Banking on Resilience: Q2 Earnings and the Durable Consumer

The Rithm Take

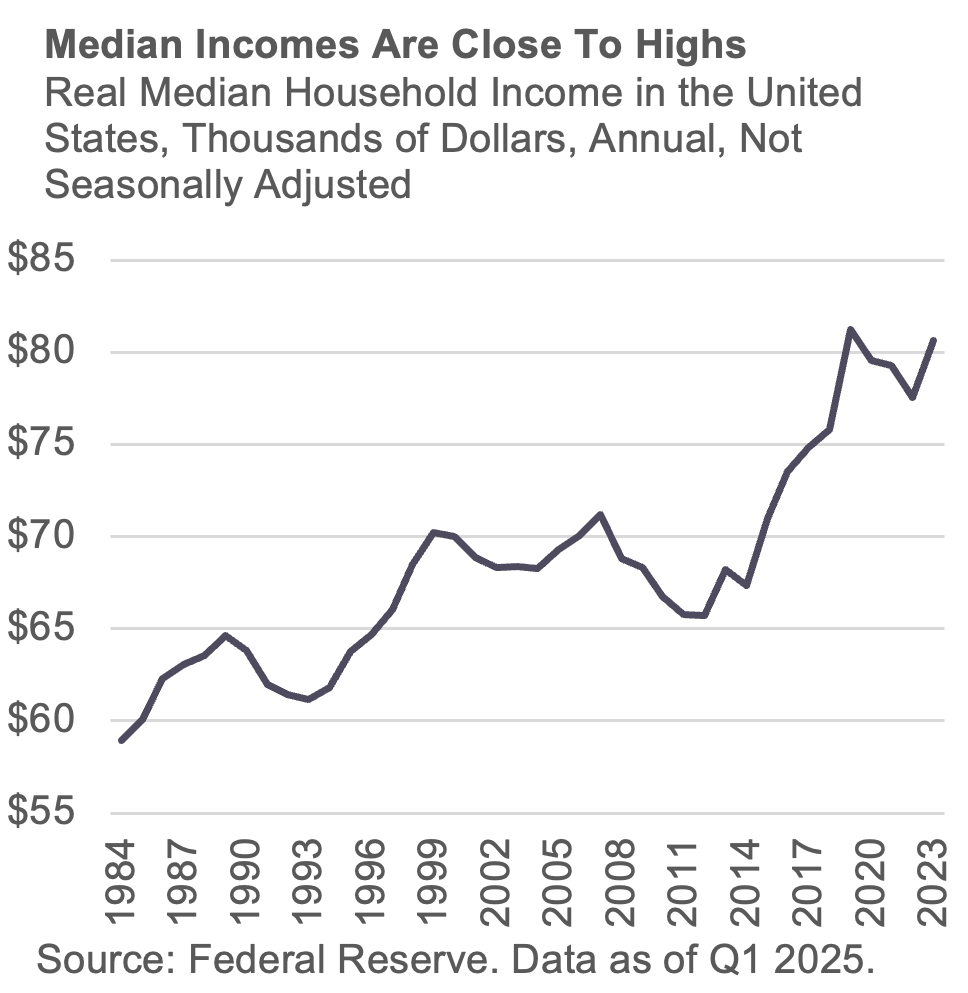

The American consumer remains the cornerstone of the US economy, driving nearly 70% of its Gross Domestic Product. For almost three years now, the resilience of the consumer has consistently defied widespread economist expectations for a slowdown. Recent bank earnings reports further reinforce this trend, signaling a remarkably robust consumer base. This ongoing strength is progressively mitigating the economic uncertainty that has characterized much of 2025, suggesting economic expansion can persist through the short-to-medium term.

Market Signals

The banking sector, possessing arguably the most comprehensive view of consumer financial health, recently delivered a strong second quarter in 2025, largely affirming continued consumer resilience. All 13 banks in the S&P 500 have now reported second-quarter earnings, with all but one beating earnings expectations. Collectively, the banking segment achieved an impressive aggregate earnings growth of approximately 11.5%, more than doubling the growth seen in the previous quarter.

