Expressing The Durability of Homeownership In Credit Markets

The Rithm Take

Despite the prevailing narrative of a cooling housing market, the US mortgage ecosystem is demonstrating a level of resilience not seen in prior economic cycles. The structural enhancements and robust underwriting standards of the post-crisis RMBS 2.0 framework have proven to be a durable barrier against regional price volatility and builder concessions. This strength is progressively insulating a critical segment of the credit market. This suggests that public securitized RMBS and private asset-backed finance, including consumer credit, can provide a stable and attractive source of income and diversification even as the broader economy navigates a complex transition.

Market Signals

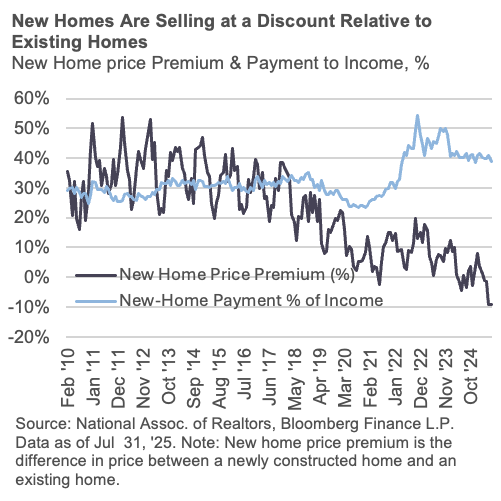

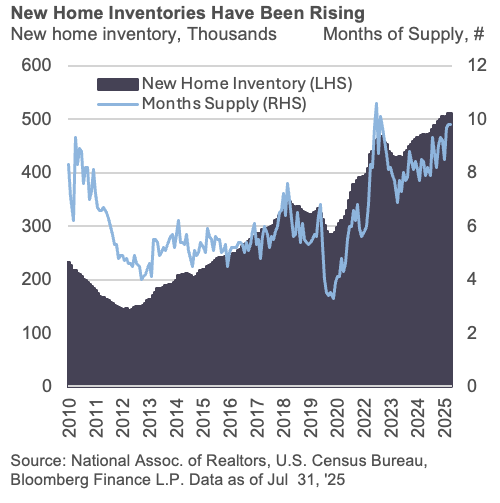

The relationship between new and existing home sales has fundamentally shifted. Historically, new homes have traded at a premium, but that dynamic has broken down in the US. New homes are now trading at a discount relative to existing home inventories on average, a change driven by a post-pandemic decline in affordability (with housing costs now representing around 40% of income, up from 30%). With increased inventory on their balance sheets, builders are actively seeking solutions to offload supply. The latest Housing Market Index from the National Association of Home Builders revealed that 38% of builders reported cutting prices in July, the highest percentage since tracking began in 2022. The current months of supply for new homes are at levels that have historically preceded price declines.

