Eyes on the Market Q3 2025

The Rithm Take

Markets are pricing in not just one but potentially two interest rate cuts by September. This expected steepening of the yield curve is a formidable tailwind for financials, real estate, and real assets. Growing visibility into household finances—as FICO inflation subsides and student loan performance emerges—is happening as the labor market adjusts to the effects of lower immigration and AI. A robust pickup in bank M&A, along with easing regulatory hurdles, is creating room for banks to realign assets to their shorter liability structures and open the door for asset sales through synthetic risk transfers (SRTs). Tight credit spreads are supported by growing earnings breadth and strong technical forces. While housing headlines have been subpar, the strong credit performance of existing homeowners lends to strength in related assets.

Market Signals/The Conversation

Jackson Hole may mark the start of a cutting cycle. Futures markets have shifted the probability of a September rate cut to approximately 100%. This expectation follows the weaker-than-expected July jobs report, which included a combined downward revision of 258,000 jobs for May and June—the largest two-month revision since 2015. This has led to a steeper yield curve, with long-term yields rising as short-term yields fall, suggesting markets anticipate future economic growth and inflation despite a short-term slowdown.

With the appointment of Stephen Miran, a new "dove," to the Federal Reserve Board—adding to the two dissenting governors from the July meeting (the most since 1993)—the Fed’s leadership appears to be shifting. All eyes are on the Jackson Hole Summit from August 21-23, and specifically on whether Chair Powell will open the door for a September cut.

