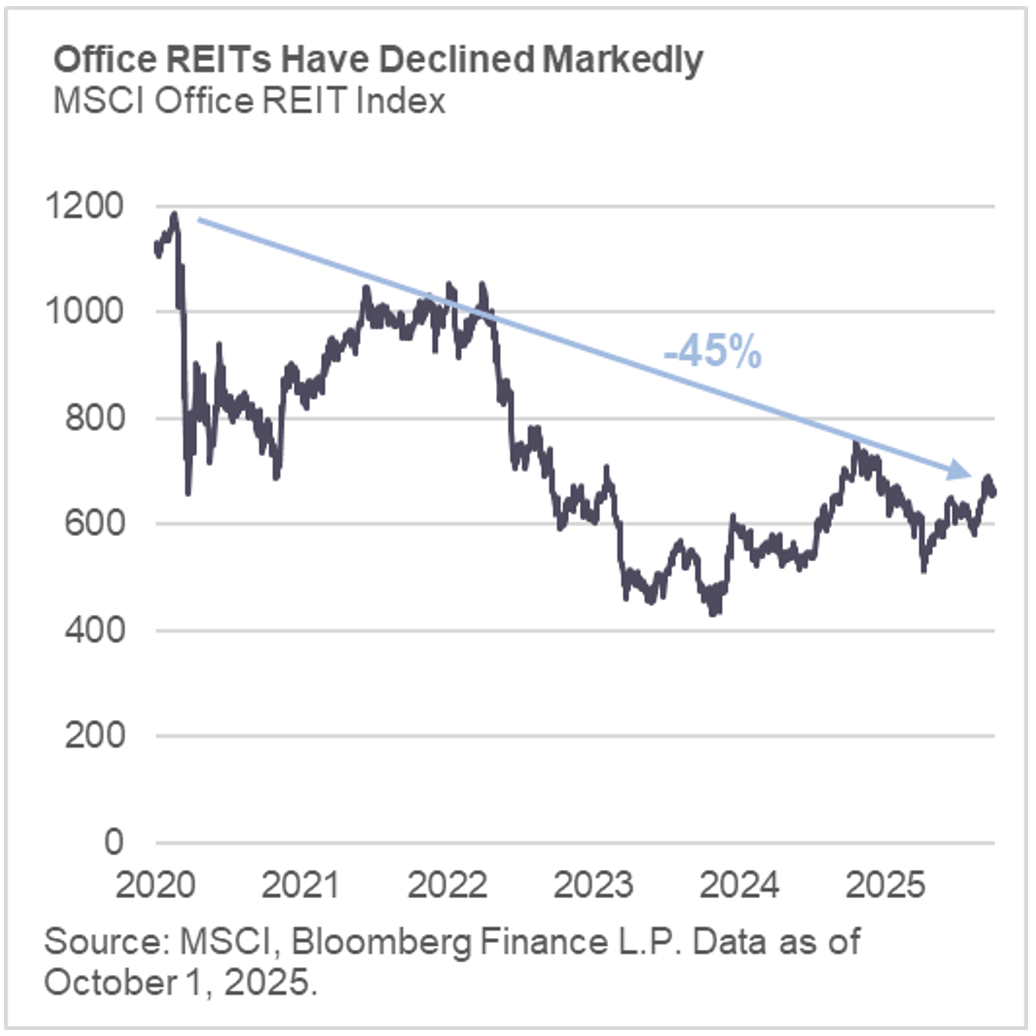

The MSCI US office REIT index is ~45% below peak 2020 levels.

