Dollar Signals and the Quality Bias

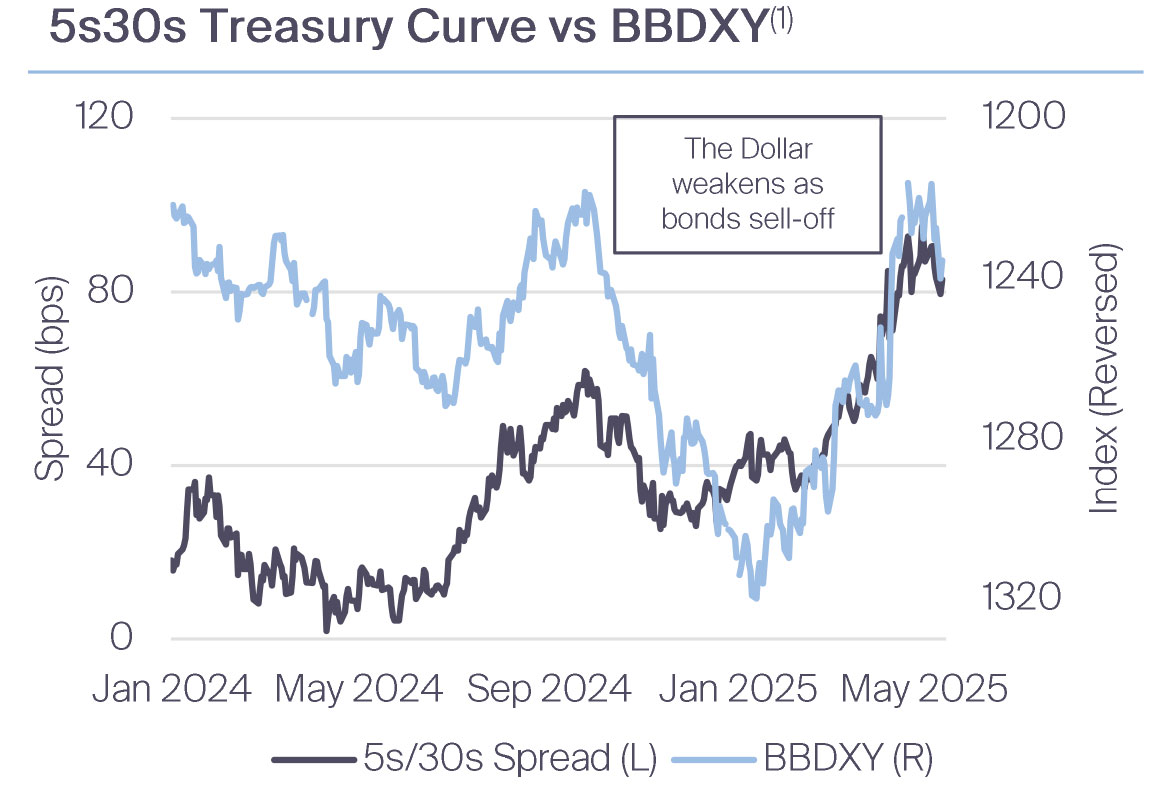

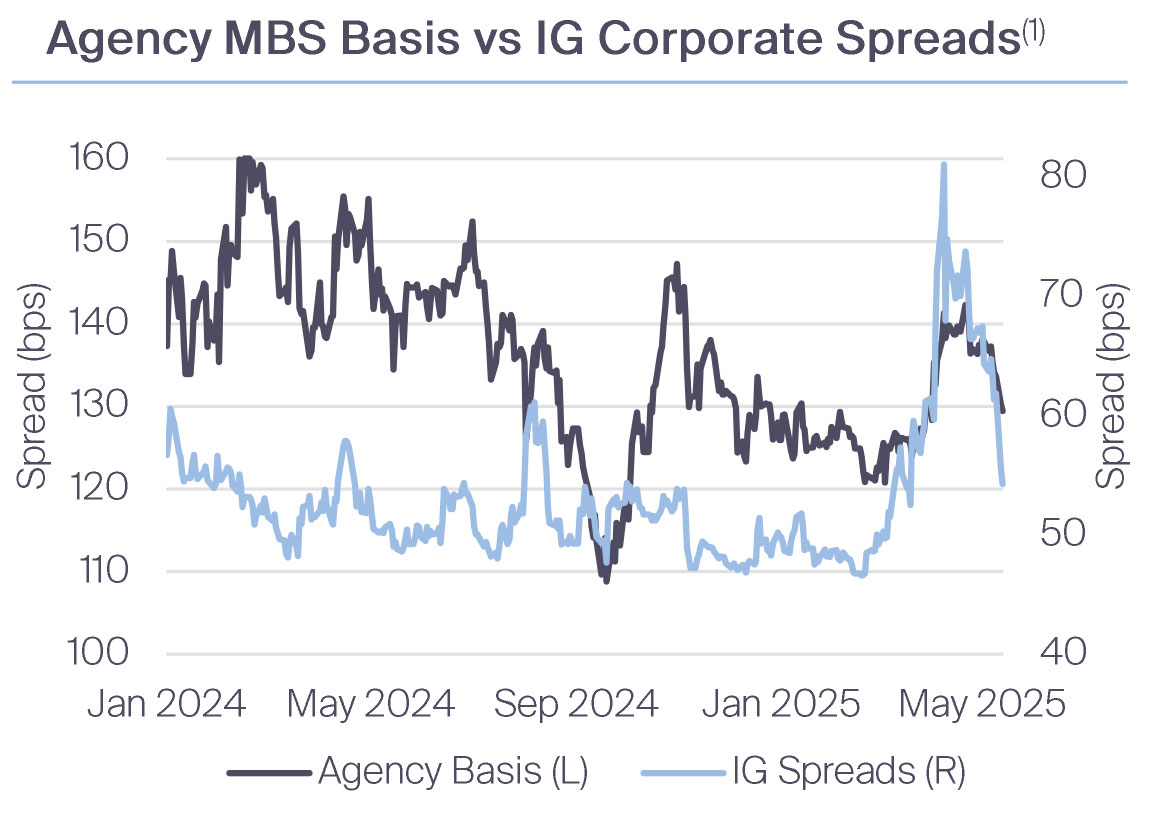

Treasury Secretary Scott Bessent has framed tariffs, tax cuts, and deregulation as the three key pillars of the Administration’s plan to boost growth and rein in the federal deficit. Deficit concerns have raised questions about the dollar’s dominance. The Bloomberg Dollar Index (BBDXY) peaked at 1316 in January 2025, then retreated to 1235 in early May. The 5s/30s Treasury curve has steepened, driving long-dated volatility higher. Investor hedging of dollar and interest-rate exposure amid cross-currents of tariff policy has cascaded across assets, including the agency MBS basis and IG credit.

The Conversation

The back-and-forth on tariffs, along with worries over the fiscal outlook, is reshaping global markets and asset valuations. The cost of hedging USD and interest rate exposures has risen noticeably. Swings in exchange rates and yields have hit multi-month highs as investors seek to limit their overall exposure.

The BBDXY, which tracks the trade-weighted cost of holding USD, shows bearish market positioning at its deepest point since the index began. Although we’ve seen a partial retracement as China and the US entered a three-month negotiation period, volatility tied to investor hedging on trade policy and the fiscal picture remains elevated.

This dynamic is manifesting in the cash bond market, where long-term Treasury yields have risen faster than short-term notes, steepening the curve between five- and thirty-year maturities amid added uncertainty. Agency mortgage-backed securities continue to trade at wider spreads to Treasuries than historical norms. While corporate bonds and equities have largely recovered from the tariff-driven sell-off, agency MBS spreads remain wide—a departure from historical patterns that were typically driven by recessionary expectations, now forced by recent dollar moves.

The Rithm Take

A longstanding rule of thumb in the cash bond markets has been tested by the recent shift in the dollar’s supremacy. Historically the agency MBS basis has tightened in weaker economic scenarios. It's limited credit exposure and greater appeal to banks that would face weaker loan growth, are environments where agency MBS spreads have historically led other sectors tighter. In those environments, agency spreads led credit sectors and provided a floor for overall spreads. The current post-tariff period has seen the opposite: corporate credit is leading the tightening as tariff concerns have eased—for now.