“Capital Recession” Progresses

What we’re hearing on the Street...

- JP Morgan: US Basel III Endgame increases required capital by 25%.

- Bank of America: Activity could be pushed outside banking system.

- Goldman Sachs: CRE exposure in the office space is marked or impaired down by about 50% this year. In non-office, the adjustment there through marks or impairments is about 15%.

The Conversation

The US banking system has $2.2tn in total capital. The Basel III Endgame stands to raise regulatory capital requirements, but mostly for the largest banks. The top 15 banks in the country have $1tn in total capital. The estimated 10-20% increase in capital will require $100-200bn should the ruling go into effect as currently proposed.

US banks hold a total of $2.8tn of the $5.5tn in outstanding commercial real estate (CRE). While the aggregate exposure is 18% across the entire banking system, smaller banks are disproportionately exposed to CRE. Banks with less than $250bn in total assets hold $2.1tn in CRE assets. This ranges across multi-family, office, industrial/warehouse, and retail. About half of the exposures are in multi-family and office. Transaction volumes have declined, recent appraisals are unavailable, and properties entering special servicing are rising. A 15% hit to every $1tn in CRE exposures stands to lead to $150bn in markdowns.

The compounded impact of these factors stands to tighten credit conditions. Banks are already tightening their footprint by focusing on offering “core” products in “core” markets to “core” clients. Higher cost of funds and rationalizing capital will only drive this trend further.

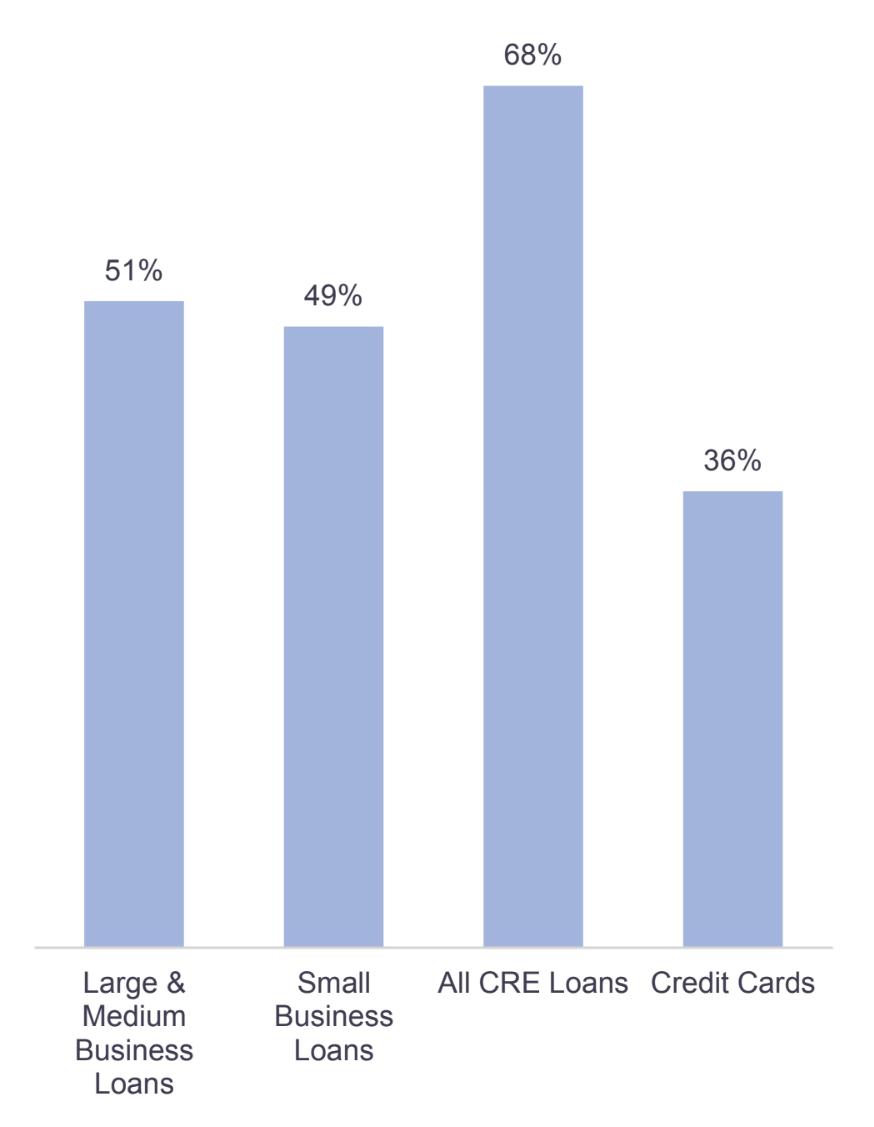

Net Percentage of Senior Loan Officers Continuing to Reduce Credit Across the Board(1)

The Rithm Take

Funding gaps for assets forced to exit the banking system has marked the post-GFC era. Starting with sweeping reform for a variety of mortgage assets, from loans to mortgage servicing rights (MSRs) in the early 2010’s and extending to leveraged loans in the mid-2010’s, specialty credit, alternative credit and private credit entities have all stepped in to fill this progressively growing gap. Another shift in the capital rules stands to only further propel this shift, intensifying a “capital recession.”