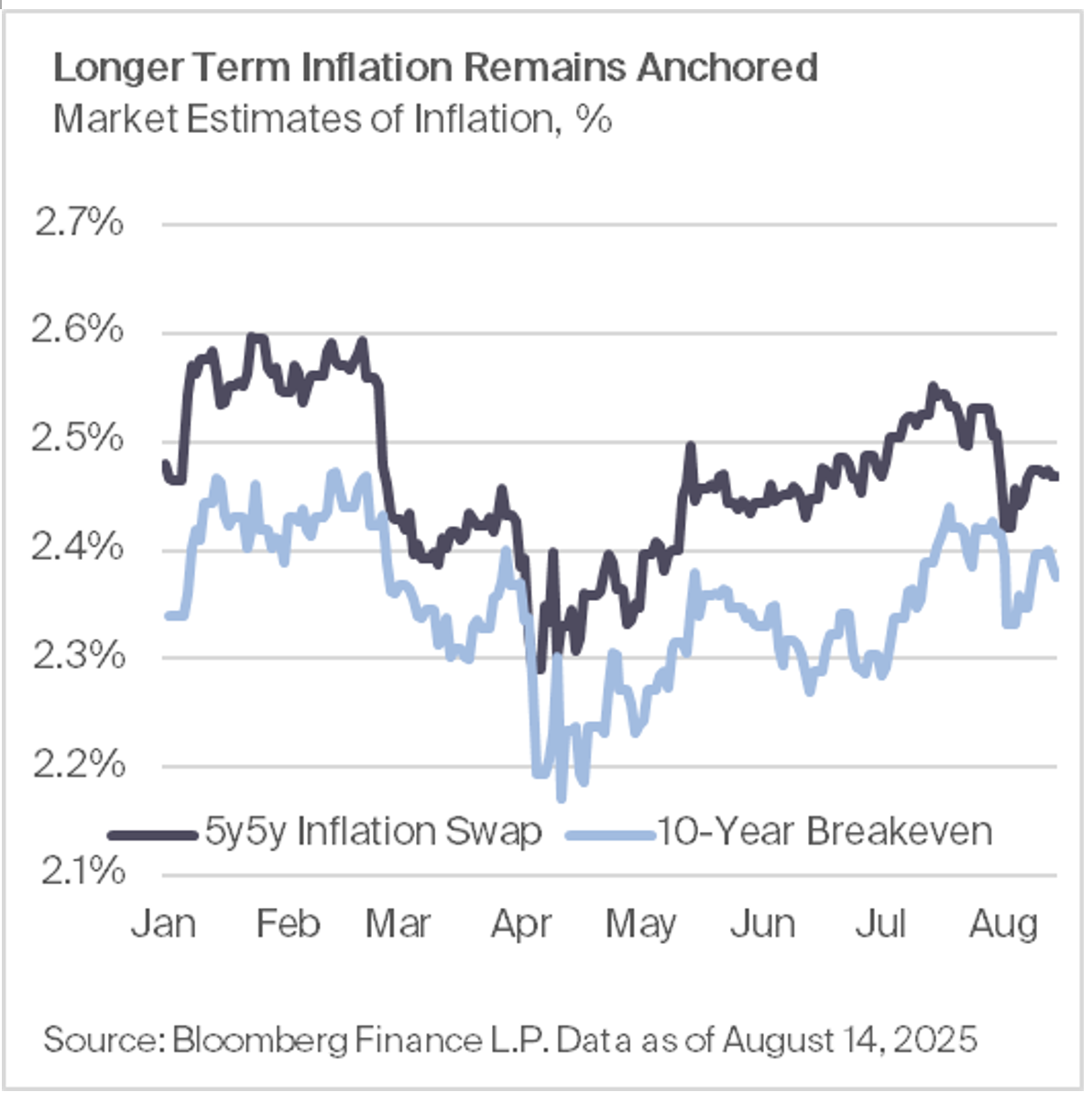

Powell has used past summits to signal major policy shifts, including the start of the hiking cycle in 2022 and the shift toward easing last year. Because increased inflation is the primary concern associated with reducing interest rates, both we and the Fed will be closely watching two factors: the speed at which inflation could fall and inflation expectations. The Atlanta Fed’s sticky CPI index, which measures components of CPI that are slow to change, increased 4.6% on a year-over-year basis in July. On the other hand, market expectations for inflation remain relatively well anchored; we don’t see signs of de-anchoring when looking at 10-year breakevens and 5y5y inflation swaps.

