Control Over Access: The Structural Edge in Asset-Backed Finance

The Rithm Take

Two recent high-profile bankruptcies have underscored a fundamental principle in credit markets: access to assets is not the same as control over them. In both cases, lenders appeared to have extended complex financing without maintaining clear, verifiable oversight of collateral. The problem wasn’t macro volatility, it was structural. When borrowers control collections, data, and reporting, lenders effectively outsource risk management to the entities they were supposed to monitor.

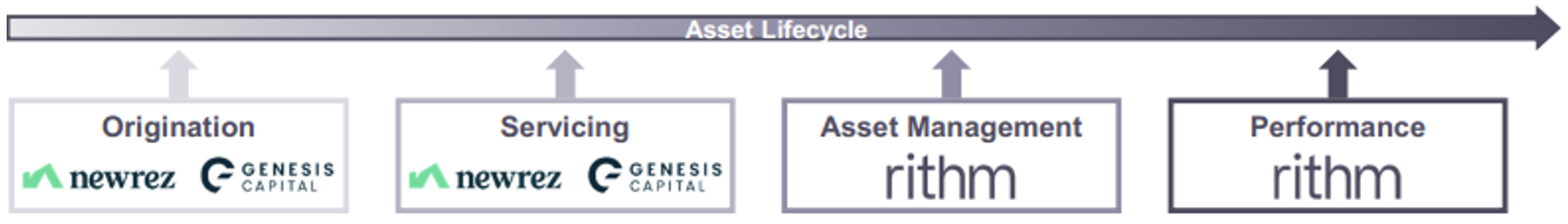

By contrast, asset-backed and mortgage finance—particularly when lenders own the origination, servicing, and asset management platforms—operate under a system of built-in verification. Here, control isn’t an afterthought; it’s the architecture. Every stage of the process is designed for transparency and accountability: liens are publicly recorded, payments flow through monitored trust accounts, and third party custodians reconcile data daily.

In an environment where yield remains plentiful but control is scarce, owning the full lifecycle of origination through servicing is the ultimate differentiator. It transforms operational friction into a structural advantage—one that converts transparency into durability and prevents liquidity shocks from becoming solvency crises.

Market Signals

Two large corporate bankruptcies this quarter indicate potential systemic failures in asset and cash-flow verification.

Based on available information, both cases seem to involve lenders relying on borrower-supplied data, without deposit account control or direct payment oversight.

In contrast, regulated asset-backed and mortgage structures feature daily reconciliation, third-party custody, and public lien records—providing built-in risk identification and protection.

The Conversation

Recent market disruptions have made one thing clear: scale and access mean little without structure and means of verification. The failures seen in corporate and specialty finance this year weren’t driven by demand or default rates, they were the result of operational design flaws. Lenders pursued growth through increasingly complex facilities, but few built the infrastructure to verify or control the collateral behind them.

When costs rose and liquidity tightened, those gaps were exposed. Borrowers acting as their own servicers redirected payments, delayed remittances, or reused collateral across multiple funding lines. Without true account control, lenders discovered they had financed assets they didn’t actually control—and realized it only after liquidity had evaporated.

The asset-backed and mortgage finance model is structurally different. It’s built around control as a process:

Origination: Loans are documented, verified, and finalized before funding. Standardized underwriting and lien recording ensure every asset is traceable.

Servicing: Borrowers do not handle collections; payments flow through trust or servicer accounts governed by control agreements, providing daily transparency.

Asset Management: Custodians and trustees reconcile performance data in real time, preventing discrepancies and ensuring every cash flow has a verified source.

These safeguards create a system defined by discipline and verification. Where some lending structures depend on trust, asset-backed finance relies on infrastructure—making risk identification and control continuous, not reactive.

In a cycle defined by rising complexity and compressed spreads, control is key. Lenders who own the process—not just the paper—can identify risk early, maintain transparency, and preserve confidence across changing market conditions.