A Peak in Rates or a Plateau?

The Three Phases of Monetary Renormalization

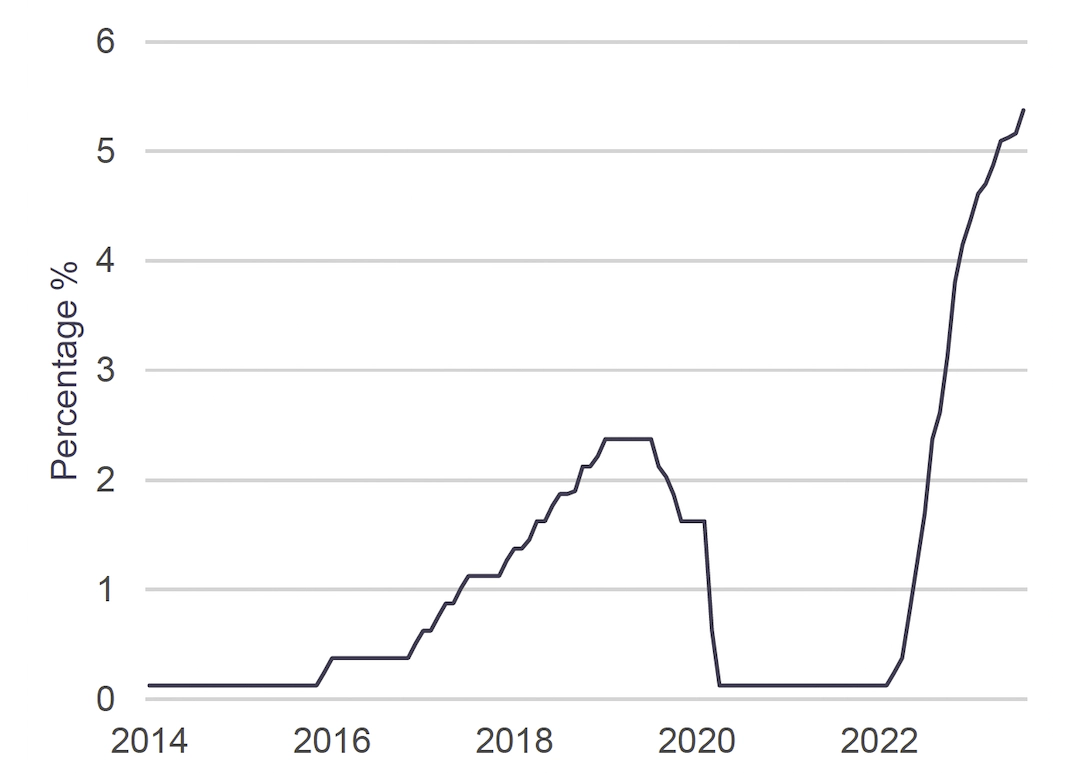

The monetary policy theme of 2022 was how quickly the Fed needed to hike rates to rein in inflation pressures. The theme this year was how high would rates have to rise to be ‘sufficiently restrictive’ to keep downward pressure on inflation. Now, with inflation falling, the focus is shifting to how long the Fed will have to hold rates at this ‘sufficiently restrictive’ level to ensure inflation declines to its 2% target and stays there.

