Conditional Resilience

The Rithm Take

The U.S. macro backdrop entering 2026 remains resilient on the surface, but the composition of that resilience is shifting in ways that matter for markets. Growth is holding up, inflation is easing at the margin, and risk assets continue to grind higher. Yet beneath the aggregates, the economy is expanding with fewer workers, heavier fiscal reliance, and increasingly uneven cash-flow generation.

That combination does not argue for a broad risk reset. It does, however, argue against treating markets as monolithic. The environment is becoming less about directional beta and more about where growth, pricing power, and balance-sheet flexibility are actually accruing.

The central tension for investors is no longer whether growth persists, but who benefits from it and through which channels.

Market Signals

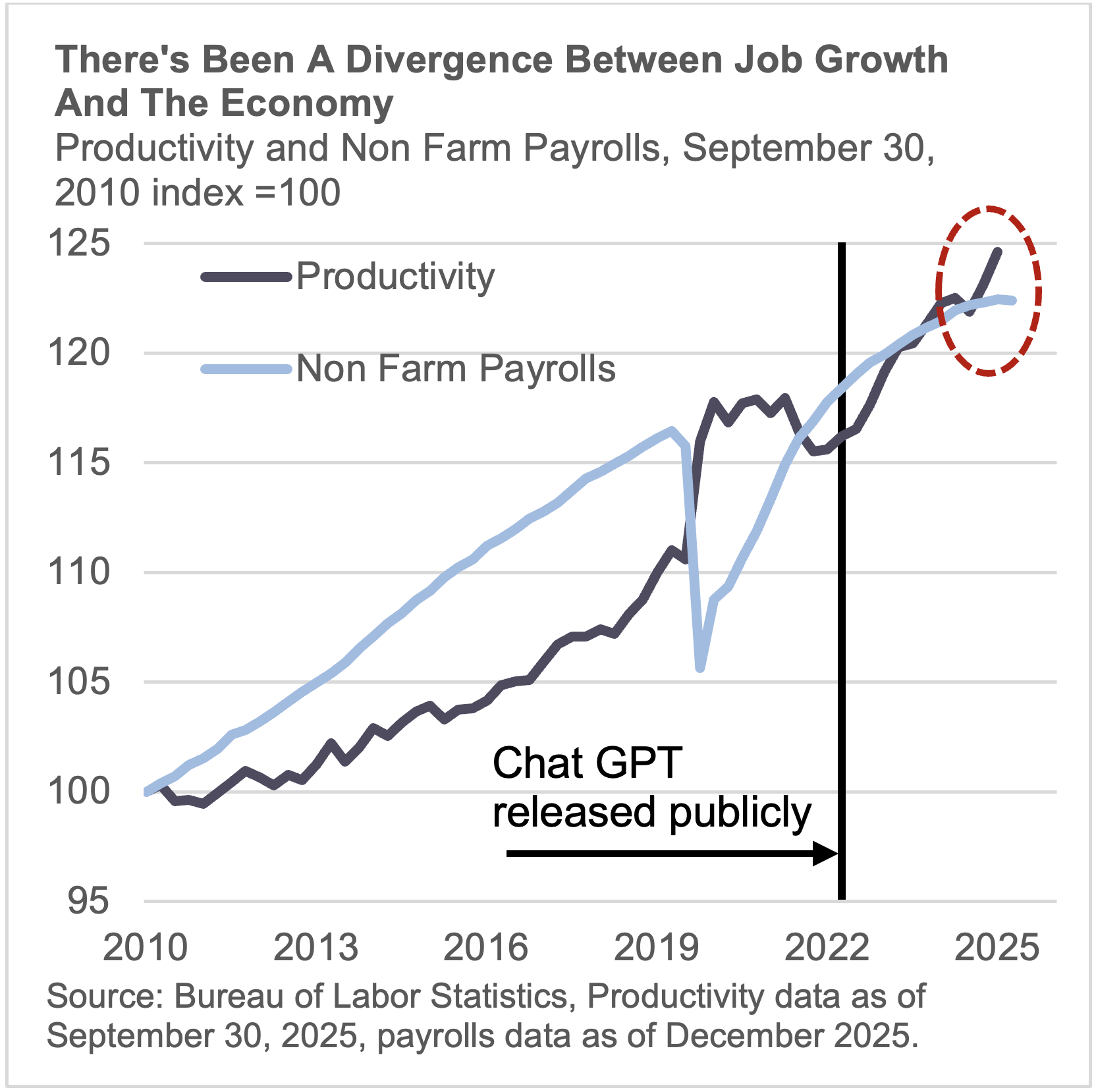

Growth is decoupling from labor.

