AI: The Unexpected Catalyst for Quality Office

The Rithm Take

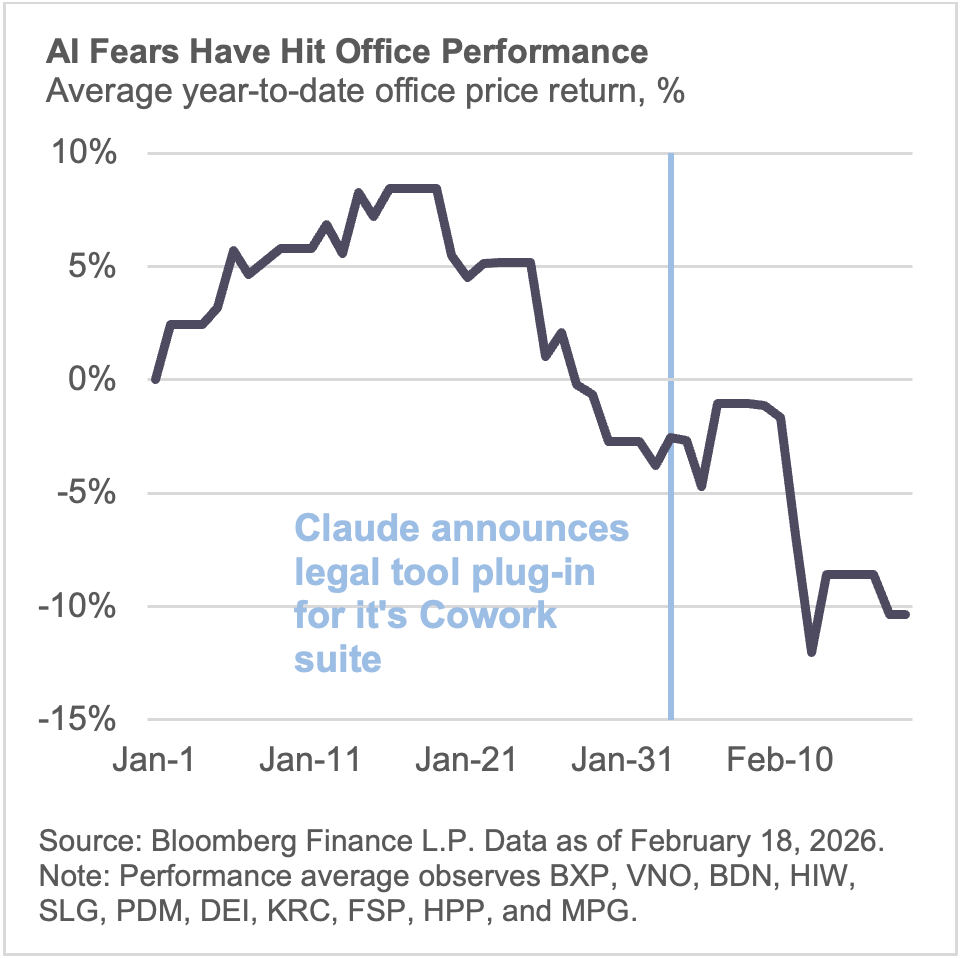

The prevailing narrative in the office market is AI reduces white-collar employment, which reduces office demand. However, in its current phase AI adoption is functioning less as a labor-reduction shock and more as a coordination shock. That distinction matters for positioning — the signal is not broad recovery, but a flight-to-quality.

The 5 Facts That Matter

1. AI leasing activity is expansionary.

In San Francisco, the active tenant pipeline is approximately 8 million square feet1 – in line with pre-pandemic levels. Roughly 85% of that pipeline is AI companies seeking space. In San Francisco there have been 140+ executed AI-related deals, with +50% of tenants new to the market2.

As investors fear what AI will do to office space, AI companies are acquiring a larger office footprint.

2. Vacancy is concentrated in lower-quality inventory.

In Manhattan, approximately 32 million square feet is available3, and per broker insights, the majority of which sits below floor 11 – indicating a demand for higher quality space.

3. Supply at the top of the market is limited.

Unlike prior cycles, there is no meaningful supply wave coming. U.S. office construction has fallen to roughly 14 million square feet nationally, with 2025 completions the lowest since 2012. 4At the same time, conversions and demolitions are actively shrinking the competitive set, with roughly 80+ million square feet of office inventory in the U.S.5 currently slated for conversion. In a market where AI-driven demand is emerging and vacancy is skewed toward lower quality space, a record-low development pipeline materially limits supply elasticity at the premium end.