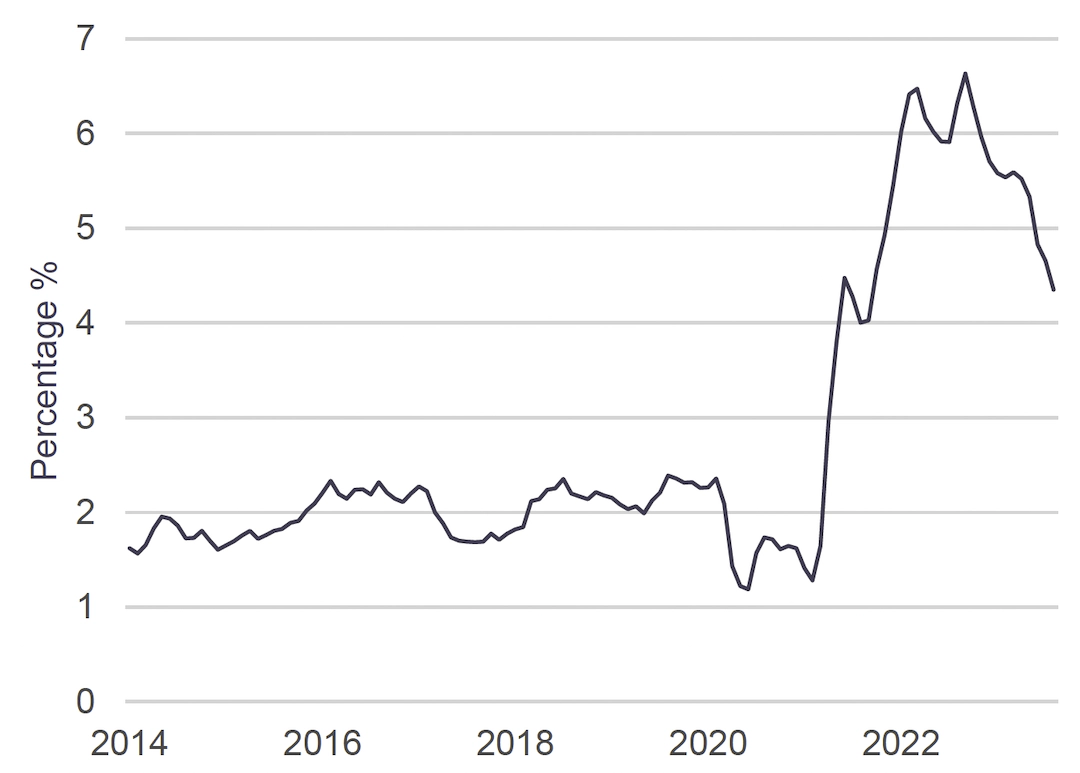

Core CPI Inflation Rate, 12-Month % Change(1)

Fed Funds Target % Rate(1)

Proceed Carefully

The Fed’s monetary policy strategy is often summarized by a short catch phrase like “sufficiently restrictive” and Fed Chair Powell rolled out a new catch phrase in late August at the Kansas City Fed’s annual conference at Jackson Hole when he said “Given how far we have come, at upcoming meetings we are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks.“ With inflation falling and with the policy rate being above the inflation rate, the Fed can afford to take its time in judging whether interest rates are high enough to return inflation to 2% especially since many Fed officials believe there is still further restraint on the economy to feed through from prior rate hikes. In a desire to prevent piling on, we see the Fed entering a wait-and-see period on policy. If inflation continues to trend lower, then we think the Fed is unlikely to hike rates again but we also think it is unlikely that the Fed will cut rates anytime soon with inflation still well-above target.

The Good News on Inflation

From a peak of 9.1% in June 2022, 12-month CPI inflation has fallen to 3.7% in August 2023 but higher energy prices have pushed inflation up from 3.0% in June and 3.2% in July. The Fed focuses on inflation measures excluding food and energy prices—so-called core inflation—and this rate has continued to subside to 4.3% in August from a peak of 6.6% in September 2022. Moreover, over the last three months, the annualized core inflation rate has been a mere 2.4%. While the slight tick up in the core CPI to 0.3% from 0.2% bears watching, it seems unlikely that the Fed will be spurred to hike rates next week.

Inflation Lower but Growth Remains Solid

At the mid-point of the third quarter, the Atlanta Fed’s GDPNow estimate of growth stands at a whopping 4.9% with consumer spending seen rising at a solid rate of 3.5%. With inflation still declining, strength in the economy is unlikely to push the Fed to hike rates. However, even as inflation has declined more quickly than the Fed expected, the economy has remained stronger. While the strength of the economy may fuel hopes among Fed officials for a soft landing (a slowdown that avoids a recession), at this point it also undermines the rationale for rate cuts next year.