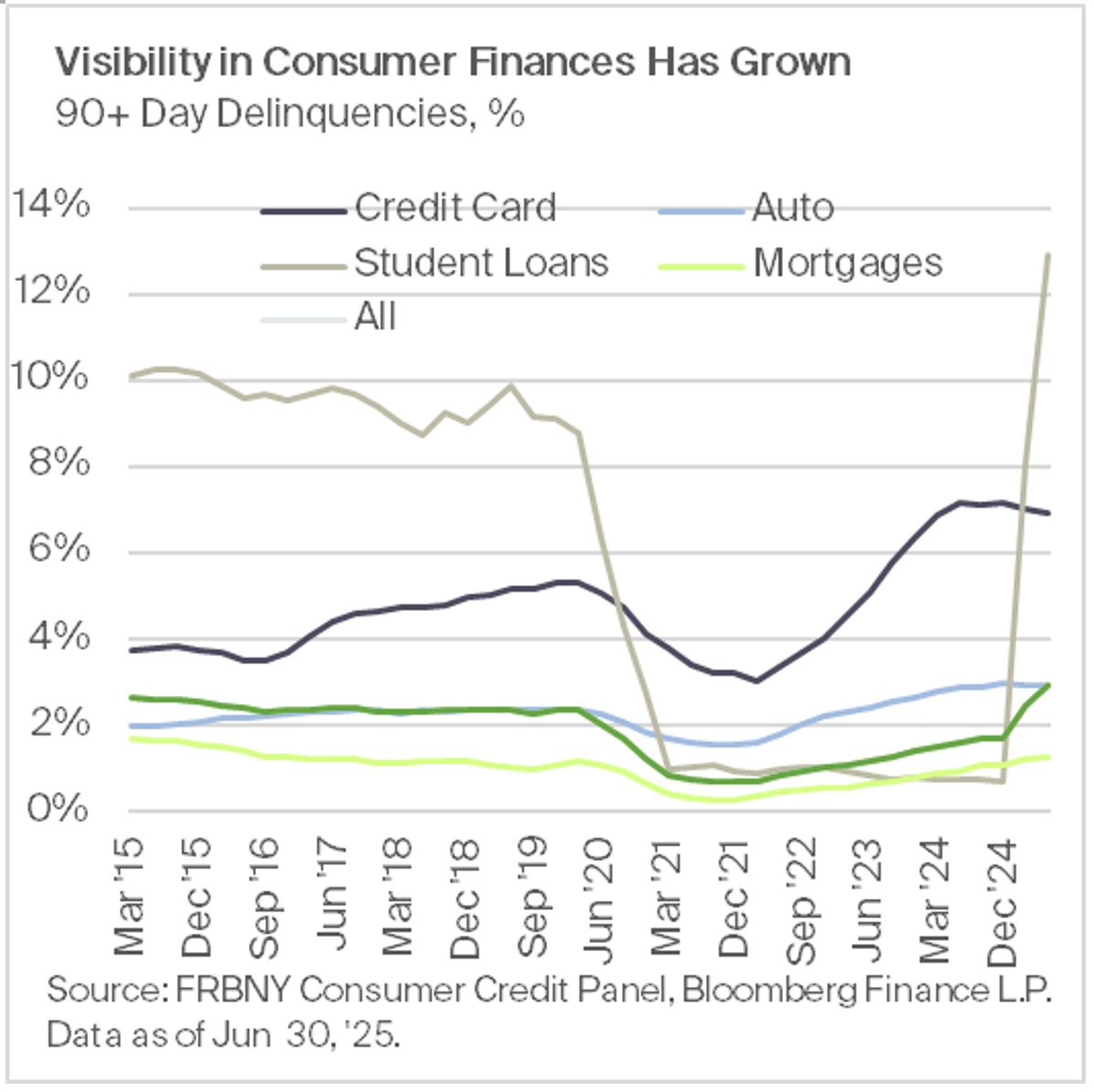

The latest data on consumer credit reveals a nuanced picture of both resilience and risk. While overall household debt is up, the stability of the mortgage market and strong lending standards show an underlying strength in consumer finances.

However, the real story is the normalization of credit quality and the growing visibility into household finances. The period of FICO inflation, where credit scores were artificially boosted by pandemic-era support, is now ending. This provides a clearer view of consumer health, which is most evident in student loans. The sharp spike in delinquencies to 10.2% after a five-year pause is a critical stress test. While it will disrupt some households, analysts believe it won't be a destructive force for the broader market, which is still supported by high cash balances and wage growth driven by labor hoarding in key sectors. In short, we're seeing the true state of consumer finances; some cracks are appearing, but the foundation remains solid.

