3-3-3 Meets OPEC: When Oil’s Drop Eases Fiscal Heat

Market Signals

Oil prices have fallen to $63/bbl from $72/bbl on Liberation Day and a 2025 peak of $80/bbl. Driving prices lower is OPEC’s decision to raise production; the last three consecutive months have seen OPEC plan a 1.4mm barrels per day (bpd) increase. Higher oil production aligns with one leg of Treasury Secretary Scott Bessent’s 3-3-3 plan to increase oil production by 3mm bpd, drop the deficit-to-GDP ratio to 3% and support real GDP growth of 3%. The plan for higher oil production in the US, Drill, Baby, Drill, has instead turned to, Drill, Habibi, Drill!

The Conversation

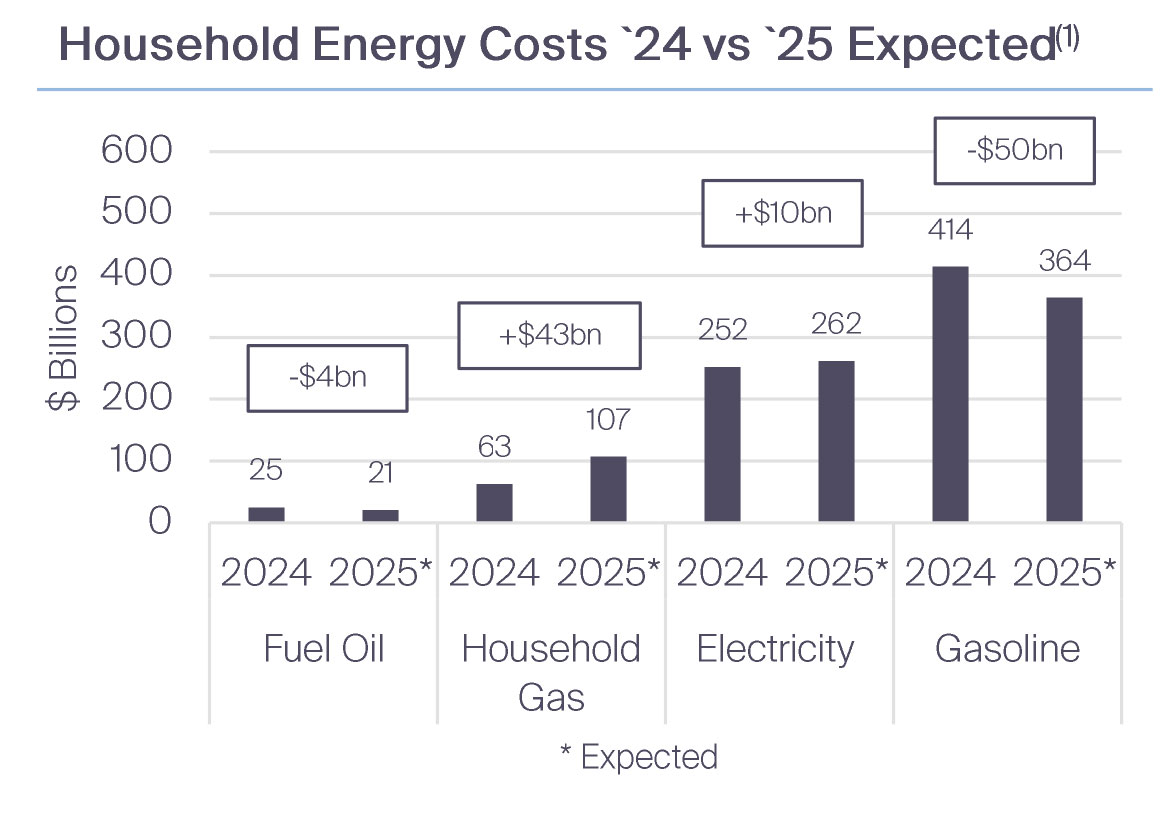

Oil’s recent slide has translated into substantially cheaper gasoline and heating oil, giving consumers a break at the pump and relieving manufacturers that rely on refined products. Based on 2024, household spending of $414bn on oil and $25bn spending fuel oil, consumers stand to save $50bn and $4bn, respectively. Comparatively, the cost burden from higher tariffs are estimated at somewhere between $225bn to $490bn, using tariff rates of 6.9% from the Yale Budget Lab to 15% referenced recently by Federal Reserve Governor Waller. Further offsetting savings from the drop in oil prices is the increase in electricity and gas, with 2024 spends of $252bn and $63bn, respectively, raising costs by $43bn and $10bn.