Real GDP has continued to exceed expectations even as hiring has slowed meaningfully. Unemployment has remained stable not because job creation is strong, but because labor supply is contracting through reduced immigration and lower participation. The implication is higher output per worker rather than broader employment gains.

Productivity is re-emerging as a driver.

The disconnect between growth and labor points toward rising productivity, with early confirmation showing up in corporate earnings—particularly among large firms that have been heavy investors in automation and AI-enabled workflows. This is supporting margins and revenues without requiring incremental labor input.

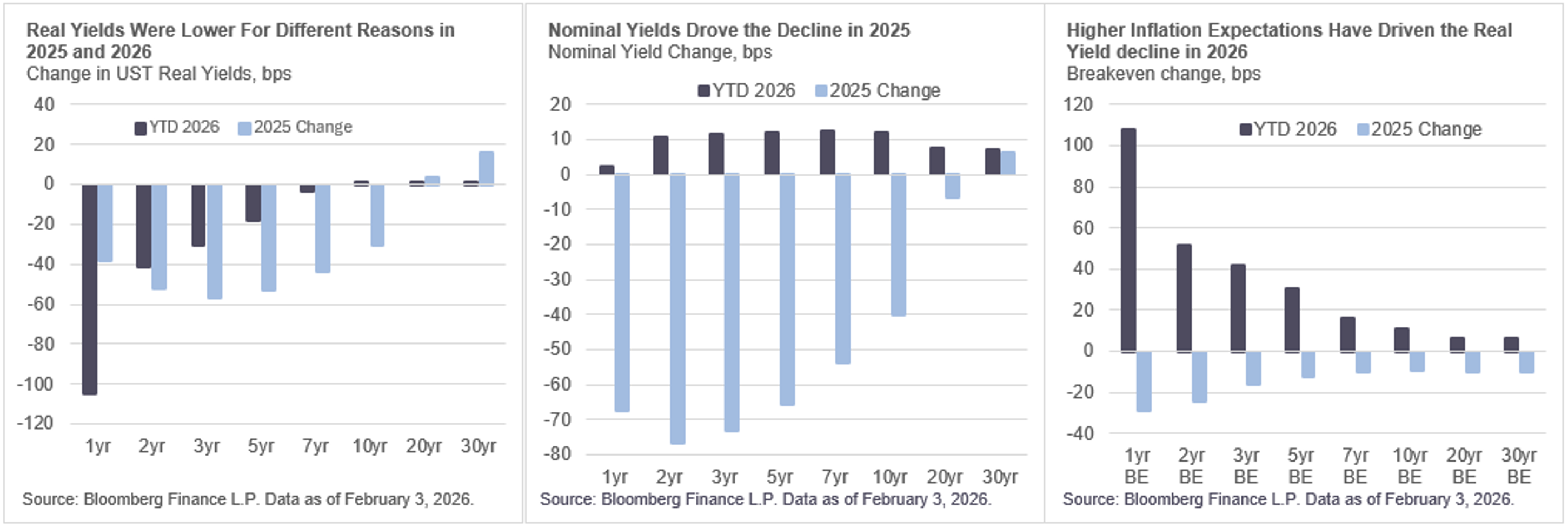

Fiscal dynamics are asserting themselves in rates.

The Treasury curve remains steep, driven less by near-term growth concerns and more by persistent borrowing needs and rising interest costs. Heavy issuance and structurally large deficits continue to weigh on the long end, and markets price two rate cuts in 2026 at the front-end.

Real yields declined in both 2025 and 2026, but for different reasons. In 2025, the move was driven by falling nominal yields alongside easing inflation expectations, consistent with a benign disinflationary backdrop. In 2026, real yields are again lower, but the decline is being driven by higher breakeven inflation, not meaningfully lower nominal rates. Fiscal supply and term premium have kept nominal yields more constrained, while inflation compensation has firmed. The result is a similar outcome with a different signal—less about easing financial conditions and more about inflation risk being re-priced.

