Deferred Risk: The Rise of PIK Financing

Since 2021, Payment-in-Kind (PIK) financing has risen in popularity in the private credit and bank syndicated loan markets. Loan restructurings from PIKs are deferring interest obligations. Amplifying these tail risks today are margin squeezes and weakening sales from US tariffs and any threat of recession. This is prompting lenders to reconsider capital structures and explore options for de-leveraging. While offering short-term relief, the risks are rising from trade-offs in terms of asset encumbrance, structuring complexity, and long-term flexibility.

The Conversation

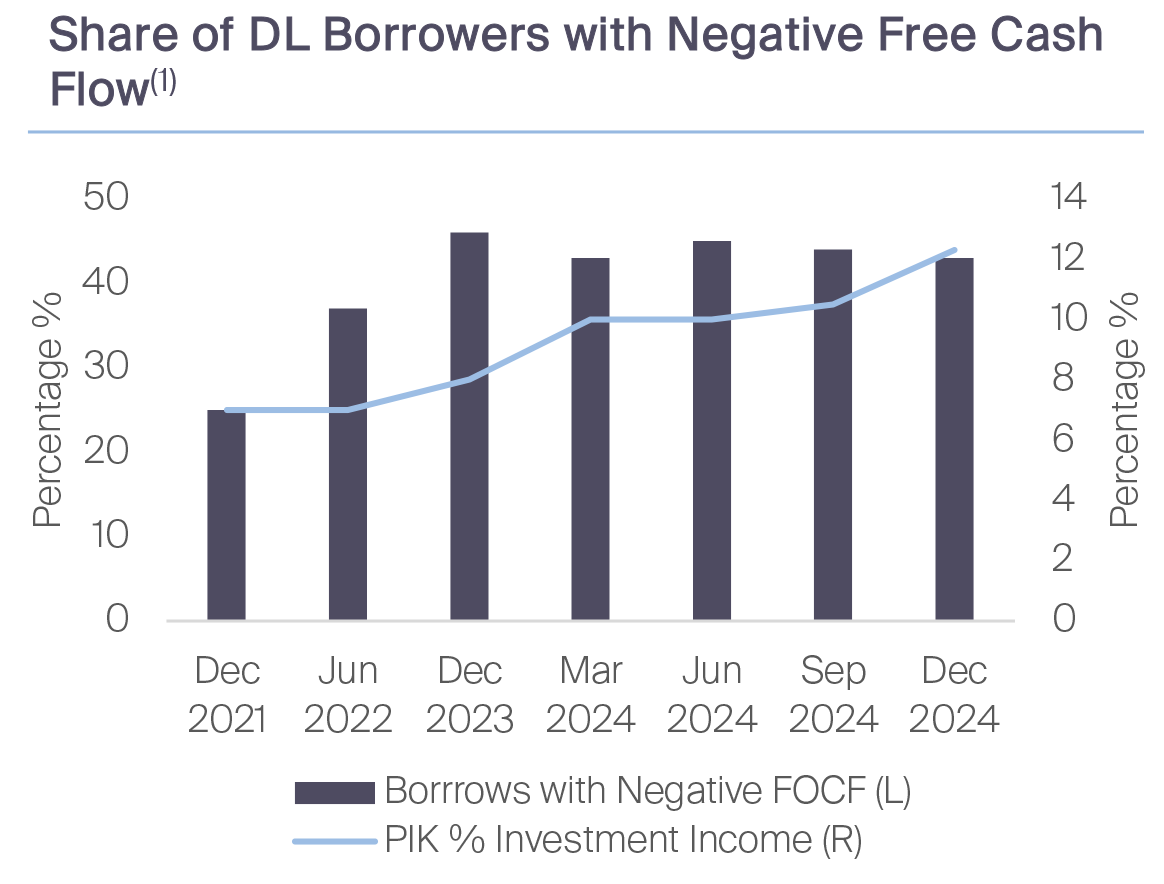

The steady build-up of exercising PIK toggles is changing the fundamental landscape. Estimates show 10.2% loans held by business development companies (BDCs) at fair value in Q3 2024 were loans making PIK payments. More than two-thirds of those PIK-paying loans won’t mature until at least 2028, suggesting many involve recent-vintage or recurring-revenue deals that are permitted to PIK from the outset. While PIK can preserve liquidity, avoid immediate default, and provide workout flexibility, its true payoff depends on either better refinancing conditions or improved operating performance. Without this positive outlook, PIK’s risk compounding leverage burdens, diluting equity value, and raising recovery risk for credit holders.