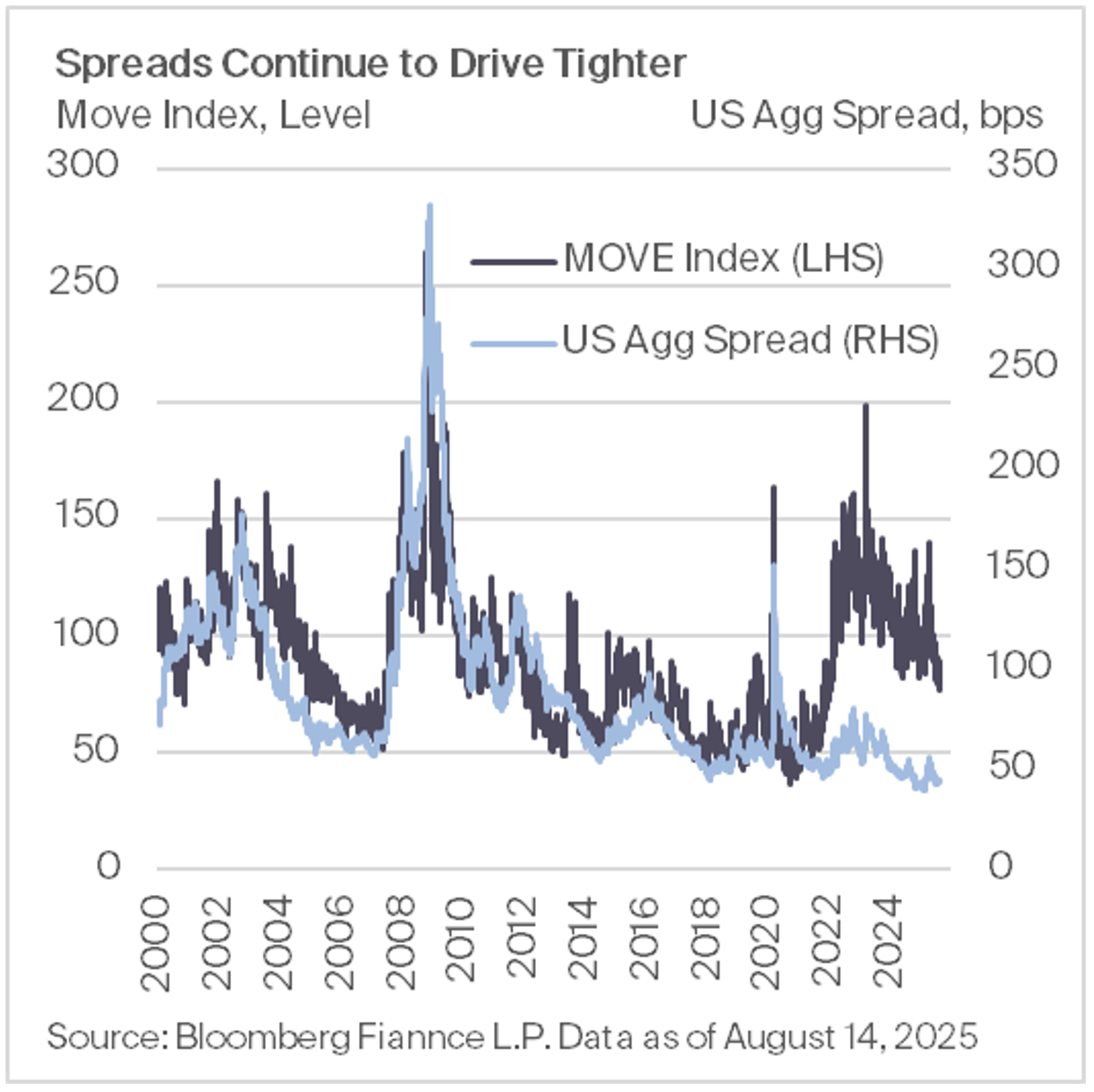

Credit spreads have been historically tight, while catalysts for further tightening exist. Year-to-date corporate bond issuance (as of the end of July) is up 3.2%, with bond volatility hovering near three-year lows and investment-grade credit spreads near 25-year tights. In July, the high-yield (HY) bond market saw over $33 billion in new deals, coinciding with the leveraged loan primary market’s busiest month in history. This strong issuance was supported by a consistent demand for income-generating assets and an abundance of capital available for reinvestment. According to Goldman Sachs, if high-yield market coupons were entirely reinvested, they would be sufficient to absorb 85% of the net supply for the rest of 2025. The supply shortfall relative to demand is likely to persist and could drive spreads to record tights, especially as corporations are supported by still-strong earnings growth. The combination of these factors has led to an easing of financial conditions without the Fed altering its target interest rate policy.

Earnings have been a bright spot. The S&P 500's strong Q2 2025 earnings, reporting a 10.5% growth rate, mark the third consecutive quarter of double-digit expansion and highlight a critical connection between corporate performance and the broader economy. The index’s impressive approximately 9.5% return has been heavily influenced by the "Magnificent 7," who contribute 40% of the gains.