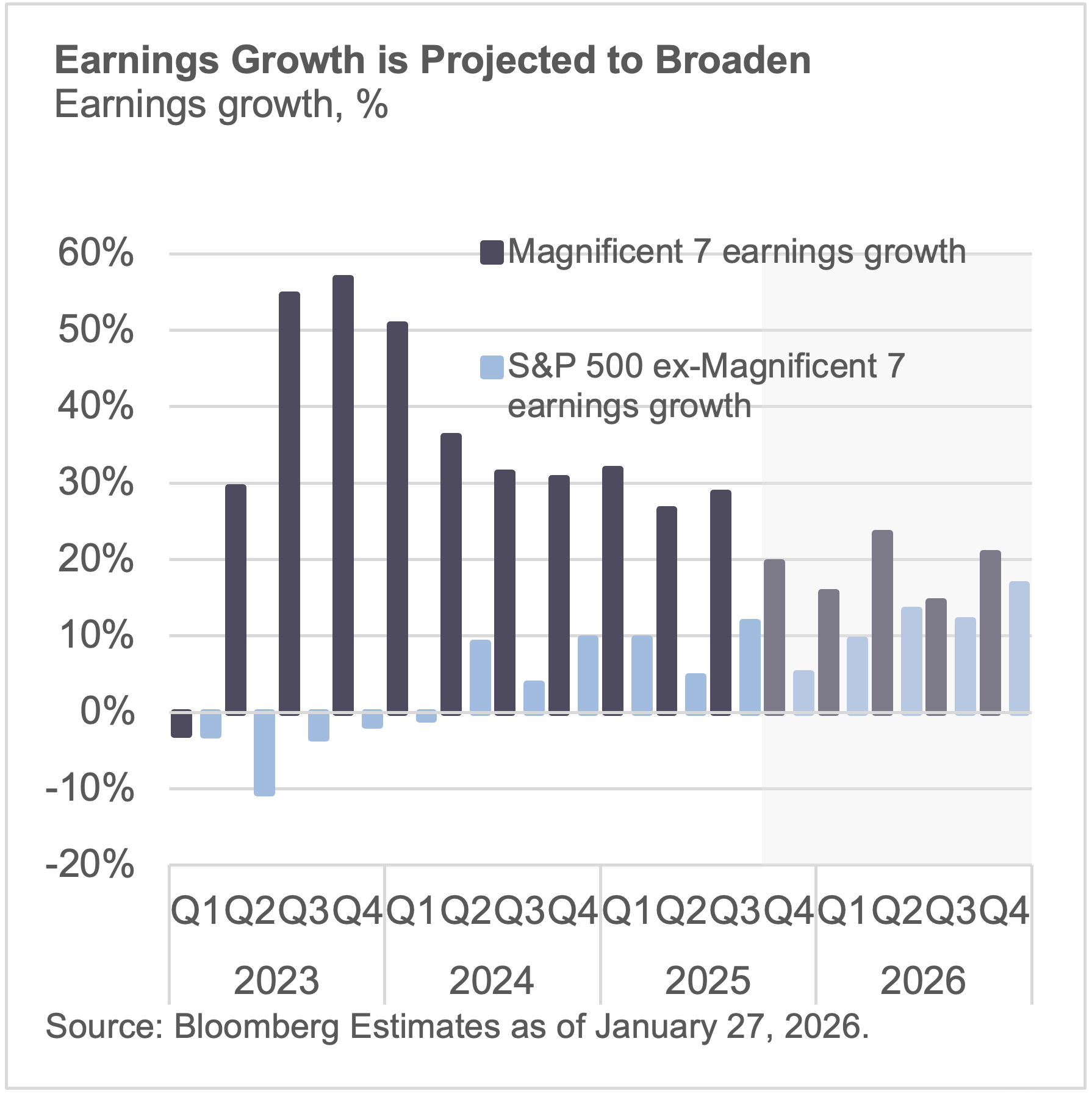

Equity earnings are broadening.

Earnings growth is no longer concentrated solely in a narrow group of mega-cap firms. The expected gap between large-cap leaders and the rest of the market is narrowing in 2026, suggesting a shift toward broader earnings participation, and all else should create opportunities for active managers.

