A Foregone Conclusion? Fed Most Likely to Cut Again

The Rithm Take

When the FOMC met on October 29, the Committee voted to cut rates by 25 bps, lowering the target range for the fed funds rate to 3¾%–4%. The decision drew two dissents: Governor Miran favored a larger cut, while Kansas City Fed President Schmid preferred no change. Chair Powell nevertheless struck a hawkish tone, noting that “a further reduction in the policy rate at the December meeting is not a foregone conclusion,” and invoking a “driving in the fog” analogy to justify moving more slowly. Those signals helped push futures pricing for a December 10 cut down from 92% (October 28) to a low of 29% (November 19).

Some of the “data fog” lifted on November 20, when the delayed September Employment Situation Report showed nonfarm payrolls up 119,000 and the unemployment rate edging up to 4.4% from 4.3%. While the jobless-rate increase reflected a larger labor force rather than weaker employment, it modestly raised cut odds. The bigger catalyst came on November 21, when New York Fed President Williams said he still saw room for a “further adjustment in the near term” toward neutral. Markets took that as a near-term cut signal, lifting implied cut probability to 91%. Given the Powell Fed’s preference to avoid surprising a market priced for action, it would be imprudent to forecast otherwise.

This meeting may be the most contentious since September 21, 2011 (three dissents for tighter policy), or even October 2, 1974 (five dissents for easier policy). Recent Chairs have emphasized consensus, but that looks harder this time. The year’s rotating voters include Schmid, St. Louis’ Musalem, Boston’s Collins, and Chicago’s Goolsbee; all four have expressed caution about near-term cuts. Among the seven nonvoting presidents, most have voiced similar caution. Powell himself said on October 29 that “there were strongly differing views about how to proceed in December,” and it is plausible those differences show up as dissents. Three or four dissents against a cut is not out of the question.

Powell is likely to pursue a compromise between those who want to hold steady to gather more information and those favoring preemptive easing to support the labor market. One avenue is to forge consensus via the Summary of Economic Projections, which includes forecasts for growth, unemployment, and inflation, plus the policy-rate path. But the strategy faces hurdles. First, October’s “hawkish cut” messaging contrasted with the market’s interpretation of the November 21 Williams remarks as an implicit green light for December, despite limited new information. Second, the median dot implied end-2026 at 3¼%–3½% (roughly one additional cut), and it would take only a small shift in participant views to lift that median. Finally, with Powell expected to step down before mid-2026, sustaining forward guidance beyond the next few meetings may prove more difficult.

Market Signals

The Treasury Market has not received the 150 basis points of rate cuts today particularly well. The low point in 10-year yields in 2024 was 3.61% on September 16, which was two days before the Fed cut rates by 50 basis points. This yield comprised a 10-year inflation breakeven of 2.09% and a 10-year real yield of 1.54%. At the time of writing, the 10-year yield stands at 4.10%, which is an increase of almost half a percentage point even though the fed funds target has been cut by one and a half percentage points and looks set to be cut by a further quarter point next week. The 10-year yield today is decomposed into an inflation breakeven of 2.27% and a real yield of 1.81%. Thus a reduction of 175 bps in the policy rate has been accompanied by a 49 bp increase in 10-year yields. This move represents a steepening of the yield curve and a better carry on holding long-term debt. However, it does little to reduce the interest cost of a 30-year mortgage. If we adjust today’s real yields and inflation breakevens to PCE price inflation terms, which is the Fed’s preferred measure and presented in their projections, this is an inflation breakeven of 2% and a real yield of 2.1%. It is as if the market is saying that it expects the Fed to hit its inflation target over the next 10 years but doing so will require a higher real yield than the FOMC’s median assessment of the longer-run real fed funds rate of 1.0%. The backward-looking real fed funds rate will be down at 1.0% after next week’s presumed rate cut, which market real yields suggests might not be restrictive at all and could be accommodative. If the new Fed Chair seeks to push the target rate significantly lower, the result could turn out to be a rise in inflation from levels that have been above target for over five years.

The Conversation

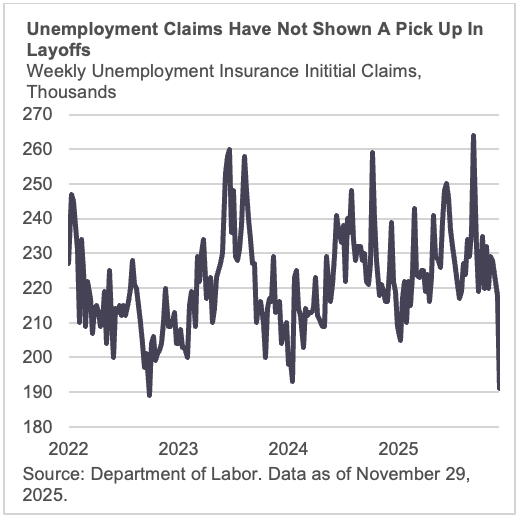

Prior to the last Fed meeting we said “The Fed’s resumption of rate cuts in the face of no further progress on disinflation raises the question of the independence of monetary policy. Since the Fed began cutting rates 13 months ago, the 10-year yield has actually risen by about 30 basis points. The evidence from countries around the world is that independent central banks have a better record on delivering low inflation than central banks whose decisions on monetary policy are heavily influenced by the fiscal authorities. President Trump has made no secret of his desire to see the Fed cut interest rates and his criticisms of Powell have been vocal.” We felt this was worth repeating—especially since the data available to the Fed is little different than it was back in October because of the shutdown. The Fed will get two months of employment data for October and November on December 16 and the CPI for November on December 18. There will be no unemployment or CPI data for October and these will have to be inferred by interpolation. By December 18 the data fog will have lifted somewhat but the decision on rates will be taken eight days earlier and arguably 19 days earlier when President Williams gave his speech in Chile. The cut will no doubt be described as being needed to address the risks of the labor market objective relative to the price stability objective but the government data on the labor market that has been available throughout the shutdown, namely weekly jobless claims, has shown no pickup in layoffs. The press conference is likely to be very interesting and the meeting perhaps a foretaste of the dissension that might occur under a new Fed Chair.