Dispersion Over Direction

The Rithm Take

This week reinforced a central theme for the year: dispersion is doing more of the work than direction.

Markets are moving, but not together. Traditional beta is delivering diminishing explanatory power, while relative outcomes are increasingly driven by volatility assumptions, leverage, and policy sensitivity. Uncertainty is rising across trade, fiscal trajectory, and monetary reaction functions, yet volatility remains suppressed and select risk assets advance.

In this environment, performance is less about forecasting a single macro-outcome and more about where risk is being implicitly underwritten. When uncertainty is structural rather than cyclical and volatility is deferred rather than repriced, alpha comes from selectivity, not exposure.

Market Signals

Dollar Weakness, But Not a Fiscal Revolt

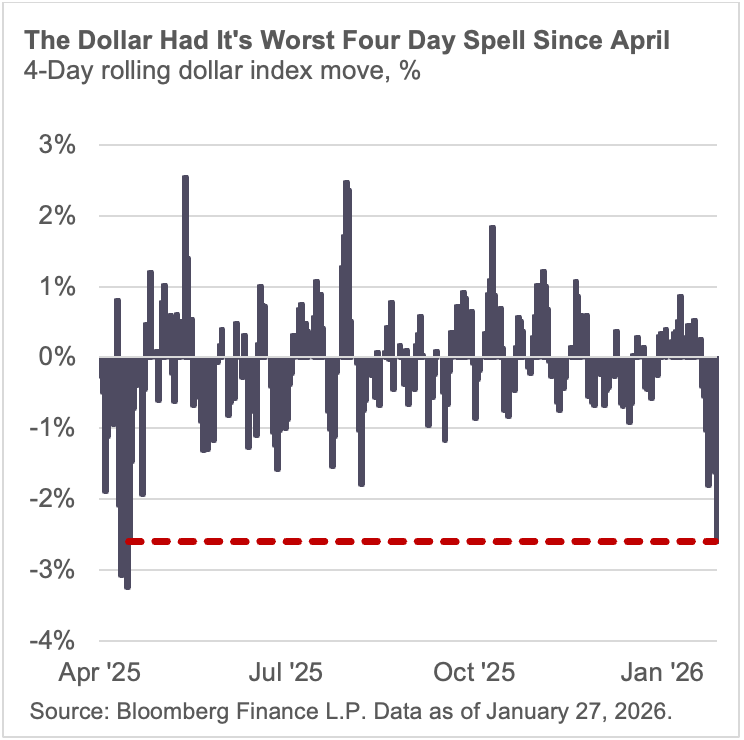

The dollar index experienced its largest four-day decline since last April this week (-2.6%), but the composition matters.

Currencies of high-debt economies such as Japan and the UK strengthened at the same time. That pattern argues against a clean fiscal sustainability story and instead points toward a broader uncertainty unwind, where capital rotates away from the dollar as the default hedge – especially when US trade and political uncertainty seems to be what investors are hedging against.

