Addressing Financial Plumbing, Before a Flood

The Rithm Take

The recent rise in SOFR outside of traditional stress periods has been an early warning that system liquidity is no longer abundant and that reserves are approaching operational minimums. The Fed’s decision to end QT and initiate short-end reserve management purchases is not a pivot toward easing, but a preemptive move to protect market functioning and avoid a repeat of the 2019 funding shock. Investors should view this as a signal that the margin for error in the Fed’s balance sheet policy has narrowed materially. Now financial plumbing, not just the dual mandate policy stance, is front and center for the Fed and investors.

The Conversation

Background

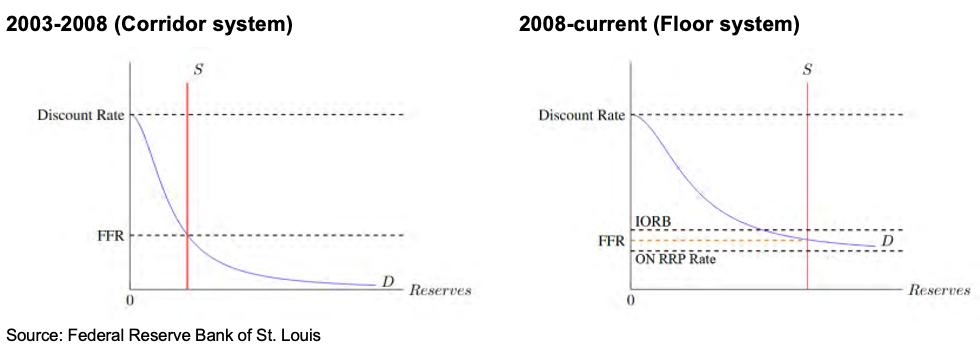

The Federal Reserve currently implements monetary policy through a “floor system.” For this framework to function effectively, the financial system must maintain a sufficient level of aggregate reserves to ensure smooth money market operations.

In response to the COVID shock in 2020, market liquidity deteriorated sharply. To stabilize funding markets and preserve the transmission of interest rate policy, the Federal Reserve more than doubled its balance sheet, from approximately $4 trillion to $9 trillion, through quantitative easing. This involved large-scale purchases of Treasury securities and agency mortgage-backed securities, which increased reserve balances across the banking system.

While these actions successfully restored market functioning, they also resulted in a significant surplus of system liquidity.

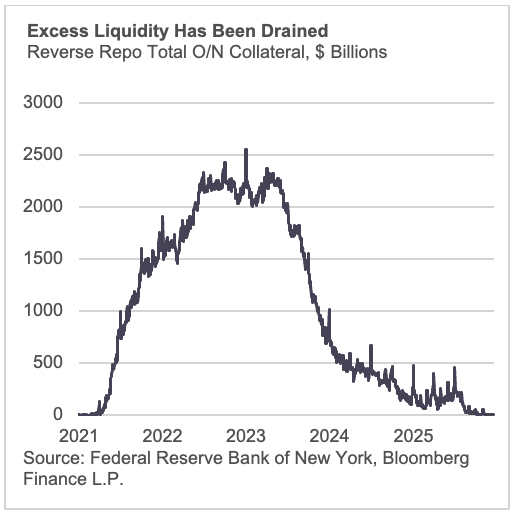

One manifestation of this excess liquidity was the sharp increase in balances at the Fed’s Overnight Reverse Repo Facility (ON RRP). The RRP serves as the effective policy floor in the “floor system,” allowing eligible counterparties to park cash overnight in exchange for securities at a fixed rate. Importantly, participants only utilize the facility when alternative private-market opportunities are unattractive, making elevated RRP usage a useful proxy for excess liquidity in the system.

To normalize conditions, the Fed subsequently initiated a quantitative tightening program aimed at reducing reserve balances toward the minimum level required for effective policy implementation. As QT progressed, ON RRP balances declined to near zero, draining roughly $2.5 trillion of excess liquidity from the financial system.