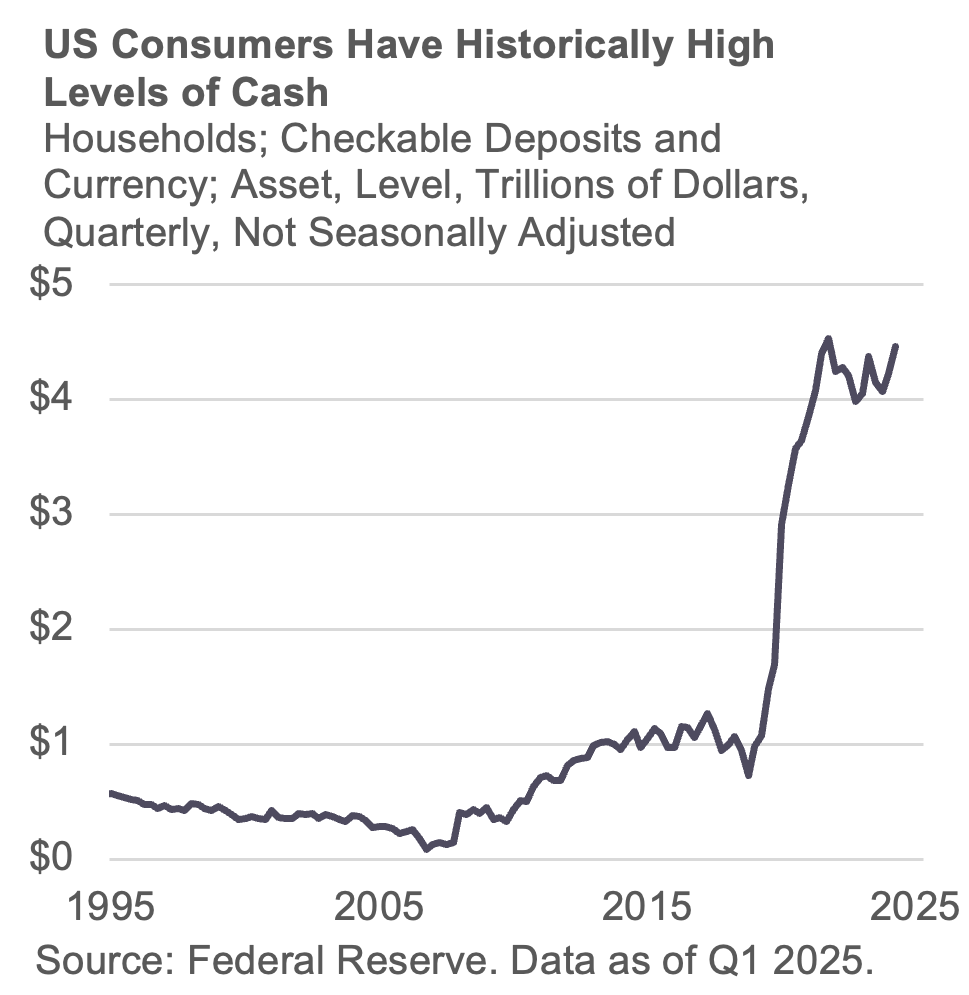

A significant driver of this strength was the remarkable resilience of the U.S. consumer, who continued to demonstrate healthy spending habits and stable delinquency trends across major financial institutions. This robust consumer performance translated into generally declining loan loss provisions year-over-year for the industry, reflecting sustained credit quality. Furthermore, consistent growth in consumer spending and stable deposit trends underscored the enduring strength in household finances. Overall, the banking industry successfully navigated dynamic market conditions while benefiting from a resilient consumer base, setting a positive tone for the remainder of the year.