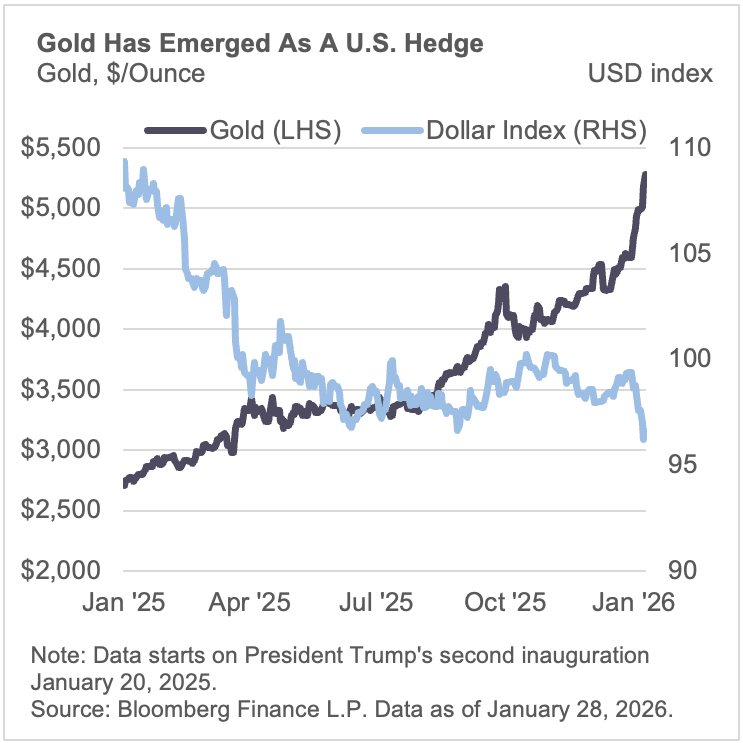

Gold Is Taking The Baton

Gold’s rally to all-time highs this week was notable less for the level and more for the context. The move occurred alongside subdued rate volatility and without a sharp drawdown in equities. Historically, that combination is uncommon. It suggests demand driven less by recession fear and more by policy uncertainty and longer-term purchasing power concerns, rather than near-term growth deterioration.

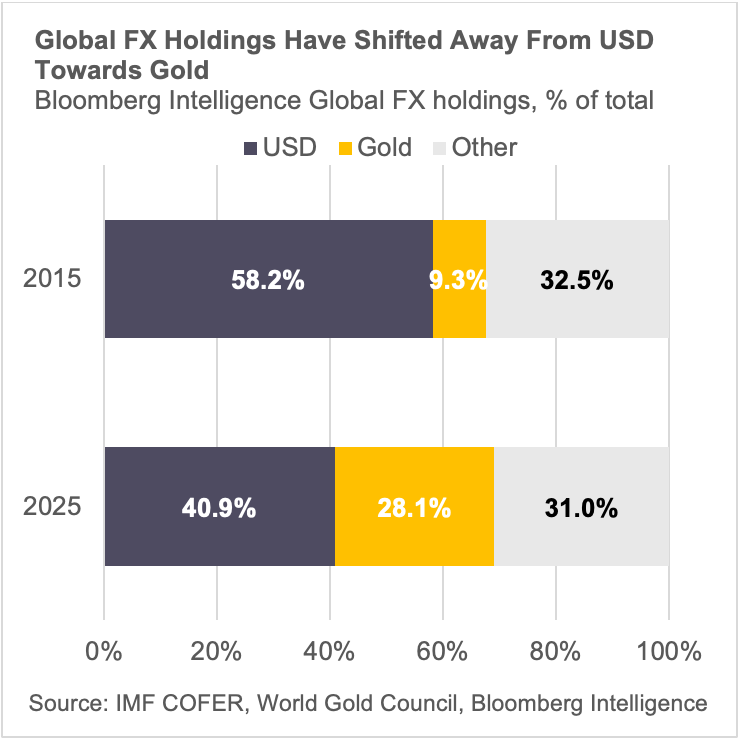

The combination of both USD diversification and central bank purchases of gold has led to a noticeable shift from dollars towards gold in the world order of reserves over the past ten years.

Bitcoin Missed the Macro Signal

Bitcoin did not meaningfully participate in the broader hedge bid, and is down over 5% since the start of the year. Despite its macro narrative, it behaved more like a liquidity-sensitive asset than a store of value. That divergence reinforces that not all “macro hedges” hedge the same risk, particularly in environments dominated by policy and structural uncertainty rather than simply risk-on or risk-off.

