2025 Scorecard: What Held, What Didn’t, What Mattered

The Rithm Take

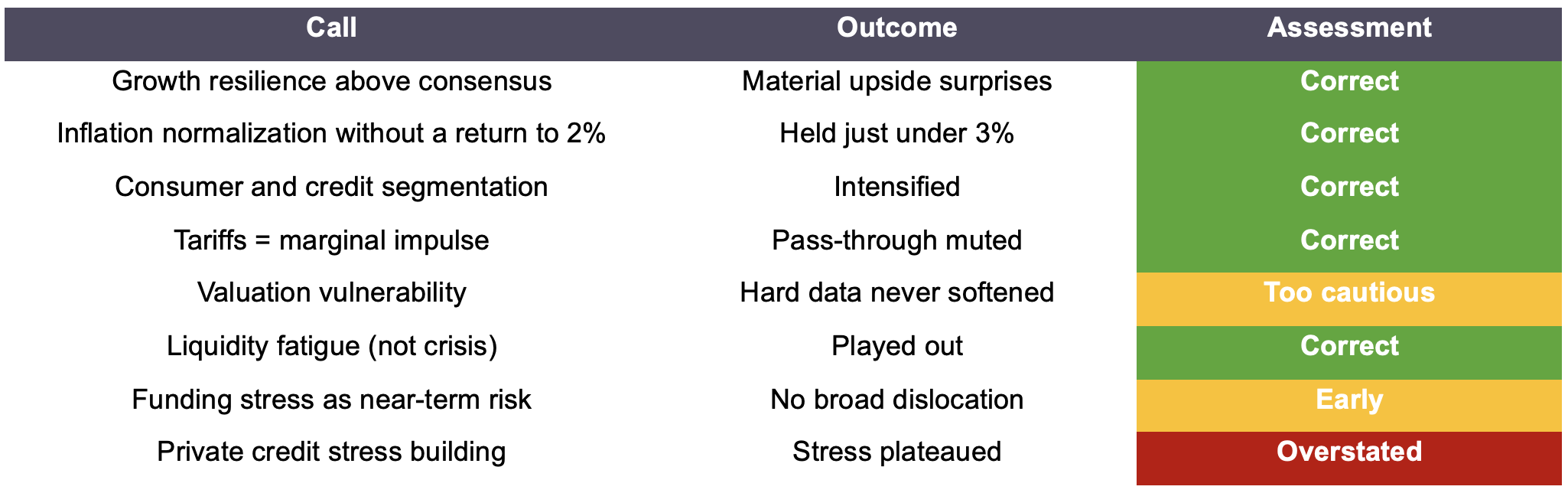

At the beginning of the year, the investment question was less about calling a recession and more about understanding the architecture of the cycle—how growth, liquidity, and borrower fundamentals would interact as policy tightened and valuations remained elevated. The expectation was that the economy would stay resilient but uneven, that market pricing would react more to liquidity mechanics than macro narratives, and that dispersion across housing, credit, and the consumer would define the opportunity set.

Broadly, that architecture held. The economy delivered upside, but the distribution narrowed. Liquidity stayed functional but thin, influencing relative value more than market direction. And dispersion across borrowers and regions persisted, validating the need for structure-focused risk taking. Where the view under-delivered was in anticipating sharper valuation and private-credit pressures than ultimately emerged.

The Conversation

Earlier in the year, the working framework rested on three pillars: that the economy would remain resilient but uneven, that liquidity and policy mechanics would matter more for market behavior than headline narratives, and that housing, credit, and consumer conditions would diverge across segments rather than move as unified aggregates. Each theme proved directionally correct, though the magnitude and timing evolved differently from initial expectations.

Resilience with Segmentation: Directionally Right, Too Cautious on Valuations

Coming into the year, the expectation was for solid top-line growth supported by strong household and corporate balance sheets, but with benefits that would accrue unevenly across the economy. The base case was that higher-income, asset-owning households and large employers would continue to drive activity, while younger and lower-income cohorts would face more pressure. Inflation was expected to moderate without securing a clean 2 percent regime, and tariffs were expected to add incremental cost pressure rather than drive the overall macro outcome. The consumer was expected to bifurcate across age, income, and balance-sheet structure, and the key uncertainty was valuations: if the real economy weakened, markets were exposed.

