Data Greenlights Resilience

Market Signals

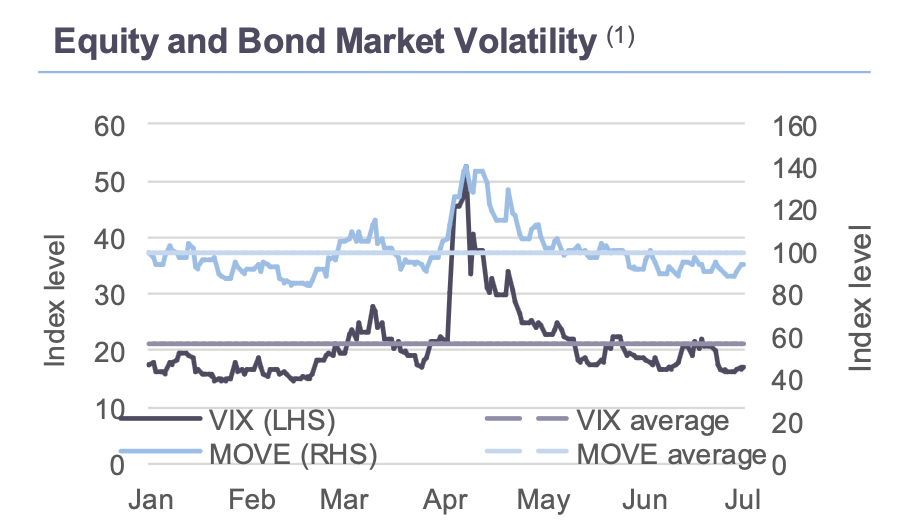

Checking in halfway through 2025, US equities are hovering near all-time highs, the VIX and MOVE indices are both below year-to-date averages. Evidence that international investors are selling dollar assets to reallocate internationally is limited, but the broad Bloomberg dollar index is lower by nearly 11% year-to-date. Rather, the dollar's weakness may be reflecting the lower yields across the curve as well as the increased anticipation for interest rate cuts this year and next. As the market has anchored its view to a slowing economy and increased expectations of an interest rate cut as the base case, strengthening labor market news has challenged that consensus view. We observed a better-than-anticipated JOLTS report, which indicated the highest number of job openings since November, and a June nonfarm payrolls print that beat expectations by nearly 40k.

The Conversation

Coming into 2025, the consensus market view was for US exceptionalism. Rates at the longer end of the curve were rising in anticipation of increased growth driven by tax cuts and deregulation. Halfway through the year, yields have fallen along with growth expectations, as trade policy – more specifically, tariffs – has dominated the investment narrative.

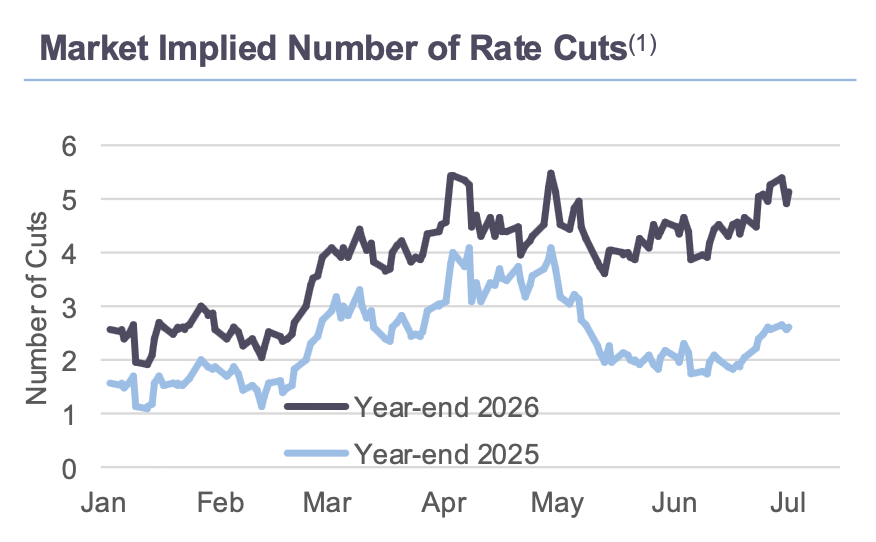

The anticipated growth drags from said policy have increased the market’s expectations for Fed cuts in 2025 and 2026. As it stands, futures markets are pricing in just over five 25bp interest rate cuts from the Fed between now and year-end 2026.

But the broader economy has held relatively more resilient amid uncertainty fears. This has raised the question of whether investors should expect to see a material deterioration from current levels in the economic data during the late summer months.

The Rithm Take

Market pricing of rate cuts is coinciding with an economy that continues to show resilience and risk assets are back to pricing US exceptionalism. The stronger than expected June jobs report, and CPI which will be released next week will be the two key points of data the FOMC will be anchoring on ahead of their month-end meeting. Markets are pricing in no move from the Fed at their upcoming meeting, but Chair Powell himself has said the committee will not rule out a July cut and rather would stay data dependent.