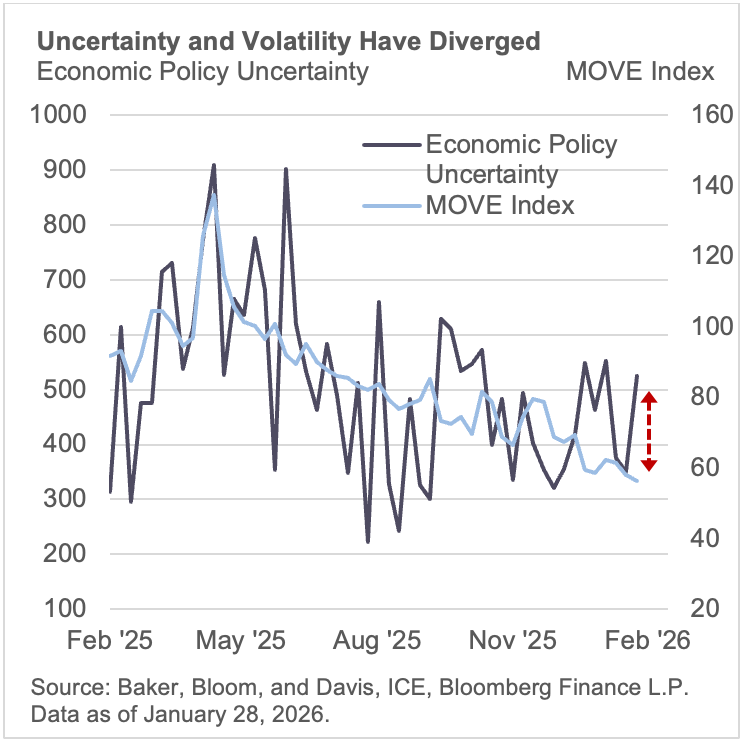

Policy Uncertainty Rising, Rate Volatility Lagging

Economic policy uncertainty has moved higher, driven by trade, fiscal trajectory, and reaction-function ambiguity. Rate volatility, by contrast, remains suppressed.

Historically, sustained gaps between policy uncertainty and rate volatility tend to resolve through volatility repricing higher rather than uncertainty collapsing. Low volatility in a high-uncertainty environment encourages leverage, compresses risk premia, and leaves markets exposed to discrete adjustments rather than gradual normalization.

This matters because rate volatility directly transmits into mortgage rates, structured credit performance, duration appetite, and carry viability.