The Conversation

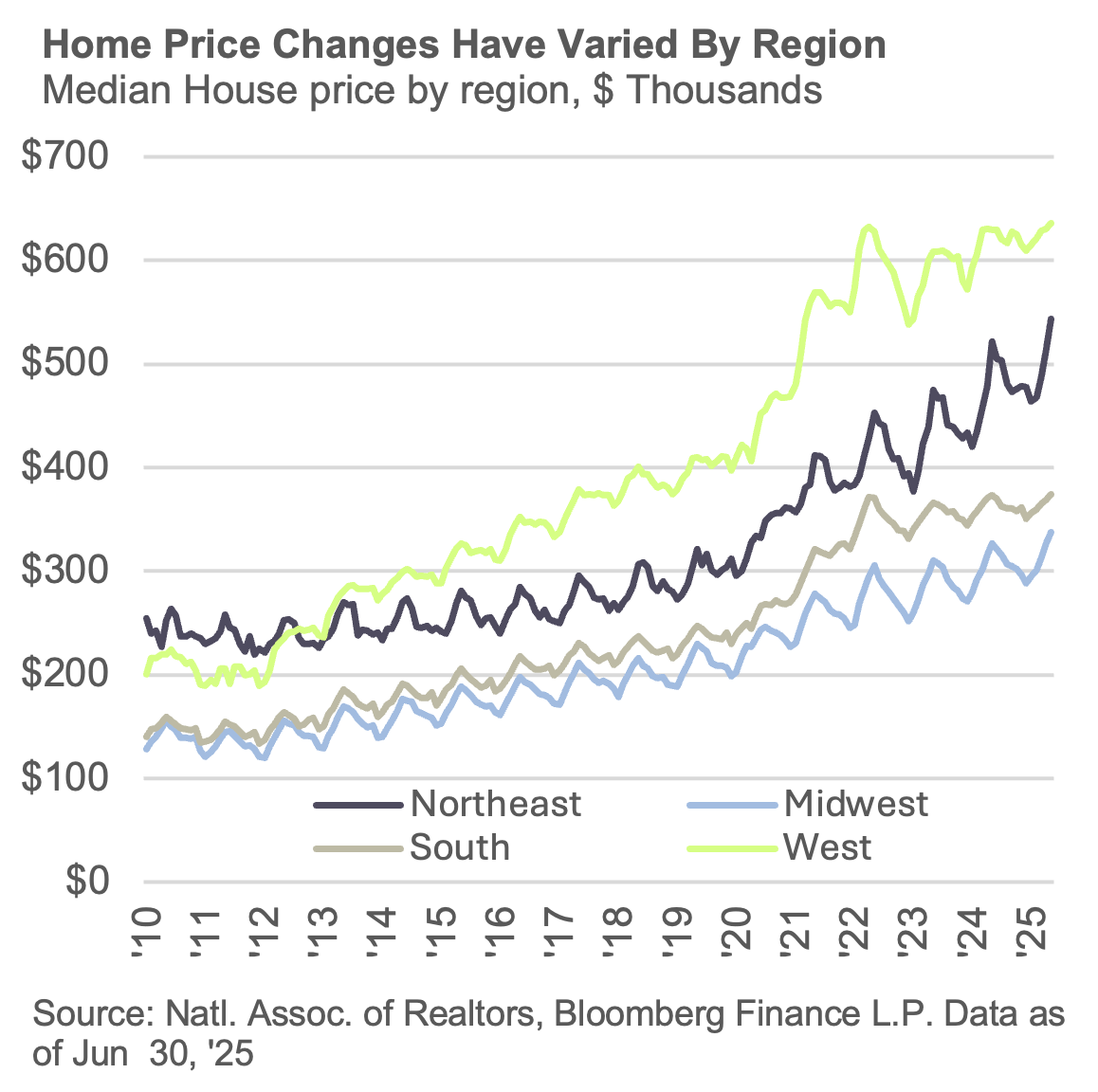

While national home prices have increased by approximately 5% this year, a more nuanced picture emerges beneath the surface with significant regional variation. For example, the median new home price in Florida has declined by about 2% year-to-date. This can be a leading indicator of increased mortgage defaults, as homeowners may find themselves in a negative equity position. This reduces the incentive to make payments, particularly for those facing financial difficulties, potentially creating a cycle of defaults and further price drops.

Despite these headwinds, the market is showing signs of resilience. Both Fannie Mae and Freddie Mac reported a turn higher in their credit losses in their second-quarter earnings releases, but these allowances remain low by historical standards. Similarly, the Fed’s latest quarterly report on Household Debt and Credit showed an increase in 90+ day mortgage delinquencies, rising to 1.29% from 0.95% in the second quarter, but this figure is also low in a historical context. A key testament to the structural integrity of the RMBS 2.0 regime is a single loss of just $900 on a $50 million bond. Rating agencies have been adjusting their ratings criteria from overly stringent to more normalized levels. This resilience has prevented a negative market reaction, as evidenced by spreads on new issue non-QM subordinate tranches trading in line with levels from the start of the year.