Fed Funds Unchanged, All Ears on Powell’s Guidance

The Federal Open Market Committee will conclude its two-day monetary policy meeting on Wednesday and anything other than an unchanged fed funds target range of 5¼%-5½% would be a shock. However, since the last FOMC meeting, inflation has run hot and the labor market has been surprisingly strong. There is little chance that Fed policymakers’ confidence has increased that inflation will sustain a move to 2%. There might even be some emerging concern that progress toward the inflation target is stalling out. Nonetheless, it is likely too soon to abandon expectations of continued disinflation, though Fed Chair Powell will have a challenging job communicating the policy outlook.

The Conversation

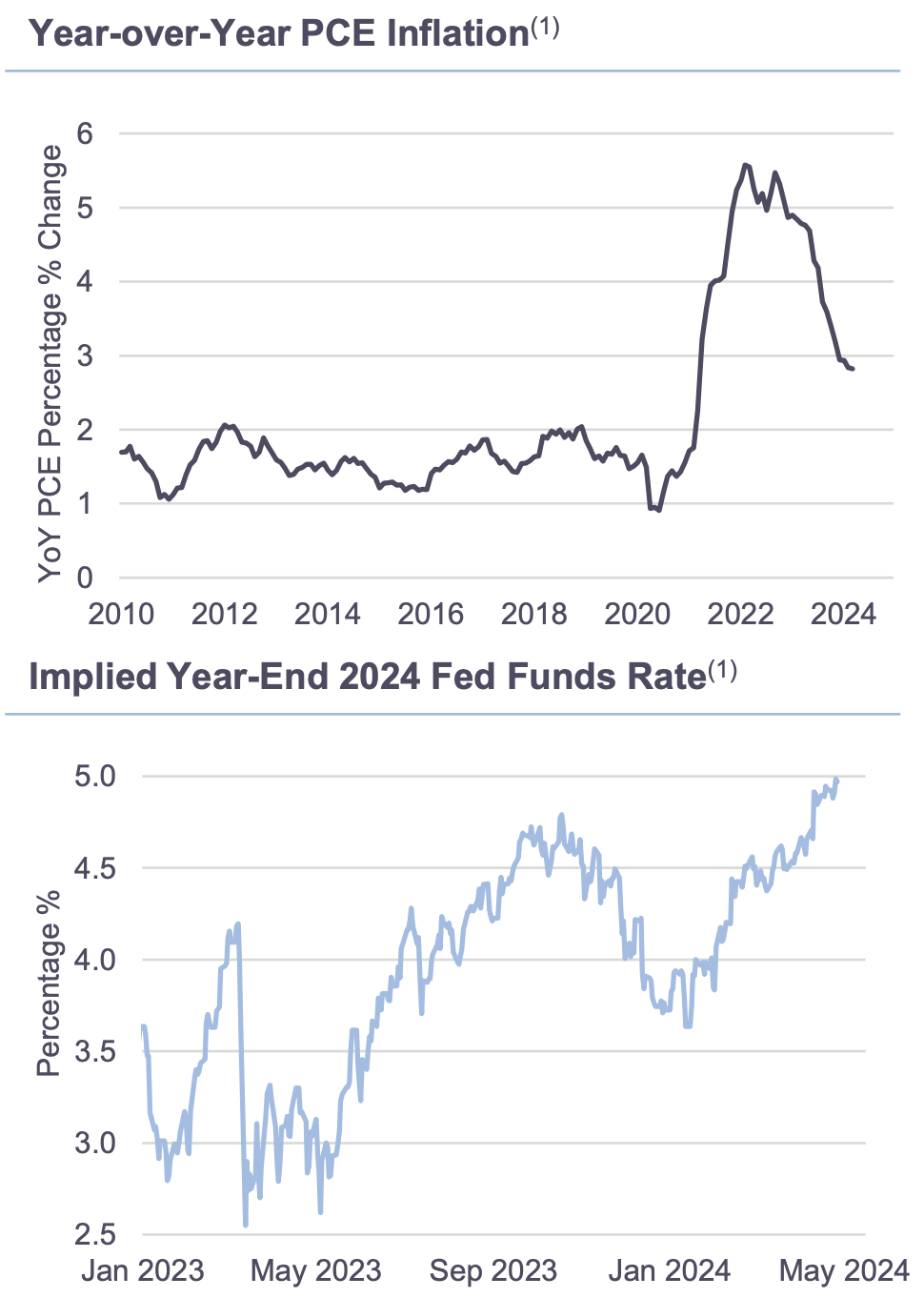

At the last FOMC press conference on March 20, Powell said: “January CPI and PCE numbers were quite high” but February was “not terribly high” and “I take the two of them together, and I think they haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimesbumpy road toward 2 percent.” Core PCE prices rose 0.3% in March and by 2.8% year-over-year, which continued the gradual disinflation that began in the first quarter of 2022 (the year-over-year core PCE inflation rate in March 2024 was the lowest since March 2021).

After Powell said in December 2023 that it was “natural” to discuss “when it will become appropriate to begin dialing back the amount of policy restraint that’s in place,” interest rate futures markets moved to fully price in a quarter-point rate cut at the March FOMC meeting and almost seven 25bps cuts in 2024. However, the economic data did not support the aggressive rate cutting that the market priced in after Powell’s December press conference. Though the outlook remains uncertain, Powell will likely signal that the Fed still expects inflation to move down and policymakers believe that the peak fed funds rate has been reached. However, the timing and extent of rate cuts this year will depend on the incoming inflation data.

The Rithm Take

The pricing of Fed rate cuts implied by interest rate futures markets has swung wildly in recent months. In January this year, the market priced in almost seven quarter-point rate cuts in 2024, whereas today the market implies only one rate cut (and this cut is not fully priced until the November FOMC meeting). Powell contributed to this volatility in rate cut expectations with his December press conference, and he will likely want to avoid a repeat on Wednesday given the uncertain outlook for inflation.

1. Sources: Bureau of Labor Statistics; Bloomberg LP

This Rithm Market Update is provided in partnership with RDQ Economics. For any further questions about Rithm Capital or this article, please reach out to ir@rithmcap.com. This article is being provided for informational purposes only. It may not be reproduced or distributed. No representation is made regarding the accuracy or completeness of the information contained herein. Nothing contained herein constitutes investment advice nor an offer of securities.