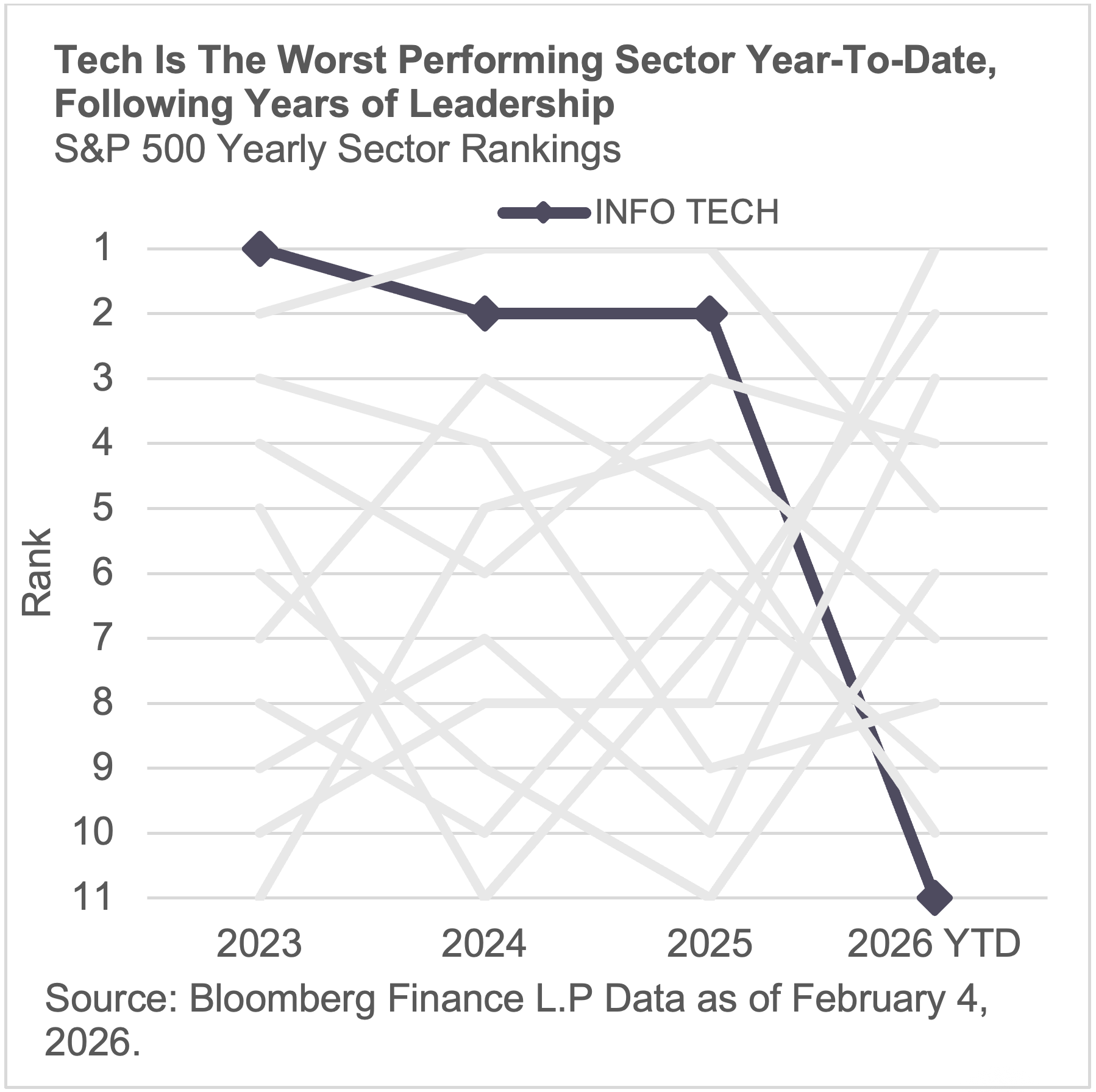

Dispersion in equity performance is re-emerging. After three consecutive years of outperformance, technology has become the worst-performing sector in the S&P 500 year-to-date, as investor concerns grow that AI may erode the competitive moats of software and data-centric business models.