Equities Grind Higher as Performance and Earnings Breadth Improves

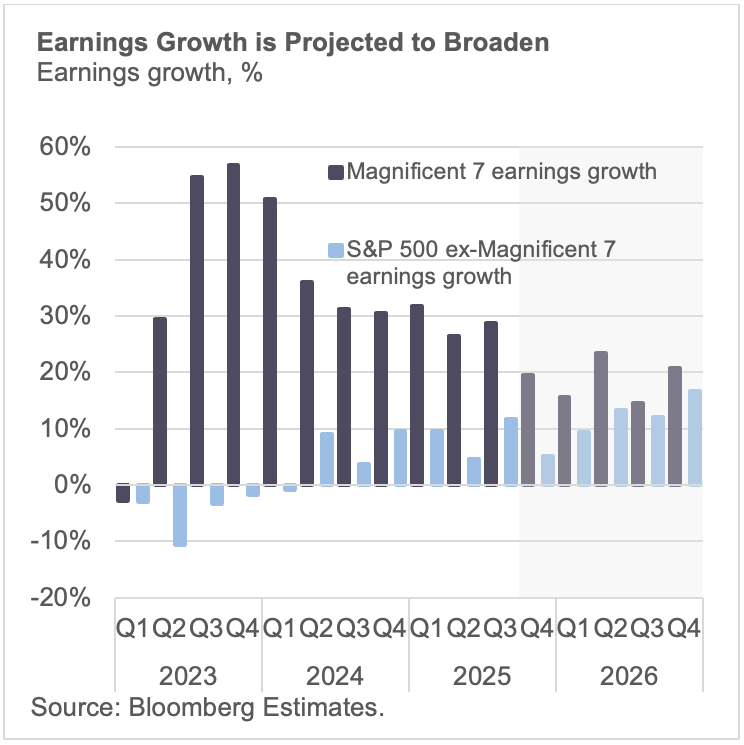

Equities continue their 2026 advance, with large caps reaching all-time highs this week, supported by earnings durability and stable financial conditions. Importantly, leadership is beginning to broaden. Earnings expectations are no longer confined to a narrow cohort, with improving contribution from cyclicals, select financials, and domestically oriented sectors alongside secular growth leaders. While dispersion across rates sensitivity, trade exposure, and consumer mix remains elevated, index strength is increasingly supported by a wider set of fundamentals. This is still not a pure beta environment, but the market is moving away from the highly concentrated dynamics that characterized prior phases of the rally.

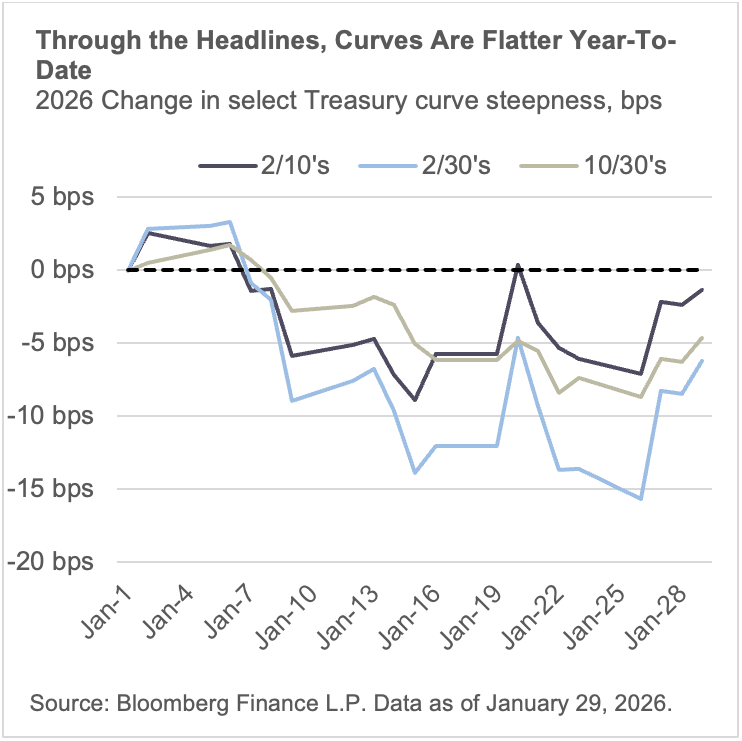

The Fed Holds and The Curve Moves

This week the yield curve steepened as long rates drifted higher even with the Fed holding policy steady. It is a reminder that front-end stability does not guarantee easier conditions across the curve, especially as growth expectations are being revised higher, and uncertainty demands term premium. Regardless, of this week’s move and throughout all the “Sell America” headlines of 2026, by Thursday’s close 2’s10’s, 2’s30’s, and 10’s30’s are flatter than where they started the year.

The Conversation

Taken together, this week’s market action was not about risk-on or risk-off, but about selective repricing.

Large moves occurred across commodities, currencies, and the yield curve, while equities continued to grind higher with little visible stress. Some traditional macro hedges responded forcefully, others did not. The result is an increasingly fragmented market.

Investors are hedging uncertainty, but selectively. They are carrying risk, but with a preference for structures that benefit from suppressed volatility and stable funding. Carry remains attractive, leverage is being used, all in the context of rising policy uncertainty that is not yet being priced through volatility.

This configuration is orderly, but it is also path-dependent. When volatility is delayed rather than eliminated, outcomes tend to be non-linear. The divergence across gold, FX, crypto, rates, and credit is the signal. Markets are not broadly mispriced; they are unevenly priced.

That unevenness is where both risk and opportunity reside.