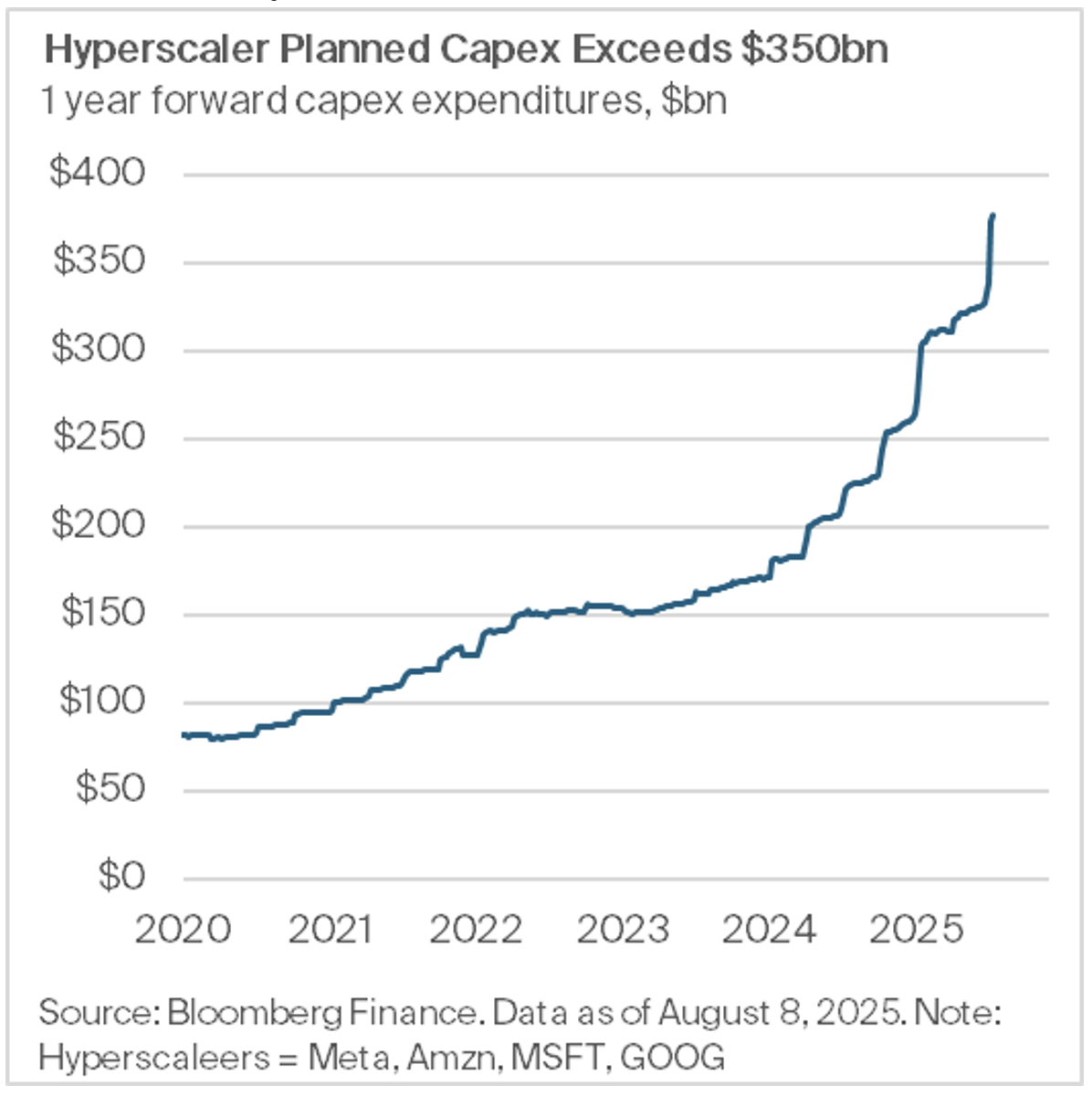

The key takeaway from this earnings season is the ripple effect on both household wealth and credit. The outperformance of mega-cap companies, fueled by relentless investment in AI, is driving significant gains for investors. This strong performance and the concentration of gains in a few major companies indicate that risk appetite remains high, as investors continue to pour capital into these high-growth, technology-driven firms. For example, the four major hyperscalers are projected to spend approximately $375 billion on capital expenditures in the next 12 months—a sum equivalent to a top 25 company in the index. These investments are paying off, as Meta, Alphabet, and Microsoft all cited AI as a direct contributor to revenue growth in their Q2 reports. Essentially, the strength of the largest corporations is directly helping to underpin the financial health of households and credit markets that rely on that wealth.

Promising greenshoots emerge in bank M&A. The rise in bank M&A activity isn't just about a thawing market; it's a strategic response to a complex environment. While more favorable regulations might be paving the way for deals and making capital less of a headwind, the underlying challenge of Asset-Liability Management (ALM) remains a significant driver. Banks are finding that their liability structures, increasingly composed of shorter-term deposits, create a material challenge, especially when their long-term assets are sensitive to the volatile interest rate environment. By merging, they aim to build more resilient balance sheets that can better withstand these challenges.