The realized path largely validated the resilience and segmentation call. Growth outperformed consensus, led by equity-rich and home-owning households. Signs of strain were concentrated in younger and lower-income cohorts, reflected in a more uneven labor backdrop and a gradual increase in delinquency rates at the lower end of the spectrum. Inflation drifted below 3 percent but never convincingly re-anchored. Tariff pass-through into inflation and margins appeared more gradual and uneven than early fears suggested, broadly consistent with the view that tariffs would add basis points rather than creating an immediate macro shock, even as they remained a non-trivial headwind for specific supply chains and margin structures.

Where the view proved too cautious was in the expected valuation vulnerability. Hard data held firm, spreads remained tight, and equity multiples stayed resilient. The analytical concern was reasonable at the time, but the macro backdrop never softened enough to force a repricing. The core framework—resilience, segmentation, and a contained but not negligible tariff impact—was solid. The miss was in conditioning asset-price vulnerability on a macro rollover that never materialized.

Plumbing Over Headlines: Liquidity Fatigue Materialized, Acute Stress Did Not

At the outset, the view was that the most important dynamics for markets would be found in the plumbing rather than the headlines. Quantitative tightening, Treasury issuance patterns, reserve distribution, TGA swings, and tariff-related cash flows into government accounts were expected to produce a liquidity environment that remained functional but felt increasingly thin. This implied banks would emphasize asset-liability management and capital optimization rather than balance-sheet expansion, and that non-core assets would continue to migrate through sales, securitization, or structured risk-transfer channels. Funding markets, in this framework, would become more sensitive to shocks even without a full-blown liquidity event.

This framing held up well. As the year progressed, reserves moved toward the lower end of comfortable ranges, issuance remained heavy, and balance-sheet reduction persisted. Banks engaged in optimization—pursuing M&A, portfolio sales, and risk-transfer solutions rather than broad lending expansion. These dynamics influenced both the pace and pricing of capital deployment.

Where the view overshot was in anticipating more persistent funding pressure. Funding markets experienced episodic volatility, but stayed orderly. Liquidity mechanics shaped relative value and risk appetite, but did not escalate into the type of systemic stress that would have fully validated the more defensive interpretation. The core idea—that the year would be governed by liquidity mechanics rather than liquidity accidents—held; the expected degree of pressure was simply less severe.

Housing, Credit, and Consumer Dispersion: Largely Accurate, One Overstatement

From the start, housing, credit, and consumer behavior were treated as distributions, not aggregates. The assumption was that national home prices would remain firm despite poor affordability; that regional and product-level differences would widen; that credit stress would concentrate in floating-rate borrowers, weaker documentation, and more aggressive private structures; and that consumer performance would remain two-tracked, with high-income and asset-owning households offsetting localized weakness. There was also a view that, as the year progressed, stress in certain corners of private credit could become more visible through marks and financing terms.

This broad structure played out. National home prices held firm even as specific Sunbelt markets and parts of the new-build segment softened and relied more heavily on incentives. Credit bifurcation sharpened: large, fixed-rate issuers enjoyed stable market access and tight spreads, while smaller, floating-rate borrowers leaned more on amend-and-extend and liability-management exercises. Consumer dispersion widened, with higher-income households showing stable spending and younger, lower-income cohorts experiencing more visible labor and credit strain.

The main overstatement lay in the expected severity and visibility of private-credit stress. While there were challenged situations and idiosyncratic bankruptcies, including those of Tricolor and First Brands, the evidence from PIK usage, amendment activity, and observed marks was more mixed than initially assumed. Signs of strain were evident in certain portfolios, but, on balance, these indicators pointed to a drawn-out adjustment process rather than a sharp, system-wide break.

Overall, the directional calls on dispersion across housing, credit, and the consumer were validated. Where adjustments were needed, they were in intensity and visibility rather than direction.