Assessing Increased Demand for Mezzanine Lending in Commercial Real Estate

Market Signals

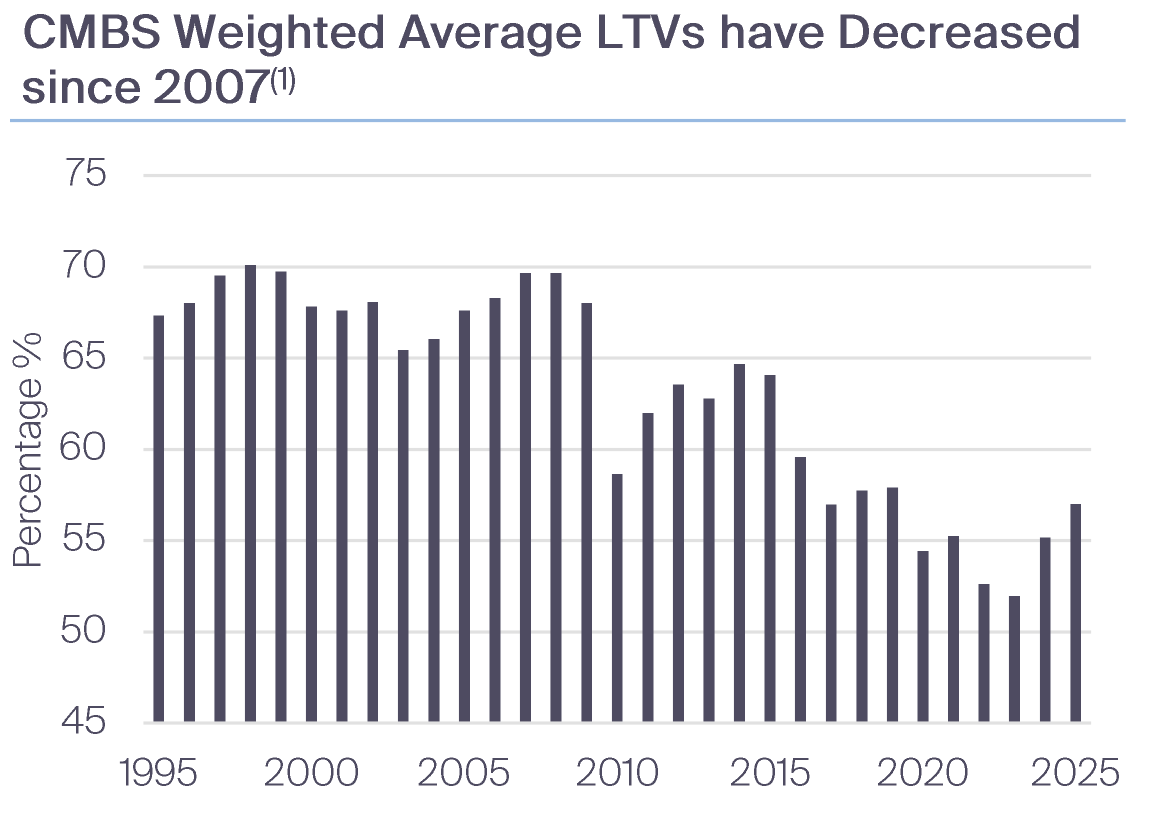

Mezzanine lending in commercial real estate (CRE) is experiencing a boom in the post-pandemic era. Commercial mortgage-backed securities (CMBS) data shows that loan-to-value (LTV) on senior loans have been trending down for the past decade. Despite a recent uptick, this dynamic, paired with property values that are down ~20% in the last three years, has created a loan proceeds gap for many properties with loans maturing. Unsurprisingly, 95% of the respondents in the Commercial Mortgage Alert’s latest annual survey of high-yield lenders expect their mezzanine debt originations to increase in 2025. Chalk some of this up to ambition, but market participants are responding to a clear need from the borrower community.

The Conversation

Following Dodd-Frank regulations, the large banks became more constrained with their CRE lending. Using CMBS data as a proxy, the weighted average amount of leverage being provided on senior loans has come down from highs of 70% in 2007 to a low of ~52% in 2023. However, borrowers still have plenty of demand for higher leverage levels. Mezzanine debt has filled that gap nicely, with many borrowers willing to pay a premium for the additional leverage. In many cases, borrowers are willing to incrementally increase their overall cost of funds in the short term in order to retain control, and the future upside of an asset.

Almost halfway through 2025, property values are being reset. Transaction activity across asset types has picked up following a sluggish few years. Rates remain higher, debt continues to mature and there is less investor appetite for outright equity. As such, borrowers looking to ride the CRE recovery story are searching for alternative ways to fully repay existing loans and to supplement lower proceeds being provided by senior lenders.

The Rithm Take

Mezzanine lending should continue to proliferate across commercial real estate while markets find their footing. Many existing loans have been extending to their fullest and borrowers are looking for repayment. There should be plenty of opportunities for existing lenders, borrowers and new lenders to achieve wins in this market. Robust sponsorship in the mezzanine sector underscores healthy capital inflows into CRE. However, CRE equity sponsorship remains scarce—its lag holding back a full green light on broader risk appetite.