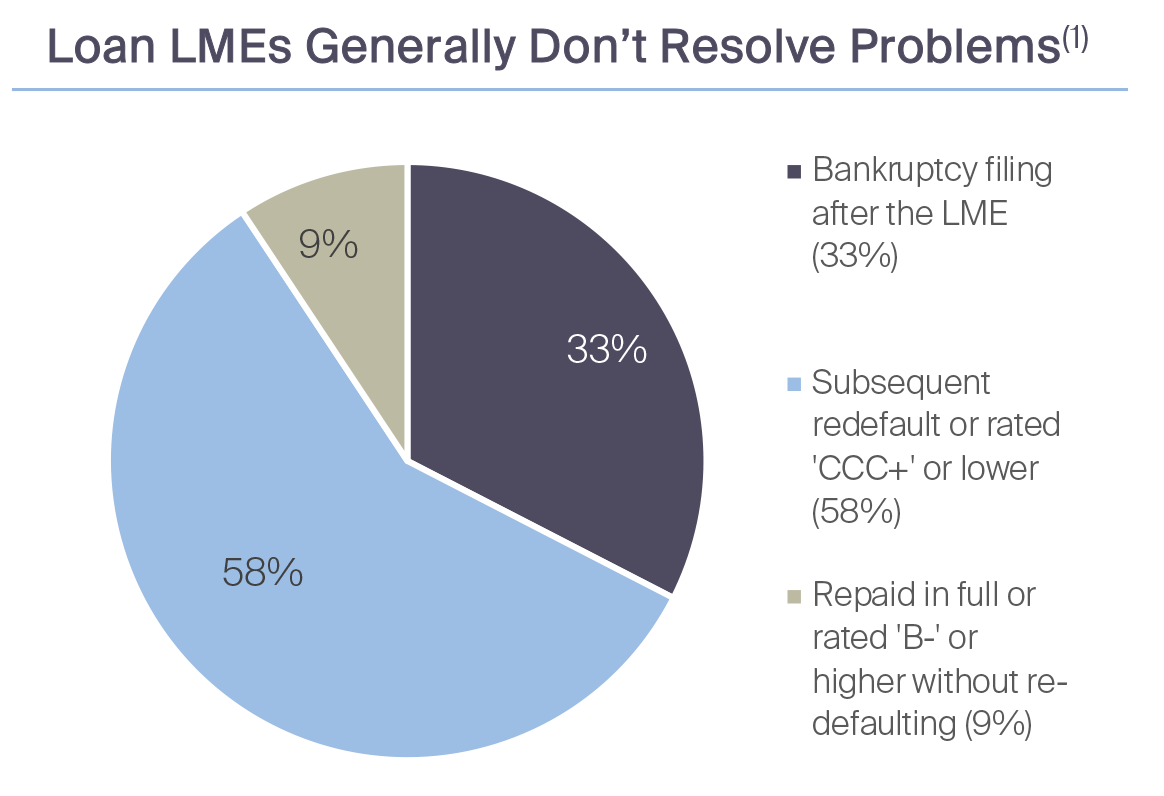

Counterintuitively, the rise in PIK income is suppressing otherwise weak performance metrics. Default rates for broadly syndicated loans and direct lending exposures have climbed above banks’ loan-loss provisions—around 1.6% of total loans by end-2024—highlighting growing credit stress. In the Collateralized loan obligations (CLO) sector, liability management exercises (LMEs) have become increasingly common, often involving amendments or restructurings that avoid formal default classifications but can shield underlying distress. These deals frequently include maturity extensions or covenant adjustments that can hurt existing delay recognition of impairment. Such measures are only a short term solution, masking deterioration and compounding losses when defaults ultimately crystallize.

The Rithm Take

PIK structures can become increasingly binary, especially in an uncertain macro outlook for the US economy in the face of tariffs, inflation and a potentially weakening consumer. Tail risks are increasing. Outcomes may be more likely to face worst impairment than otherwise estimated. Should the credit cycle turn, the covenant light BSL sector stands to be more adversely exposed than direct lending. In this context, asset quality and business model resilience will matter more than ever—firms with recurring, defensible cash flows will retain options, while others may find that financial flexibility narrows quickly as the cycle turns.