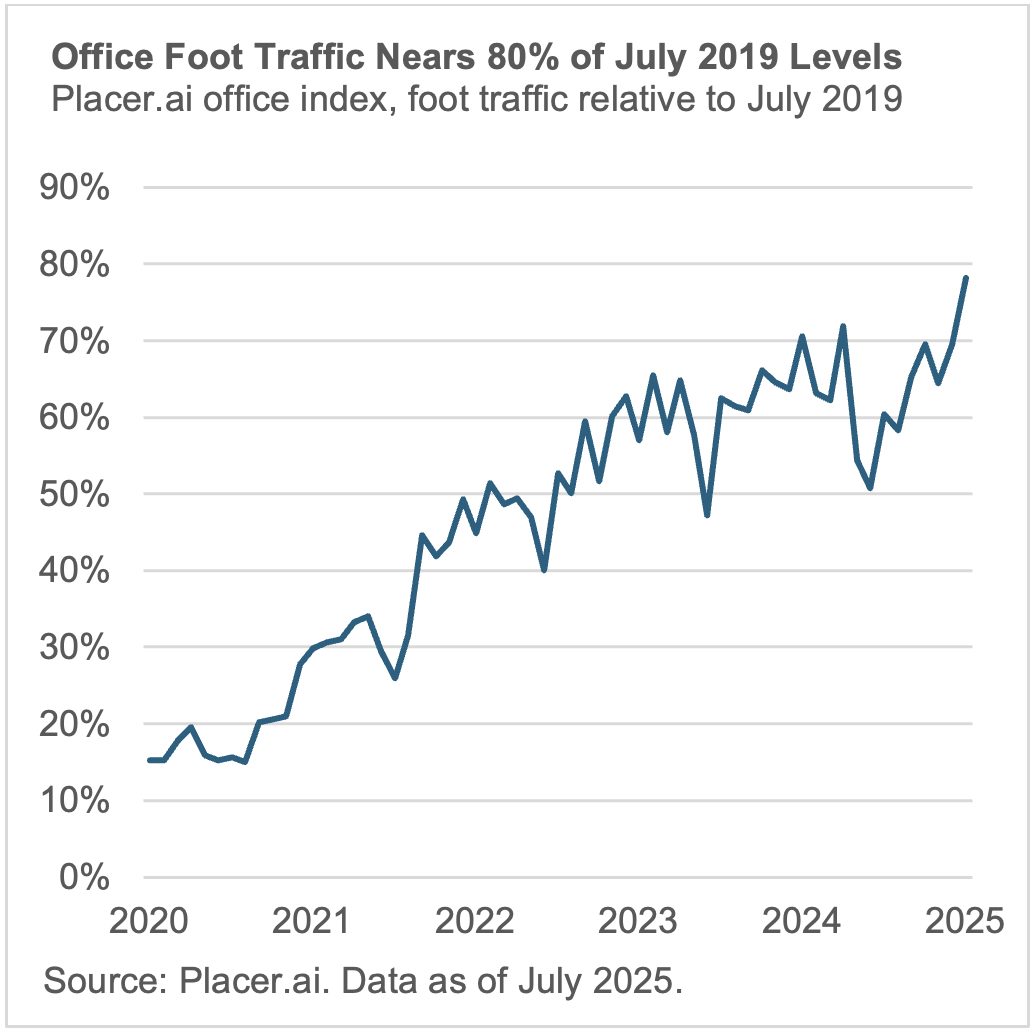

Nationwide office foot traffic nears 2019 levels.

The Conversation

The office sector remains the most challenged corner of U.S. commercial real estate, with the NCREIF Property Index showing it as the worst-performing asset class for 14 consecutive quarters. Vacancy rates nationally remain elevated, hitting a record 19.6% in Q1 2025, with even the highest quality Class A buildings in major cities like San Francisco facing vacancy north of 21%.

Yet, the narrative is shifting decisively from “existential crisis” to “selective recovery.” Office sales volume surged an astounding 69% year-over-year in the quarter ending June 30, driven by a remarkable preference for Class A office assets, which commanded over 70% of sales activity. This illustrates a powerful “flight to quality” trend, as tenants increasingly demand modern, amenity-rich, trophy-caliber properties over commoditized, obsolete spaces.

This bifurcation is stark: Class A office absorption rose 65% year-over-year in Q2 2025, with premier markets like Midtown Manhattan posting extraordinary absorption of 2.9 million square feet of Class A space over the past 12 months, making it by far the country’s strongest office demand market. San Jose and Austin follow as other top performers, while San Francisco, though recovering at a slower pace, has achieved impressive positive absorption and leasing growth, signaling a robust rebound in tech and life sciences sectors.

Importantly, according to JLL, the post-COVID talent narrative has also shifted back toward major Tier 1 cities. Whereas remote flexibility initially suggested top talent could work from anywhere, JLL’s 2025 Talent Hub rankings place New York and San Francisco as the #1 and #2 U.S. talent markets, respectively. They note that 86% of elite graduates—defined as alumni of the top 20 universities—are now concentrating in the 10 largest talent hubs, up from 77% in 2024. San Francisco and New York also host the first- and second-largest concentrations of ML/AI talent nationally, reinforcing their status as irreplaceable innovation hubs.

Manhattan stands out as a premier global gateway market nearing full recovery, underpinned by iconic office assets that remain irreplaceable economic hubs. San Francisco, similarly, is marking a significant rebound after historic challenges, reinforcing its status as a blue-chip innovation center.

Capital markets are also showing unequivocal signs of thaw. Pricing has reset aggressively, with decreases of up to 30–40% in some cases narrowing the bid-ask gap and enabling a clearer path to transactions and new valuation benchmarks. While debt maturities continue to present challenges, lender forbearance and nimble private capital are proactively paving a pathway to resolution by supporting well-positioned, high-quality assets.

From a macro perspective, falling interest rates are reigniting investor confidence in cash flow underwriting and cap rate contraction. Although the office sector will not fully revert to its pre-pandemic form, an undeniable bottoming process is now underway.