Eye on the Fed: Hike, Skip, Pause? Looking to June 14 and Beyond

Markets Leaning to No Hike This Week

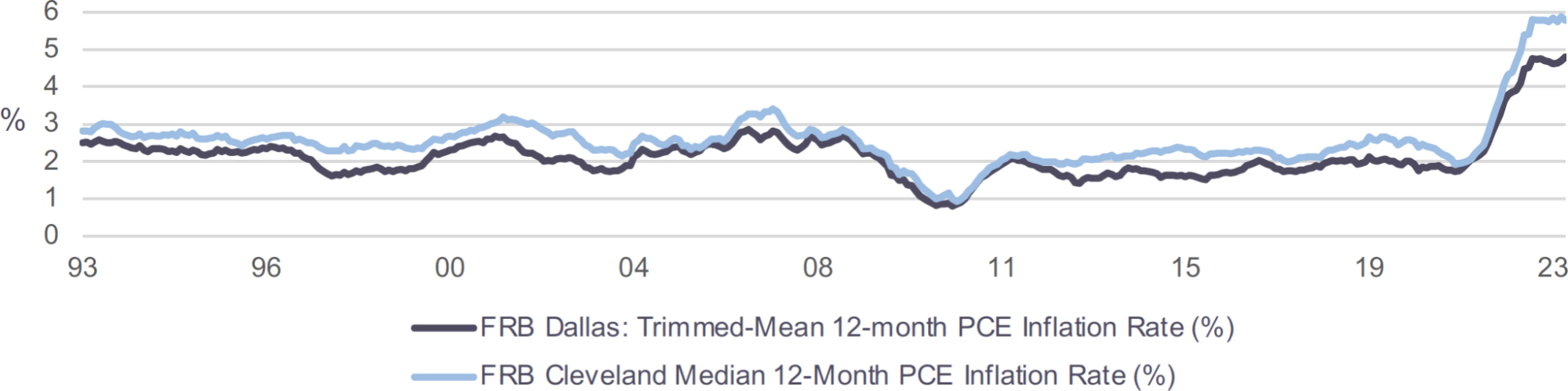

- The Federal Reserve is tasked with maintaining price stability and maximum employment. With PCE price inflation at 4.4% in April, which is more than double the 2% inflation target, and with the unemployment rate at 3.7%, which is below the Fed’s long-run estimate of full employment of 4.0%, inflation remains too high and the economy appears to be operating beyond levels that are sustainable over the long haul.

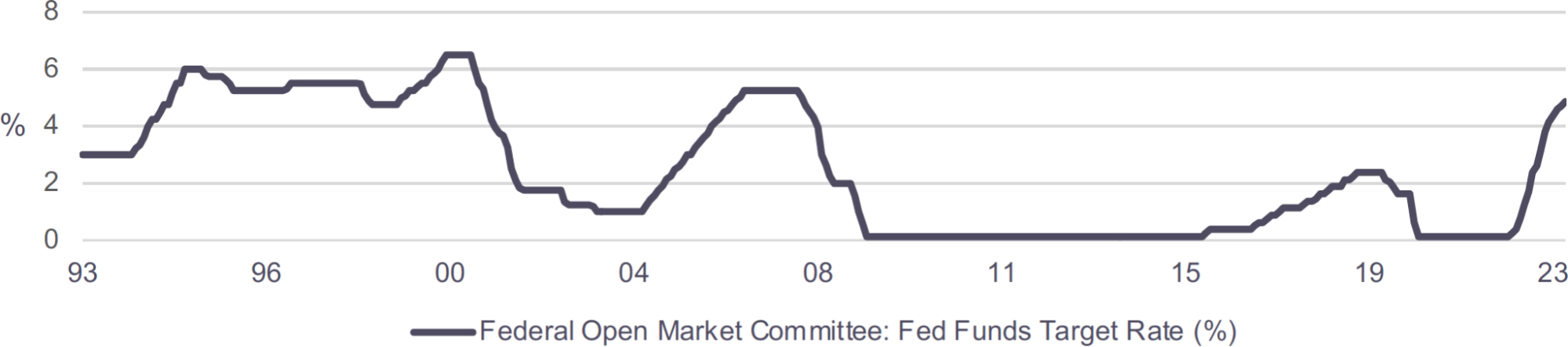

- Economic fundamentals would appear to argue for a further upward adjustment in interest rates particularly as high-frequency inflation indicators, such as the three-month core PCE price inflation rate of 4.3%, show little sign of progress in lowering inflation to target. Fed Governor Chris Waller said on May 24 “I do not expect the data coming in over the next couple of months will make it clear that we have reached the terminal rate. And I do not support stopping rate hikes unless we get clear evidence that inflation is moving down towards our 2% objective.”

- In a speech last week Vice Chair Nominee Philip Jefferson said “skipping a rate hike at a coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming” and this sharply lowered market expectations of a rate hike at the June 14 FOMC meeting. Nonetheless, he qualified this with “A decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle.”

Underlying Inflation Measures Show Little Progress in Returning Inflation to 2%(1)

- The decision as to whether the Fed hikes rates a further quarter-point on June 14 could well hang on the May CPI report, which is released the day before the rate decision. While year-over-year inflation rates are likely to drop because of the sizeable increases that occurred in May of last year, high-frequency core inflation rates are expected to remain elevated. Market expectations nonetheless are for the Fed to skip hiking next week but then to raise rates again on July 26.

- If the Fed does not hike rates this week, we would expect the statement and accompanying forecasts to signal that the Fed expects to hike rates again and then to leave rates on hold for the rest of the year. We expect the median forecast of policymakers to show a 51⁄4% - 51⁄2% funds rate at the end of this year, which compares to a market expectation of 5%. Fed Chair Jay Powell will have his press conference after the FOMC meeting and his monetary policy testimony the following week to drive home his message to market participants.

The Fed Typically Leaves Rates on Hold at Peak Levels for at Least Six Months Before Cutting(2)