Current State

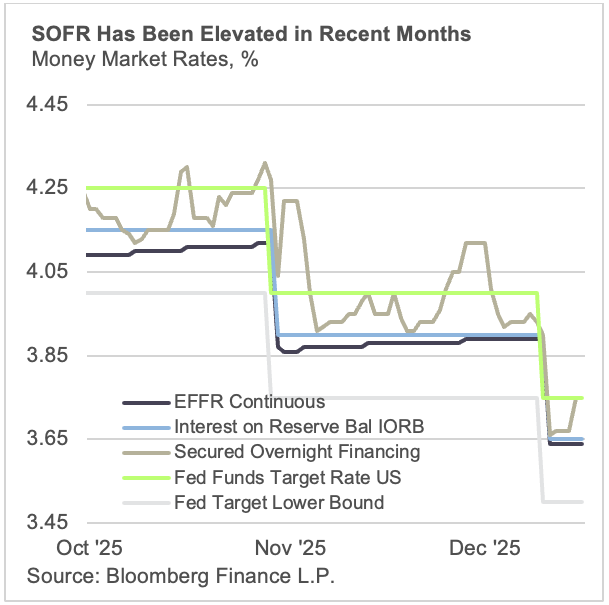

Since October, signs of strain have emerged in the financial plumbing. In particular, SOFR—the rate at which cash is borrowed overnight against Treasury collateral—has moved higher within the Fed’s target range during intra-month periods, not just around traditional balance sheet stress points such as month-end.

Why This Matters

Persistent upward pressure on SOFR outside of known reporting or settlement periods suggests tightening liquidity conditions. Market participants are increasingly required to pay up for short-term funding, indicating that reserves may be approaching less-than-ample levels.

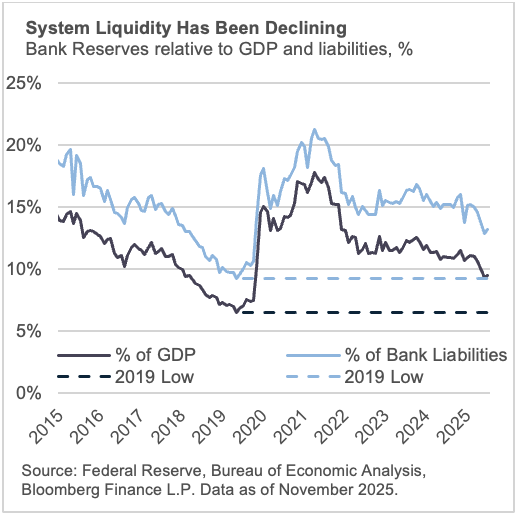

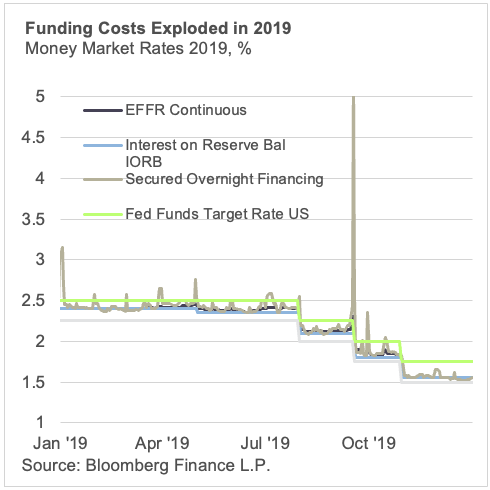

This dynamic is notable given the Fed’s experience in 2019. During the prior QT episode, reserves declined to approximately nine percent of GDP.

Once reserves became scarce, funding markets destabilized rapidly, with SOFR spiking roughly 300 basis points above the target range and impairing normal market functioning.

Avoiding a repeat of that episode remains a key policy objective.

How Has the Fed Responded?

In light of these emerging pressures, the Federal Reserve concluded its three-year quantitative tightening program on December 1, halting the passive runoff of securities from its balance sheet.

Additionally, the Fed announced a reserve management purchase program at its most recent FOMC meeting. These purchases will initially focus on Treasury bills and, if necessary, Treasury securities with maturities of three years or less totaling approximately $40 billion in the first month, with the pace potentially remaining elevated for several months.

The objective is not to ease financial conditions broadly, and as such we don’t view the latest reserve management program as a restart of a quantitative easing program (which is usually focused on the longer end of the curve), but rather a prudent support of liquidity markets which can reduce the risk of funding disruptions as reserve balances are near their operational minimums.