The Conversation

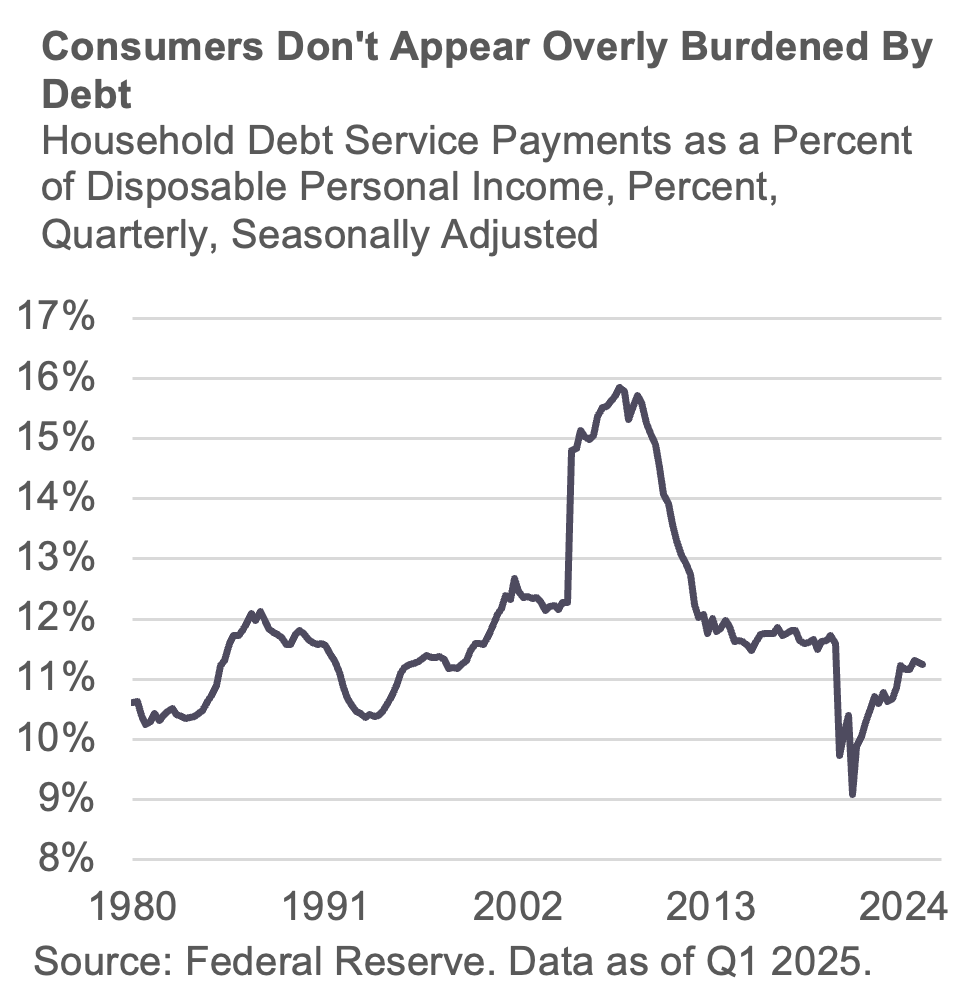

The New York Fed's first-quarter Household Debt and Credit Report initially flagged emerging concerns, showing aggregate delinquencies climbing to 4.3% from 3.6% and consumer debt burden rising from historically low levels. However, a more granular view reinforces the consumer's underlying resilience. Much of this increase, particularly in unsecured credit like credit card loans, is driven by "Debt-to-Income (DTI) stretch," representing growing pressure on consumers whose debt service obligations are disproportionately increasing relative to their incomes. This trend is exacerbated by higher rates, renewed student loan payments, and post-stimulus FICO normalization, reflecting a healthy return to pre-pandemic credit behaviors rather than widespread distress.

Further insight from the MBA Q1 2025 National Delinquency Survey on mortgage performance highlights stability in prime segments amid a nuanced divergence. Conventional mortgage delinquencies remained stable or modestly rose year-over-year, contrasting with a more pronounced rise for government-backed (particularly FHA) loans. This aligns with the DTI stretch thesis: FHA borrowers, often with lower FICO scores and higher DTIs at origination, are naturally more susceptible to rising financial pressures, including increased housing-related costs like insurance and property taxes, particularly for post-2022 originations. Critically, this remains a localized trend, well-contained within specific borrower segments, underscoring the overall robustness of the broader mortgage market.

Beyond these specific pockets of stress, market sentiment is clearly shifting. Recent Q2 bank earnings and management commentary strongly emphasize American consumer resilience. This underlying strength is critical for housing and mortgage finance, as stable job markets, consistent wage growth, and healthy household balance sheets typically lead to lower mortgage delinquencies and defaults. This strong stability directly underpins residential mortgage credit quality and, by extension, mortgage-backed securities (MBS).

These positive consumer indicators continue to attract investors, fostering new sources of capital, and product innovation, enabling diversification across household balance sheets.