4. Absorption is bifurcated, not collapsing.

Headline national vacancy remains elevated near ~19–20%, but prime buildings are separating from the broader market. Across the top U.S. markets, prime vacancy runs roughly 500+ basis points below overall vacancy6. In Manhattan specifically, availability has declined to ~15.5%, down roughly 300 basis points year-over-year7, alongside positive net absorption of over 13 million square feet in 2025. The weakness in office is not uniform, rather it’s concentrated in older inventory, while premier assets are stabilizing and improving.

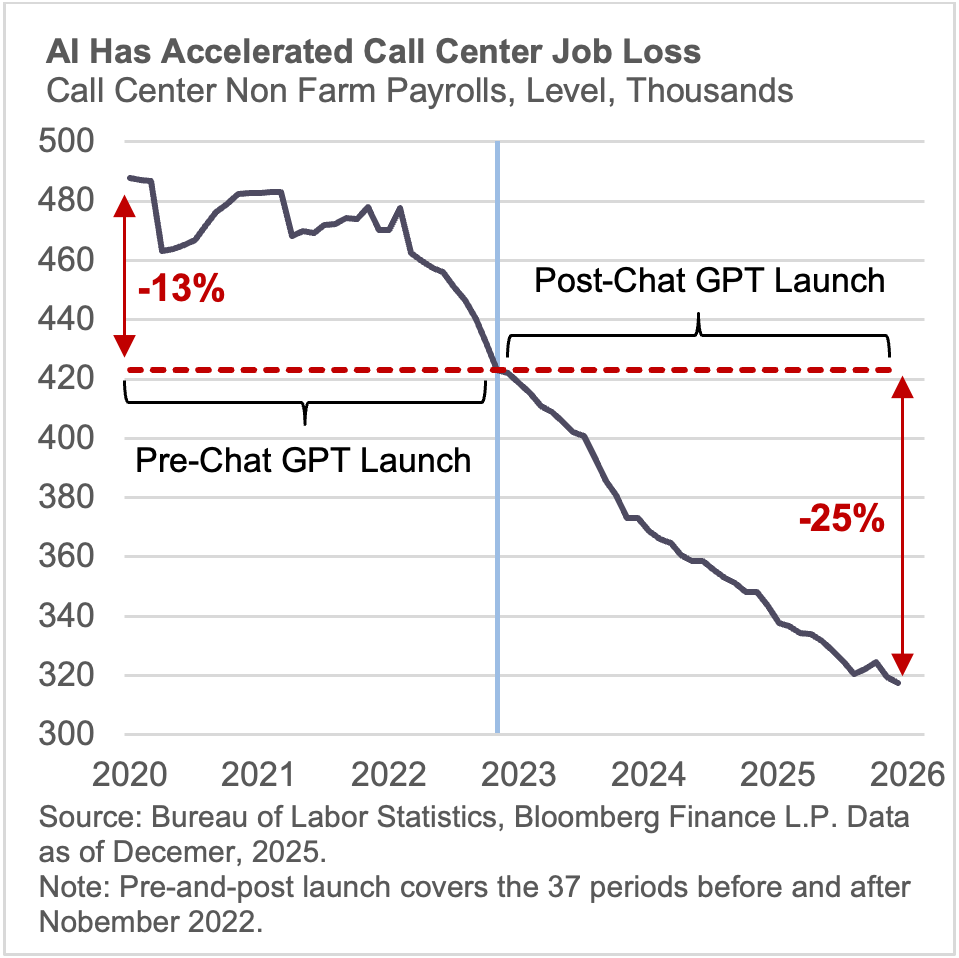

5. The functions most exposed to AI are not concentrated in trophy assets.

Automation risk is highest in repetitive support roles. Take for instance call-center jobs, which have declined 25% since the release of Chat GPT. Premier Class A and trophy buildings disproportionately non repetitive support roles such as leadership, strategic, and revenue-generating functions.

If AI were immediately destructive to office demand, we would expect pipeline contraction and accelerating givebacks. Instead, we see:

- Pre-pandemic-level leasing pipelines

- Executed AI expansion deals

- Vacancy concentrated in lower-quality spaces

- Constrained premium supply

1 CBRE 3Q SF Report

2 JLL

3 CBRE Manhattan Office Market January 2026

4 CBRE Q4 2025 US Office Figures

5 CBRE Insights, Conversions & Demolitions Reducing US Office Supply

6 CBRE Q4 2025 US Office Figures

7 CBRE Manhattan Office Market January 2026