Easy, Neutral, Restrictive, or Sufficiently Restrictive?

The Outlook for Policy Rates

Almost a year ago, in an eight-minute mic drop speech at the Kansas City Fed’s Jackson Hole symposium, Fed Chair Jay Powell announced a major shift in the Fed’s monetary policy strategy. When the Federal Open Market Committee (FOMC) began hiking rates in March 2022, various policymakers said that the neutral rate of interest was 2½%, which was the median assessment of committee participants in the longer term, and the strategy was to get back to this level and then assess from there. The problem with this approach was that this was the Fed’s assessment of neutral when inflation was running at the 2% target rate and it was flawed reasoning to use this figure as neutral when assessing what level of interest rates would be needed to get inflation down to 2%.

Powell’s switch was to argue that the Fed needed to establish positive real interest rates across the yield spectrum. Further amplification provided at post-FOMC meeting press conferences and in speeches was that the Fed was seeking to get the policy rate to a “sufficiently restrictive” level and then hold it there for a period of time to exert continued downward pressure on inflation. As the Fed heads into its next policy meeting on July 26, where does policy stand on this sufficientlyrestrictive metric?

“Sufficiently Restrictive”

It is clear from speeches that the majority of the committee see policy as restrictive but not yet sufficiently restrictive and therefore a large majority of the committee see two further rate hikes in the second half of 2023 as being appropriate. The position was clearly stated by Fed Governor Chris Waller in New York just over a week ago. With the latest inflation data in hand, he said “I see two more 25-basis-point hikes in the target range over the four remaining meetings this year as necessary to keep inflation moving toward our target. Furthermore, I believe we will need to keep policy restrictive for some time in order to have inflation settle down around our 2% target.” As for the timing of the moves, he said “I see no reason why the first of those two hikes should not occur at our meeting later this month” and he went on to say that the September 20th meeting should be considered a live meeting.

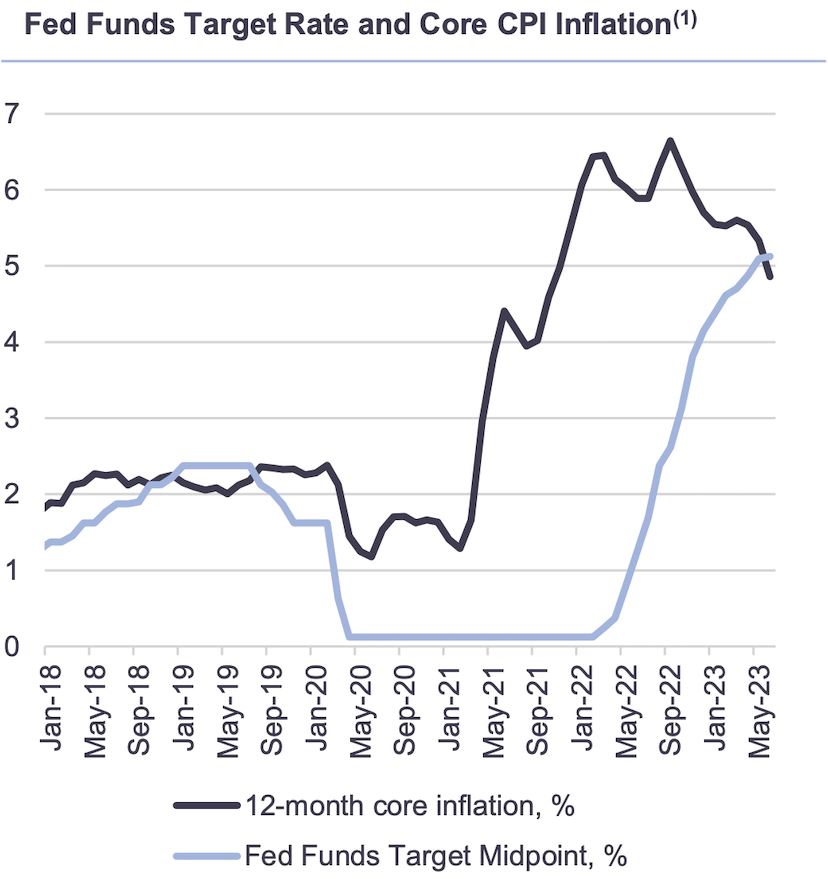

There are two indicators that suggest that policy is now restrictive and both are illustrated in the chart above. The first is that key measures of underlying inflation are declining—albeit at a slow pace as the 12-month increase in the Consumer Price Index (CPI) excluding food and energy (so-called core inflation) has declined to 4.9% in June from a peak of 6.6% in September 2022. At this pace of decline, it would take about another year for core CPI inflation to slow to a level consistent with the Fed’s 2% inflation target. Second, in June the core inflation rate fell below the policy rate—albeit only by about 0.2 percentage points. Two further quarter-point rate hikes seems a reasonable assessment of what might be needed to make policy “sufficiently restrictive,” with the first of those hikes coming next week, but much depends on the path taken by inflation.

The stance of policy is judged often by the level of real interest rates (often in relation to some guesstimate of the neutral real rate of interest) and policy could passively tighten further even if the Fed holds the nominal policy rate at 5¼% - 5½% after next week provided inflation continues to decline. The speed of the decline in inflation is likely to be the primary determining factor in whether the Fed hikes again later in the year. Regardless of whether the Fed hikes once or twice more this year, it would seem that interest rates are likely very close to their terminal level for this cycle. Policy will tighten further via the passive mechanism of declining inflation, which suggests that a relatively stable outlook for short-term interest rates in the months ahead.