Beyond the Unchanged Rate: What the Fed's Internal Divisions Mean for July

The Rithm Take

Recent speeches by Fed officials indicate that the FOMC is more divided about the appropriate setting of monetary policy than at past meetings. Although anything other than an unchanged fed funds rate on July 30 would be a shock, it is possible that we will see a dissent in favor of an immediate rate cut from at least one policymaker. Nonetheless, the resilience of the economy amid signs that prices are beginning to be boosted by tariffs—with more significant effects on inflation still to come—will leave the Fed in wait and see mode on policy and reluctant to cut rates until there is greater clarity on the employment and inflation outlooks.

Market Signals

The Federal Open Market Committee will conclude a two-day monetary policy meeting on Wednesday. The fed funds target range is widely expected to be left unchanged at 4¼%-4½%, which is where the policy rate has been since December 2024. The economy continues to exhibit resilience but tariff-related uncertainty remains high and there is some evidence in the inflation reports that prices are stirring. A couple of FOMC participants have argued in favor of a quarter-point rate cut at the July meeting, but most policymakers have indicated a preference for waiting for greater clarity before making any further adjustments to interest rates.

The Conversation

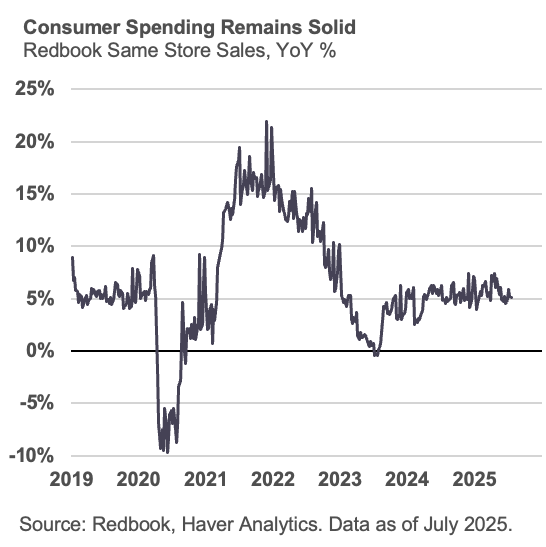

The economy continues to show resilience in the face of tariff-related uncertainties. Employment is rising at a moderate rate, the unemployment claims data indicate that layoff activity is still subdued, and consumer spending remains solid (as shown, for example, by weekly data on same-store sales).

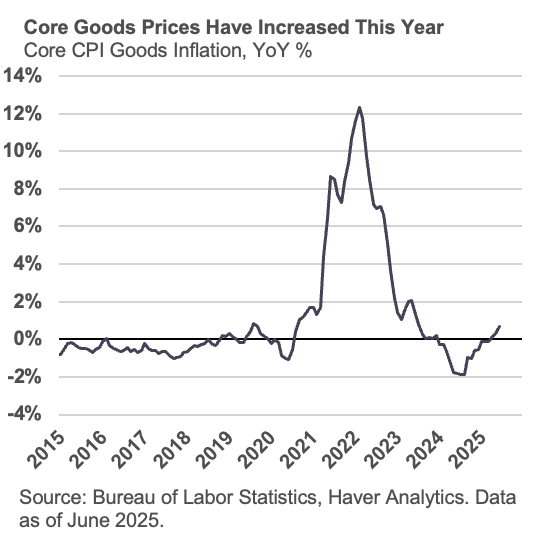

Core CPI inflation picked up to 2.9% year-over-year in June—the highest rate since February—from 2.8% in May. Core CPI goods prices have begun to rise again, reversing the goods prices deflation of 2024. Core services inflation remains elevated and the share of CPI components rising at elevated rates has picked up, indicating that inflation is becoming more broad-based. Surveys of companies indicate that a greater pass through of tariff costs into prices will be seen in the coming months.

Given a resilient economy and rising inflation pressures, most Fed policymakers appear committed to waiting for more clarity before cutting the fed funds rate further. However, a couple of Fed officials (Governors Waller and Bowman) have argued for looking through the impact of tariffs on prices and cutting rates immediately, while others (San Francisco Fed President Daly) have said they want to avoid waiting too long to cut rates as this risks a deterioration in the labor market.