Basis Compression and Borrower Behavior: Reading the Market Signals

The Rithm Take

Economic resilience continues to support housing and mortgage markets, though near-term risks to both spread widening and curve flattening remain. Adjustable-rate mortgages are gaining share as lower front-end rates filter more directly into borrower costs, while fixed-rate mortgage pricing remains more dependent on the policy path for GSE portfolios and MBS quantitative tightening. Markets have begun to price the potential for administrative intervention, with tighter agency MBS spreads reflecting expectations that housing affordability will remain a policy priority. Over the longer term, further curve steepening offers a constructive backdrop for mortgage investors, though short-term volatility may still bring periods of renewed flattening. Taken together, these dynamics reinforce the importance of positioning across both the mortgage basis and the curve, where borrower behavior and policy transmission will be the key swing factors in the months ahead.

Market Signals

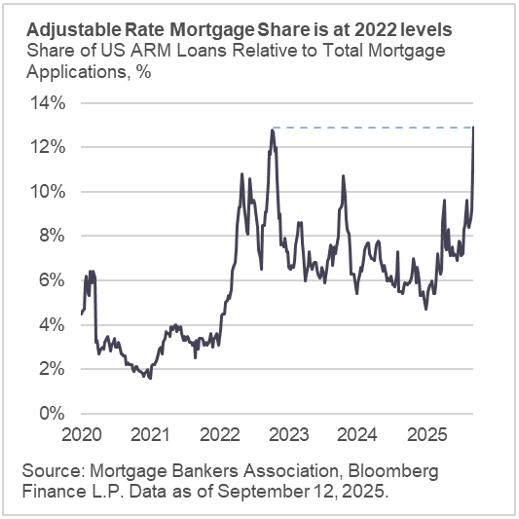

As the market anticipates that the Fed is set to begin a cutting cycle, we expect the curve to steepen over the medium to longer term. In that environment, adjustable-rate mortgages (ARMs) should become more favorable for borrowers relative to fixed-rate mortgages. ARMs have already risen above 9% of total mortgage applications, the highest level year-to-date outside of the Liberation Day volatility.

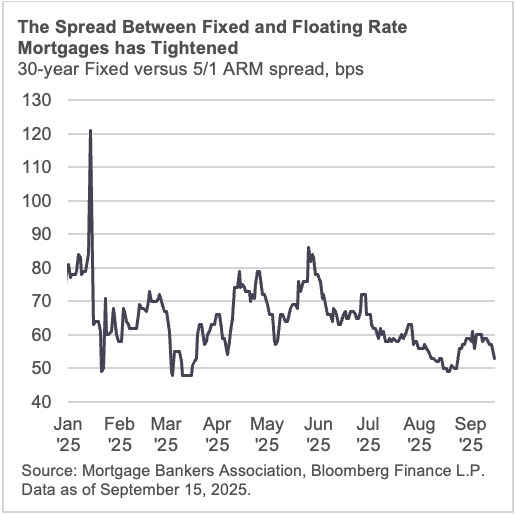

In the near term, however, spreads between the two mortgage products have compressed as the curve has bull-flattened. If our view proves correct, we would expect this spread to widen over the medium term.

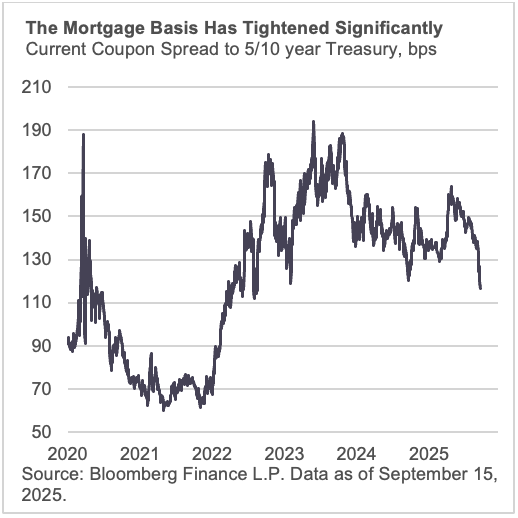

More broadly, the mortgage basis has tightened, suggesting that investors may be pricing in the risk that GSEs will increase the size of the mortgage positions on their balance sheets and that MBS quantitative tightening will come to an end.

The Conversation

The Federal Reserve’s 25bp rate cut has set the stage for a more complex discussion: how will market anticipated cuts change and what implication does that have for the curve’s shape. While the headline move was fully priced, the forward path matters for housing and mortgage markets, where transmission channels differ meaningfully across products. The immediate question is how quickly lower front-end rates filter into borrower behavior and whether curve dynamics create incentives for shifts in mortgage structures.

Housing continues to present a paradox. Affordability remains historically stretched, with elevated home prices keeping entry costs high even as financing rates begin to ease. The new home segment, which had been supported by builder incentives, is showing signs of fatigue as inventories linger longer on the market. This can be seen in new homes selling at a discount to existing homes, which is a relatively rare phenomenon. Builders’ reliance on mortgage rate buydowns proved effective in sustaining sales through much of the recent tightening cycle, but the model is increasingly being put to test as demand softens.

ARMs are one area where Fed rate policy is more directly impactful. Lower short-end rates make ARMs comparatively attractive, raising the prospect that borrowers will shift toward these products both for new purchases and through fixed-to-ARM refinancings. Early data suggest incremental evidence of this rotation. If sustained, ARMs could extend the reach of buydown strategies, broadening the borrower base able to access financing despite still-elevated home prices.

The debate often centers on the limited pass-through of Fed policy to the 30-year fixed mortgage rate, which is more closely linked to long-term yields. That view is directionally correct, but it understates the potential impact of current policy coordination. The Administration, with Treasury Secretary Scott Bessent explicitly citing mortgage rates as a policy priority, has made clear its goal of stabilizing—and potentially lowering—long-term yields. As Bessent has indicated the administration may be willing to declare a national emergency on housing which opens up various pathways for lower rates. One pathway lies in the prospect of Treasury and FHFA directing the GSEs to resume adding agency MBS to their portfolios, reversing the post-crisis trend of portfolio contraction. Another is further pressure on the Fed to pause quantitative tightening on MBS or even restart quantitative easing in the asset class.

Markets have begun to price in these risks, with agency MBS spreads tightening meaningfully. A narrower basis directly supports lower primary mortgage rates, complementing the effect of Fed cuts on ARM coupons. Together, these dynamics create a two-sided channel of relief: short-end cuts improving affordability via ARMs, and tighter MBS spreads translating into marginally lower fixed-rate mortgage costs.

For investors, the convergence of these themes reinforces the importance of curve positioning and mortgage basis risk. The Fed’s forward guidance will dictate the path for ARMs and other short-end-linked products, while administrative measures and potential GSE portfolio activity represent key swing factors for long-term yields and MBS valuations.

Housing demand remains constrained, caught between affordability pressures and limited incremental policy relief. Yet, with both monetary and administrative levers now pointing toward easing financing conditions, the sector is likely to remain a central axis for assessing the effectiveness of policy transmission. The paradox of high prices and challenged affordability is unlikely to resolve quickly, but investors should watch carefully as curve dynamics, MBS basis, and borrower behavior interact in the months ahead.