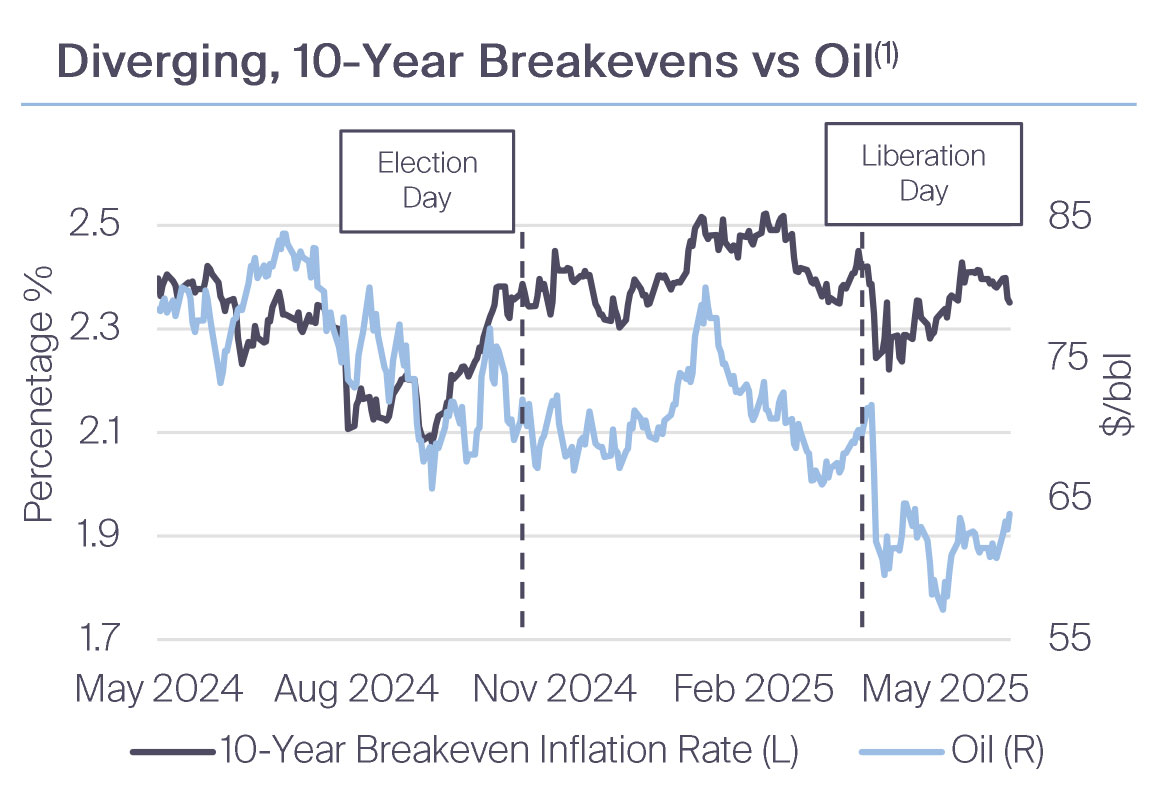

The drop in oil prices, however, will likely provide some relief on reported inflation metrics. Energy carries a 6.4% weight in the Consumer Price Index (3.2% for commodities, including heating oil, and 3.2% for services, of which 0.8% is natural gas) versus roughly 3.7% in Personal Consumption Expenditures. The 12% drop in oil prices since Liberation Day translates to a 0.77% and a 0.44% drop in the headline CPI and PCE calculations. Here too, this drop is being overrun by higher tariffs. As opposed to lowering the market’s inflation expectations, tariffs have resulted in an increase in the 10-year breakeven inflation measures. Historically, oil and breakeven inflation have trended closely, but the two series have diverged since Liberation Day.

The Rithm Take

The market cycle into 2025 has been monetary policy cooling and fiscal policy heating up, a view we have held since the 2024 election results. Tariffs, taxes, deficits have front loaded the fiscal agenda, while de-regulation is expected to follow later into the second half of this year. Higher oil production is part of a fiscal plan laid out by Treasury Secretary Bessent, which is now being delivered by OPEC rather than higher production in the US. The 12% drop in oil prices since Liberation Day stands to modestly offset the costs from higher tariffs, which also stands to help with cooling reported inflation. It’s just another example of cooling monetary policy and heating fiscal policy.