This consolidation is not a passive event—it's creating a dynamic ripple effect across the capital markets. As newly merged institutions streamline operations and seek greater scale, they are actively shedding non-core assets. This is also happening as banks are likely to use (SRT) transactions to optimize their balance sheets and free up capital, especially as the regulatory environment loosens. This creates a valuable opportunity for institutional investors to acquire entire portfolios and risk exposures that are better managed in specialized private hands. The increasing use of SRTs, which transfer credit risk to investors in exchange for a fee, boosts a bank's capital efficiency and can be a key driver of earnings. This strategic repositioning is a powerful catalyst, injecting both liquidity and new life into the secondary market as banks rebalance their portfolios and investors find fresh opportunities.

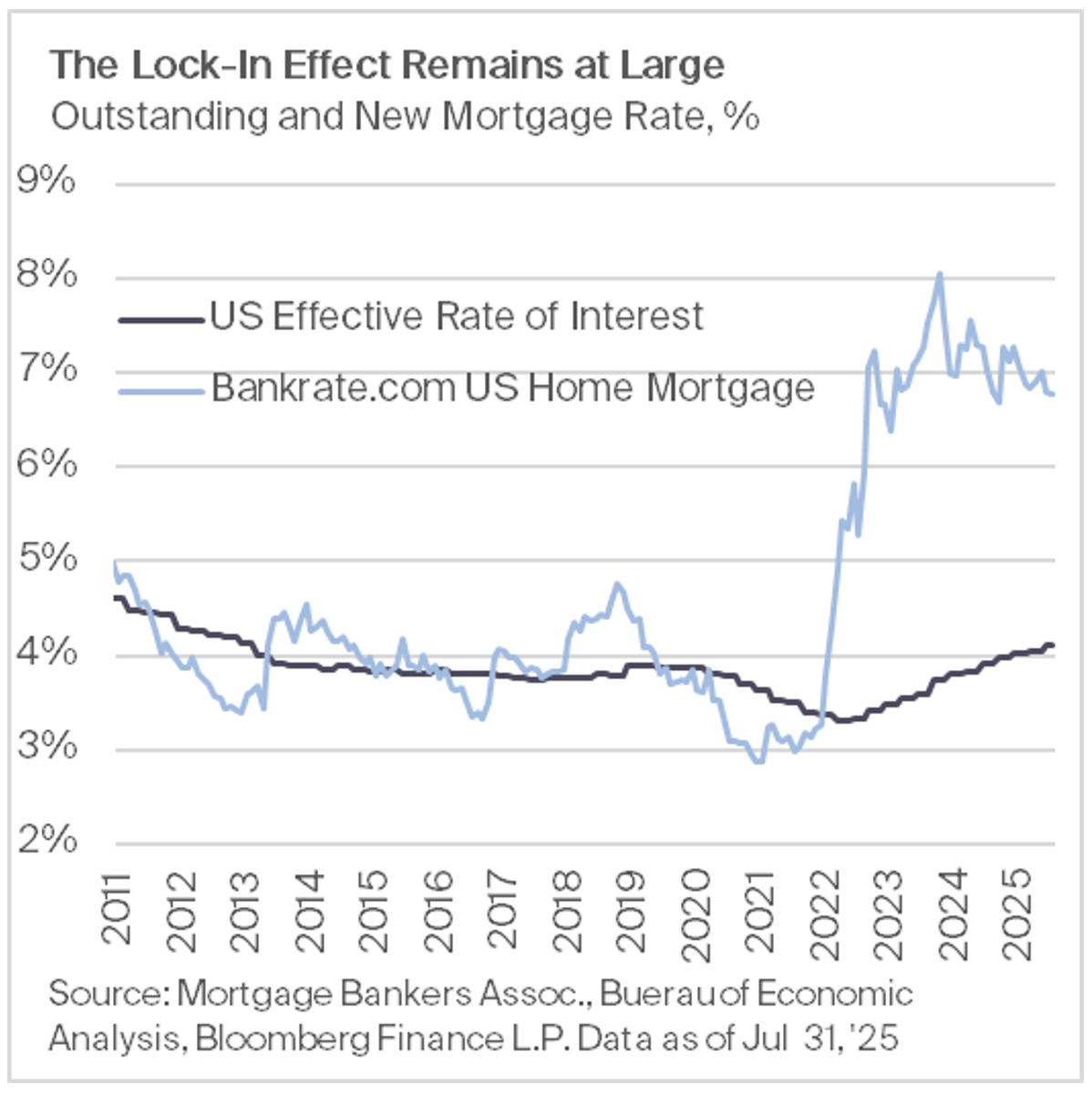

A resilient housing market. Despite headlines suggesting a cooling market, the mortgage ecosystem is proving structurally sound. The resilience of housing ownership, particularly within the post-crisis RMBS 2.0 framework, is a key takeaway. This stability is protecting credit assets from regional price fluctuations.

A notable shift is that new homes are now trading at a discount to existing homes, a reversal of historical trends driven by declining affordability. This has led builders to cut prices and increase inventory, which could be a leading indicator for increased mortgage defaults in certain areas. However, despite a rise in mortgage delinquencies and credit losses reported by Fannie Mae and Freddie Mac, these figures remain historically low. This demonstrates the market’s overall strength and provides a stable foundation for asset-based finance (ABF), as credit linked to housing continues to be a viable investment.

The path to GSE reform and privatization. The immediate privatization of the GSEs remains a long shot, with the odds stacked against a full "recap and release." Since the 2008 financial crisis, they have operated under conservatorship, a period that has seen guarantee fees (g-fees) triple and their retained portfolios capped. Additionally, strict capital rules have made it extremely difficult for them to accumulate enough capital to exit conservatorship, which has, in turn, contributed to the growth of the private-label mortgage market.

However, a new administration might be willing to explore alternative paths beyond a full IPO. Instead of a complete privatization, a new approach could involve selling a partial stake via an IPO—not a complete "recap and release," which naysayers are presenting as the only form of privatization. This would provide a way to begin monetizing the government's investment and introduce private capital without having to fully revise the current capital framework. Key hurdles remain the Treasury Department's preferred stock holdings, capital readiness, litigation overhang, and SEC readiness. While a full merger of the two GSEs is seen as unlikely due to logistical and regulatory complexities, a partial sale offers a more politically and economically feasible option for beginning the privatization process. The U.S. government remains the largest holder of the GSEs, and Congress would need to act, especially on any changes to the guarantee, or leave the implicit guarantee as is.

