Fed Poised to Cut Rates Again, But Should They?

The Rithm Take

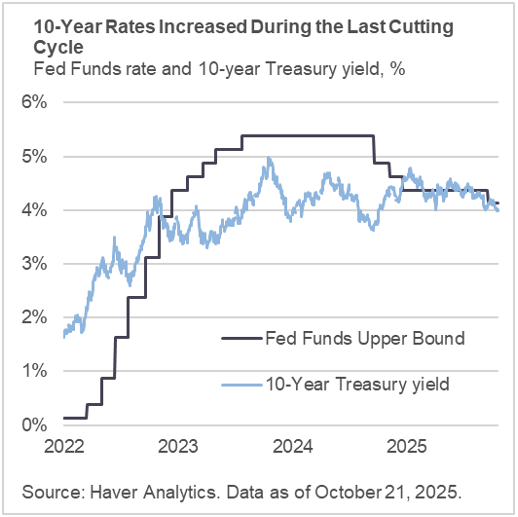

The Federal Open Market Committee meets again next week and appears poised to cut the fed funds target rate by another quarter point on Wednesday, which would lower the target rate range to 3¾%-4% from 4%-4¼%. The cut is widely expected in financial markets with the implied probability of a rate cut of 96.7% as given by fed funds futures. This would be the second consecutive quarter-point cut bringing the total reduction in the fed funds target rate to 150 basis points since September 2024.

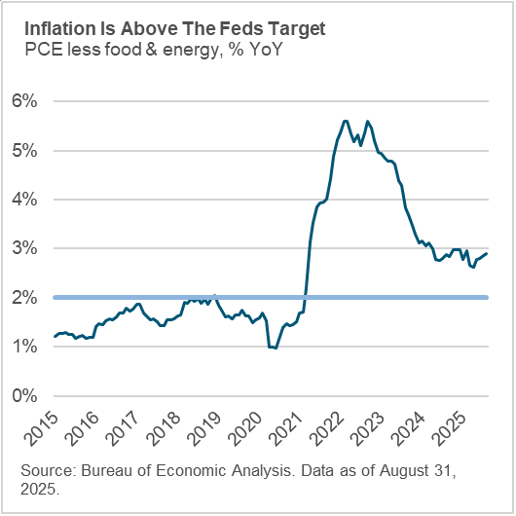

After cutting rates by a percentage point in the last four months of 2024, the Fed had held the target rate steady as policymakers focused on the inflation risks from tariff increases and as price data showed no further progress towards reattaining its 2% inflation target. The Fed’s preferred measure of short-run inflation pressures, core PCE price inflation, has edged up from 2.8% in January to 2.9% in August. Over the same period, however, the unemployment rate has risen from 4.0% to 4.3% and net payroll creation has averaged 75,000 positions per month versus 168,000 positions per month in 2024 (although this increase in 2024 is expected to be revised down by about 75,000 based on the preliminary estimate of the benchmark revision to the employment data). At his September press conference, Chair Powell said “With downside risks to employment having increased, the balance of risks has shifted. Accordingly, we judged it appropriate at this meeting to take another step toward a more neutral policy stance.” Since that meeting, however, we have had no additional information on unemployment, payroll growth, and inflation with the government shutdown. However, Powell has not pushed back on market expectations for a further rate cut, even though the data available to the Fed is essentially no different from that which was available at the last meeting.

The Fed has a Congressionally given dual mandate of maximum employment and price stability. The Fed has interpreted this mandate as maintaining a PCE price inflation rate of 2% over time and currently believes that the unemployment rate consistent with maximum employment is 4.2%. At the present time, therefore, the individual legs of the mandate pull in different directions with the labor market softening but inflation remaining stubbornly above target. Under these circumstances, Powell has previously said that the Fed would resolve the conflict by considering “how far is each from the goal, and how long is it expected to get to the goal?” Inflation is clearly further from its goal than the labor market, but the Fed has made potential labor market weakness its primary focus.

Market Signals

Since the Great Financial Crisis, the Fed has used forward guidance to condition market expectations about future rate moves. At the September FOMC meeting, the median assessment for the appropriate policy rate at the end of the year was reduced by a quarter point, which suggested the Fed was on track for two further rate cuts this year if data played out as expected. This view has been nearly fully priced into near-term interest rate futures. Forward guidance is supposed to be data-dependent but the government shutdown has turned off the flow of data relevant to Fed policy decisions. The lone exception to this is the September CPI, which is scheduled to be published on Friday, but consensus expectations are for no decline in core inflation from August. It would, therefore, likely take a significant upside surprise to shake expectations for a further rate cut next week. The interrelationship between Fed policy decisions (including forward guidance) and market expectations is a two-way street. The Fed has generally not been willing to hold rates steady when a rate cut is largely priced in, which to some extent makes market expectations for the policy rate something of a self-fulfilling prophecy. If Chair Powell had wanted to keep rates on hold next week, he would very likely have had to give a signal in his speech last week before the National Association of Business Economists. He did not, however, and said instead “Rising downside risks to employment have shifted our assessment of the balance of risks. As a result, we judged it appropriate to take another step toward a more neutral policy stance at our September meeting.” He gave no guidance on next week’s rate decision but by not pushing back he tacitly endorsed market expectations.

The Conversation

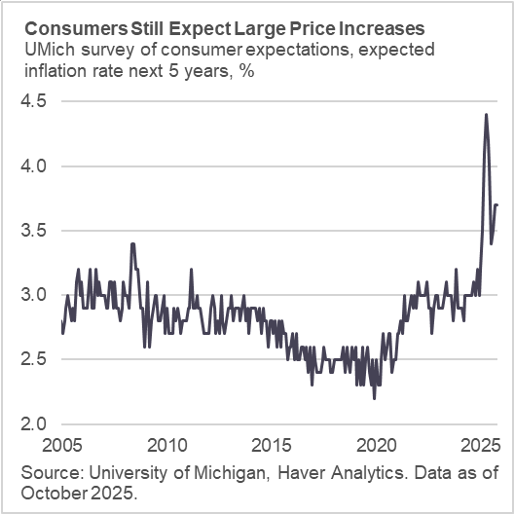

The Fed’s resumption of rate cuts in the face of no further progress on disinflation raises the question of the independence of monetary policy. Since the Fed began cutting rates 13 months ago, the 10-year yield has actually risen by about 30 basis points. The evidence from countries around the world is that independent central banks have a better record on delivering low inflation than central banks whose decisions on monetary policy are heavily influenced by the fiscal authorities. President Trump has made no secret of his desire to see the Fed cut interest rates and his criticisms of Powell have been vocal. Furthermore, pressure has been brought to bear on Governor Lisa Cook to remove her from the Board of Governors—although at this point she remains eligible to participate in next week’s policy meeting. If market participants eventually conclude that monetary policy decisions were being made in response to pressure from the administration rather than based on economic fundamentals, this could produce an adverse reaction in the bond market and produce a marked steepening of the yield curve. Easing monetary policy in a fully-employed economy that has been experiencing stubborn inflation pressures and solid demand growth is a recipe for higher inflation. The public’s expectations of inflation have moved significantly higher since April, with the University of Michigan’s medium-term inflation expectation currently standing at 3.7%. It will be some time before the data can answer the question whether tariffs are having a one-off impact on prices or a more persistent influence on the inflation rate.