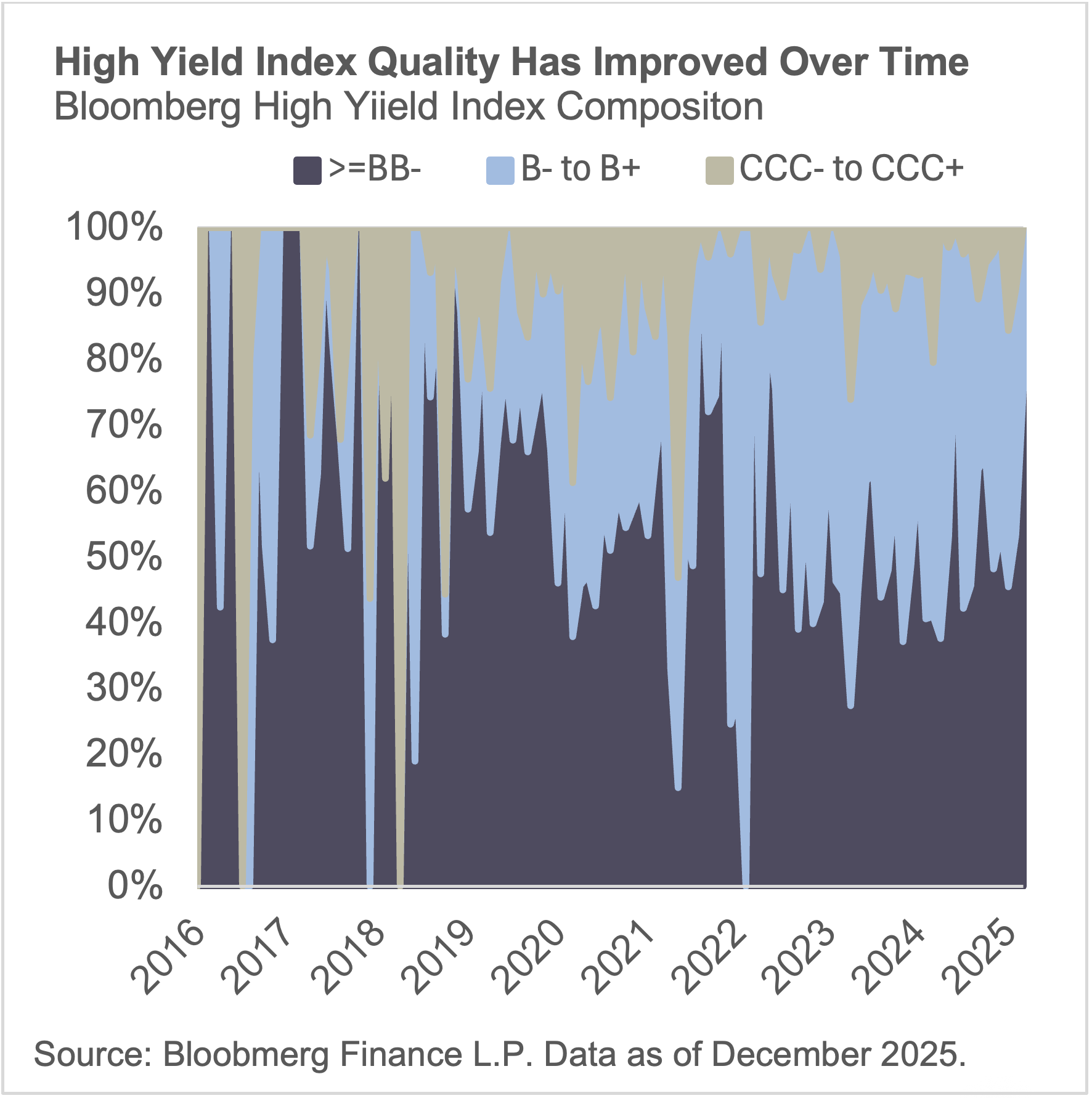

Credit spreads remain tight, but index quality has improved.

Public credit indices look expensive in headline terms, yet their composition has shifted materially toward higher-quality issuers, CCC+ credits have declined to a near zero weighting in the Bloomberg High Yield Index from ~20% in the late 2010’s. It’s plausible some of these lower-rated borrowers have migrated to private markets, to obtain more bespoke financing solutions.

The Conversation

What ties these signals together is dispersion—not just across assets, but across the mechanisms driving similar-looking outcomes.

The economy is growing, but the source of that growth matters. Output gains driven by productivity rather than hiring favor business models with scale, automation, and pricing power. Firms that rely more heavily on labor intensity face tighter constraints even in an expansionary environment, which helps explain why aggregate growth can coexist with increasingly uneven corporate performance.

A similar distinction is emerging in rates. Real yields declined in both 2025 and 2026, but the underlying message has changed. In 2025, lower real yields reflected easing nominal rates and falling inflation expectations, consistent with a broadly supportive disinflationary backdrop. In 2026, real yields are again lower, but this time because inflation compensation has firmed while fiscal supply and term premium continue to anchor nominal yields. The signal is less about easier financial conditions and more about inflation risk being re-priced beneath a resilient growth surface.

Equities are reflecting that same shift. Broader earnings growth does not imply uniform upside. Dispersion is re-emerging as leadership rotates, margin durability comes under greater scrutiny, and previously dominant sectors face questions around competitive moats and capital efficiency. Performance is becoming less about participation and more about positioning.

Credit tells a parallel story. Headline spreads remain tight, but index quality has improved as lower-rated issuers migrate out of public markets. The result is a market that looks expensive in aggregate but increasingly differentiated underneath, with outcomes driven by structure, collateral, and issuer-specific fundamentals rather than broad credit beta.

Taken together, markets are not signaling fragility—but they are signaling that headline measures are masking growing differences beneath the surface. Similar price outcomes are being driven by different forces, and those differences increasingly matter for returns. For 2026, the challenge is not calling the direction of growth, but identifying where durability, pricing power, and balance-sheet flexibility actually reside.