Fed on Hold, Bond Market Price Discovery

The Federal Reserve’s policy body meets this week, and it would be a shock if the FOMC decided anything other than to hold the policy rate range steady at 5.25%-5.5%. With the latest GDP report showing a continued decline in underlying inflation, the emphasis is likely to remain on how long the policy rate is on hold as higher rates substitute for further rate hikes. This element of time is contributing to a repricing of longer-term bond yields.

The Conversation

As we argued in A Peak in Rates or a Plateau, the Fed’s inflation-fighting strategy has entered its third phase, in which the emphasis is on how long rates remain high. We expect this to remain the main message of Fed Chair Jay Powell in his post-FOMC press conference on Wednesday.

Longer-term Treasury yields have danced to this tune of higher-for-longer with 10-year yields briefly touching 5% last week—a full percentage point higher than the level of yields following the Fed’s last rate hike in July. The rise in yields does not represent a loss of confidence in the Fed reaching its 2% inflation target. Instead, it represents an increase in the level of real interest rates seen as needed to get inflation down sustainably to this level. 90% of the rise in yields came in from higher real yields.

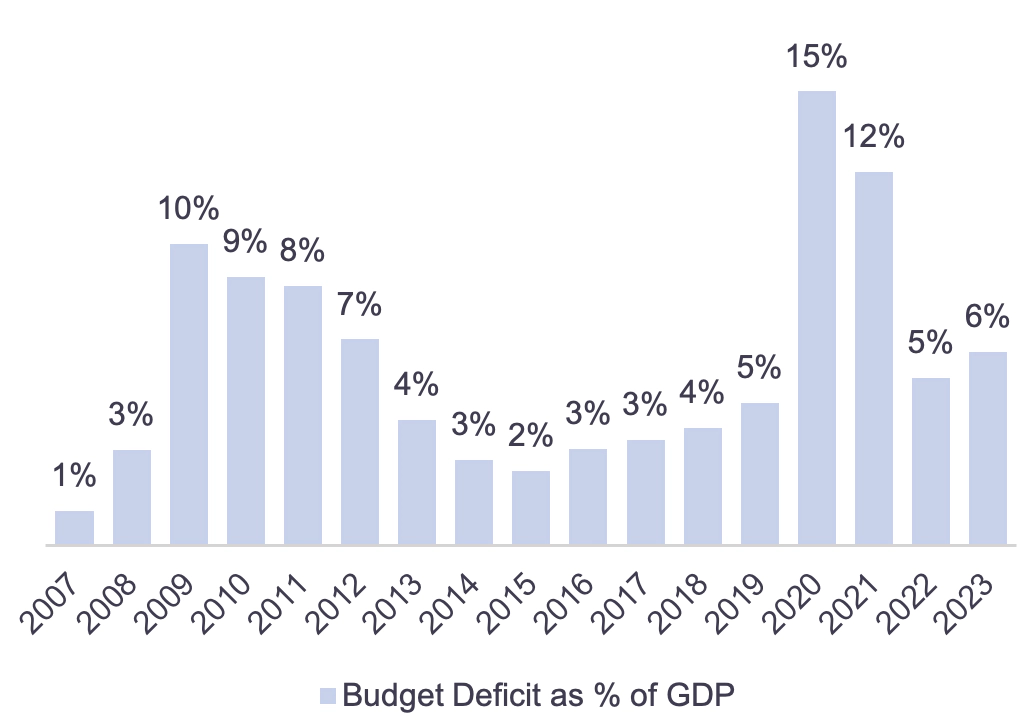

The size of the fiscal deficit has undoubtedly complicated the Fed’s fight against inflation and added to upward pressure on yields. The budget deficit increased to $1.7tn in fiscal 2023 (6.3% of GDP) from $1.4tn in fiscal 2022 (5.4%).

The Fed’s strategy is likely to lead to a further tightening in monetary policy in 2024 as we see inflation falling faster than the policy rate and as the Fed continues to allow its bond holdings to run off (passive and quantitative tightening).

Rising Real Rates Point to Further Restraint Budget Deficit Adds to Pressures on Yields(1)

The Rithm Take

We believe that although the terminal policy rate has been reached, the Fed is in no hurry to cut rate, particularly with the economy growing at nearly 5% in the third quarter and with the unemployment rate at 3.8%. At some point, however, the Fed is going to have to outline its strategy for the fourth phase of policy in which interest rates are reduced to a neutral level. In doing so, it will likely have to raise its assessment of the long-run real neutral rate of interest, which it currently puts at 0.5%, well below the real 10-year yield of 2.5%.