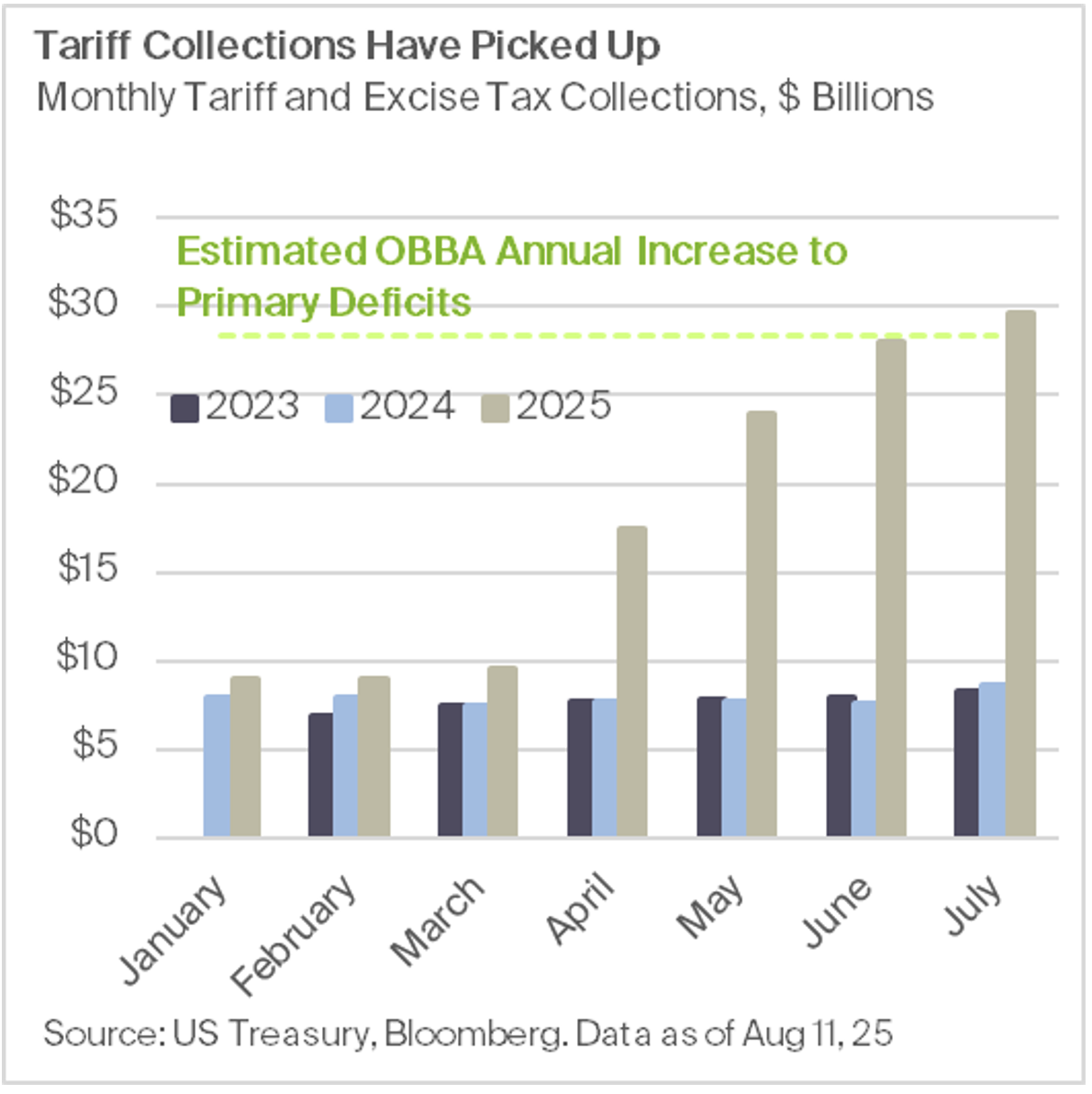

Tariff collections look to increase. J.P. Morgan Global Research estimates the current effective tariff rate in the U.S. at approximately 16% and projects it to rise to nearly 20% by year-end, compared to approximately 2% at the start of the year. A buildup of inventories by companies has delayed the impact on consumers, but most forecasters expect tariffs to work their way through the economy, reducing growth and increasing prices. Tariff collections in May, June, and July of this year have been running more than three times the level of 2024. Moreover, July’s collection totaled $29 billion, which is above the expected monthly cost of the One Big Beautiful Bill Act (OBBA) over the next 10 years.

The stimulus from the OBBA may be offset by increased funding costs. While the OBBA’s provisions are expected to modestly boost GDP growth—by about 0.2 percentage points annually through 2027—this short-term stimulus comes at the cost of significantly higher federal deficits and debt. Long-term projections estimate the debt-to-GDP ratio will rise to about 127% by 2035, compared to roughly 117% without the OBBA. The increased debt burden is expected to put upward pressure on interest rates. Continued tariff collections could ease the deficit picture, and a pickup in capex spending by corporations could raise GDP, lowering the debt-to-GDP ratios.

Treasury refunding has historically hindered funding liquidity, could raise funding pressures. Liquidity in funding markets will be a point of focus as the Treasury rebuilds its General Account (TGA) and the Fed continues its quantitative tightening. A central feature of this quarter’s strategy is rebuilding the TGA to roughly $850 billion by September 30. This higher cash buffer reflects a desire for fiscal flexibility after earlier debt-ceiling constraints, but the buildup will withdraw liquidity from financial markets because TGA balances are held at the Federal Reserve and are thus removed from circulation. Raising cash primarily through increased bill issuance can put pressure on short-term funding markets and reduce available reserves, tightening overall financial conditions.